A current Cambridge report confirms that america now leads world Bitcoin mining, prompting questions on how China will reply. Although the nation has lengthy held an anti-crypto stance, Chinese language mining swimming pools have traditionally managed a considerable portion of the worldwide Bitcoin hashrate.

The US’s present aggressive edge and renewed hostility over commerce coverage may encourage China to recapitulate. BeInCrypto spoke with representatives from The Coin Bureau and Wanchain to grasp what may encourage China to alter its stance towards digital belongings.

US Overtakes China as High Bitcoin Mining Hub

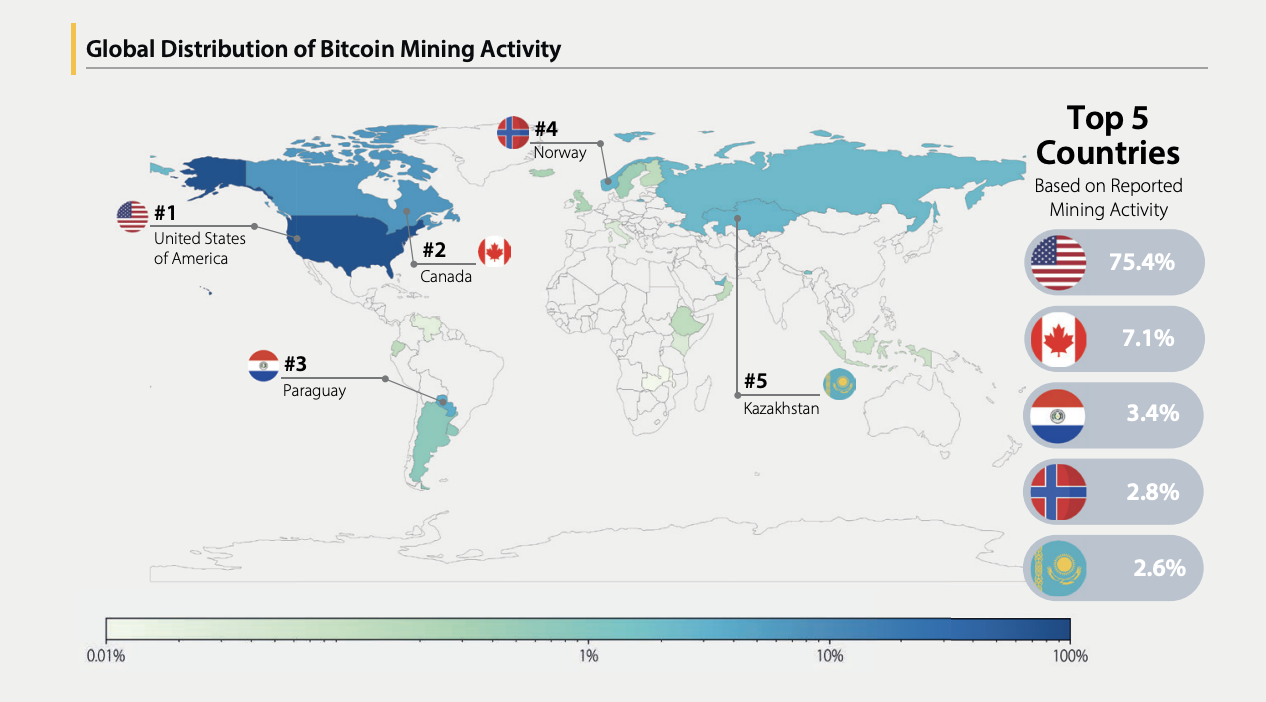

The US has firmly established itself because the world’s largest Bitcoin mining hub. A current Cambridge Centre for Various Finance (CCAF) report revealed that the US accounts for 75.4% of the reported hashrate.

World distribution of Bitcoin mining exercise. Supply: CCAF.

This latest improvement confirms a notable reversal of energy over Bitcoin mining dominance. China emerged because the world’s main Bitcoin mining nation as early as 2017, leveraging its in depth mining infrastructure and low electrical energy prices to contribute upwards of 75% of the worldwide hash charge at one level.

But, the nation would later crack down on the trade.

China’s Crypto Crackdown

In 2019, the Nationwide Growth and Reform Fee of China (NDRC) signaled its intention to ban cryptocurrency mining by releasing a draft legislation categorizing it as an “undesirable trade.”

Two years later, at the least 4 Chinese language provinces started shutting down mining operations. These crackdowns intensified amid considerations over extreme power consumption.

Towards the top of 2021, the federal government declared all crypto-related transactions unlawful, additional solidifying the ban and prohibiting abroad exchanges from serving Chinese language residents.

