The US authorities shutdown is threatening to be an extended one, which can trigger score businesses to downgrade the nation’s credit score. This bearish sign would trigger chaos for TradFi, however a attainable alternative for Web3.

Particularly, businesses warned that additional impasse may injury the US’s credit standing. Prediction markets are presently moderately assured that this shutdown will proceed for longer than the historic common.

Can Shutdowns Trigger Credit score Downgrades?

After a slim vote in Congress failed final evening, the US federal authorities entered a shutdown, with enormous potential ramifications for the crypto market.

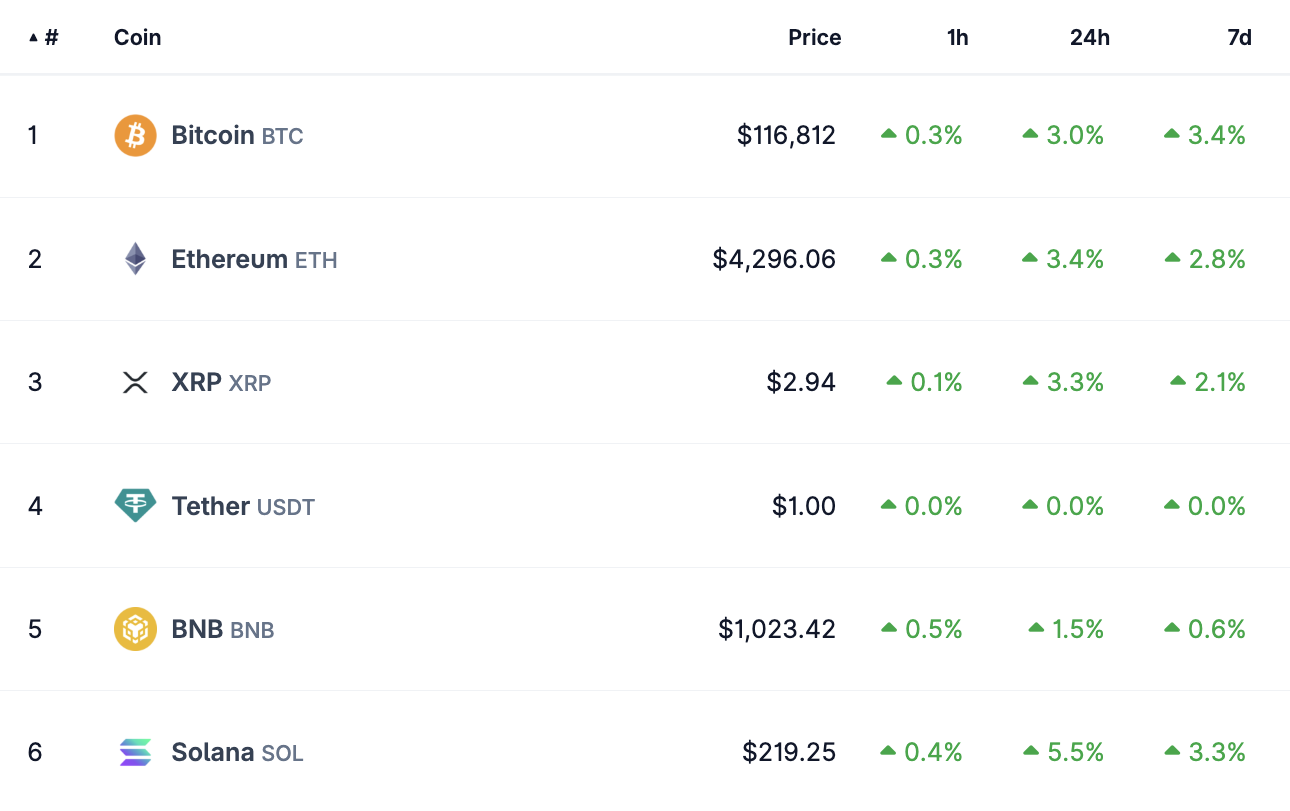

For instance, though TradFi shares went down, the crypto sector is feeling bullish, because the main tokens and common market cap have each risen healthily:

Crypto Reacts to US Shutdown. Supply: CoinGecko

Nevertheless, there’s one wild card at play right here that would show to be an actual stress take a look at for crypto’s use as a recession hedge.

Particularly, there are rising issues that this shutdown may trigger score businesses to downgrade the US credit score. This transfer would compound ongoing losses from the chaotic incident.

The US authorities shutdown:

For the primary time since 2018, the US is about to enter a authorities shutdown and traders are bracing for it.

This might furlough 750,000 staff PER DAY, costing ~$400M in each day compensation.

What does all of it imply? Allow us to clarify.

(a thread) pic.twitter.com/oewTTeOATc

— The Kobeissi Letter (@KobeissiLetter) September 30, 2025

How believable is that this situation? Sadly, there are good causes to imagine that one other authorities shutdown may trigger a credit score downgrade.

In 2023, Fitch cited a 2018 shutdown and different Congressional gridlock when it decreased the US’s credit standing. Moody’s did one thing related in Might 2025, cautioning the federal government that extra downgrades may observe:

“The score might be [further] downgraded if coverage effectiveness or the energy of establishments have been to erode to such a level that materially weakens the sovereign’s credit score profile. This might be the case if it have been to result in a deterioration in medium-term development or financial resilience to shocks, or if it was accompanied by a big and lasting transfer by international traders out of the US greenback,” Moody’s claimed in its final downgrade.

Granted, the score company didn’t explicitly cite authorities shutdowns as a part of its downgrade determination, nevertheless it actually looks as if a believable subtext. Furthermore, this incident may show notably punishing.

Prolonged Impasse and Crypto Alternatives