Nonetheless, China possesses a confirmed capability to regulate to geopolitical shifts that would jeopardize its financial dominance, and the present atmosphere might current such a problem.

Has Bitcoin Mining in China Actually Stopped?

Even with China’s official stance towards crypto, mining exercise has not stopped throughout the area. In July 2024, Bitcoin environmental influence analyst Daniel Batten reported that the hashrate inside China presently accounts for roughly 15% of the worldwide complete.

“Regardless of the official ban, the infrastructure is already in place: from offshore mining to cross-border buying and selling hubs. With extra world momentum behind crypto adoption and the US taking the lead, China might discover itself incentivized to lean in additional strategically, even when unofficially,” Nic Puckrin, Co-founder of the Coin Bureau, instructed BeInCrypto.

China additionally has a geographical benefit over america, particularly relating to technological developments.

Crypto mining, particularly for proof-of-work cryptocurrencies like Bitcoin, is determined by Utility-Particular Built-in Circuit (ASIC) tools to deal with the required advanced calculations for validation and mining.

China’s place as a prime exporter of crypto mining {hardware}, significantly to the US, provides it a possible benefit ought to it determine to revive its mining sector.

The unfolding tariff dispute between the 2 nations provides a layer of uncertainty to the long-term value effectivity of US mining operations.

Puckrin believes that the mix of commerce friction and the US’s invigorated push for crypto dominance may be enough to make China rethink its place.

“It’s unlikely China will make a public U-turn on its crypto mining and buying and selling ban anytime quickly. Nonetheless, with US-based miners accounting for larger and better proportions of Bitcoin’s hashrate, China is certain to be paying consideration and could be quietly reassessing its stance,” Puckrin instructed BeInCrypto.

Nonetheless, China has methods past restarting its Bitcoin mining trade to undermine america’ dominance.

China’s Nuanced Strategy Past US Affect

Although China opposes the widespread use of cryptocurrencies domestically, it might nonetheless see worth in digital belongings to counterbalance the US greenback’s world foreign money dominance.

A number of nations worldwide have both adopted or are contemplating central financial institution digital currencies (CBDCs) to strengthen their home currencies. China is on the forefront of those developments.

“Regardless of the ban on Bitcoin mining, China has actively participated in the digital asset area, by way of initiatives like CDBC analysis and the digital yuan, or e-CNY,” Wanchain CEO Temujin Louie instructed BeInCrypto.

Actually, China’s efforts to create a digital yuan are partly pushed by its want to de-dollarize its economic system and reduce its dependence on the US greenback.

Louie additionally urged that no matter transfer China makes, it gained’t solely base its resolution on what the US does or doesn’t do.

“As all the time, with China, a nuanced strategy is finest. Any shifts in coverage will not be due to US tariffs. Quite, China’s selections will be knowledgeable by world market developments and China’s personal home technique,” Louie added.

That mentioned, China’s selections about digital foreign money will, in flip, have an effect on how its place on crypto continues to develop.

“Weakening USD dominance, whether or not exacerbated or precipitated by President Trump’s strategy to tariffs, might embolden China to be extra aggressive in [its] efforts to internationalise the yuan, together with the digital yuan, or e-CNY. Any change to China’s broader technique will probably be mirrored in [its] stance in the direction of crypto,” he concluded.

China’s exercise in different areas of worldwide commerce already proves how nuanced its coverage adjustments are usually.

May China’s Conflicting Crypto Insurance policies Sign a Change?

Except for its appreciation of digital currencies just like the e-CNY, China’s stance on crypto has already confirmed considerably contradictory. These discrepancies might gas the assumption that the nation may simply be keen to revert—or at the least soften—its complete ban on mining.

A month in the past, funding agency VanEck confirmed that China and Russia –two nations significantly burdened by US sanctions– are reportedly settling a few of their power trades utilizing Bitcoin.

“With the US greenback more and more getting used as a political lever –significantly in tariffed economies– different nations are actively exploring options. Certainly, many nations around the globe, together with China and Russia, are already utilizing Bitcoin instead for buying and selling in commodities and power, for instance. This pattern is just going to speed up as digital belongings turn out to be a extra outstanding a part of the worldwide economic system,” Puckrin instructed BeInCrypto.

In accordance with Puckrin’s evaluation of those indicators, China’s “shadow crypto economic system” is projected to develop this 12 months, which might lead to a reassertion of its energy. This resurgence could be primarily in response to de-dollarization efforts, moderately than a response to US dominance in mining.

We’ll possible see this exercise ramping up within the close to future, particularly as extra nations use crypto to bypass dollar-dominated programs,” he concluded.

It is going to stay essential to interpret China’s intentions, particularly relating to cryptocurrency, by observing its actions moderately than relying solely on its official statements.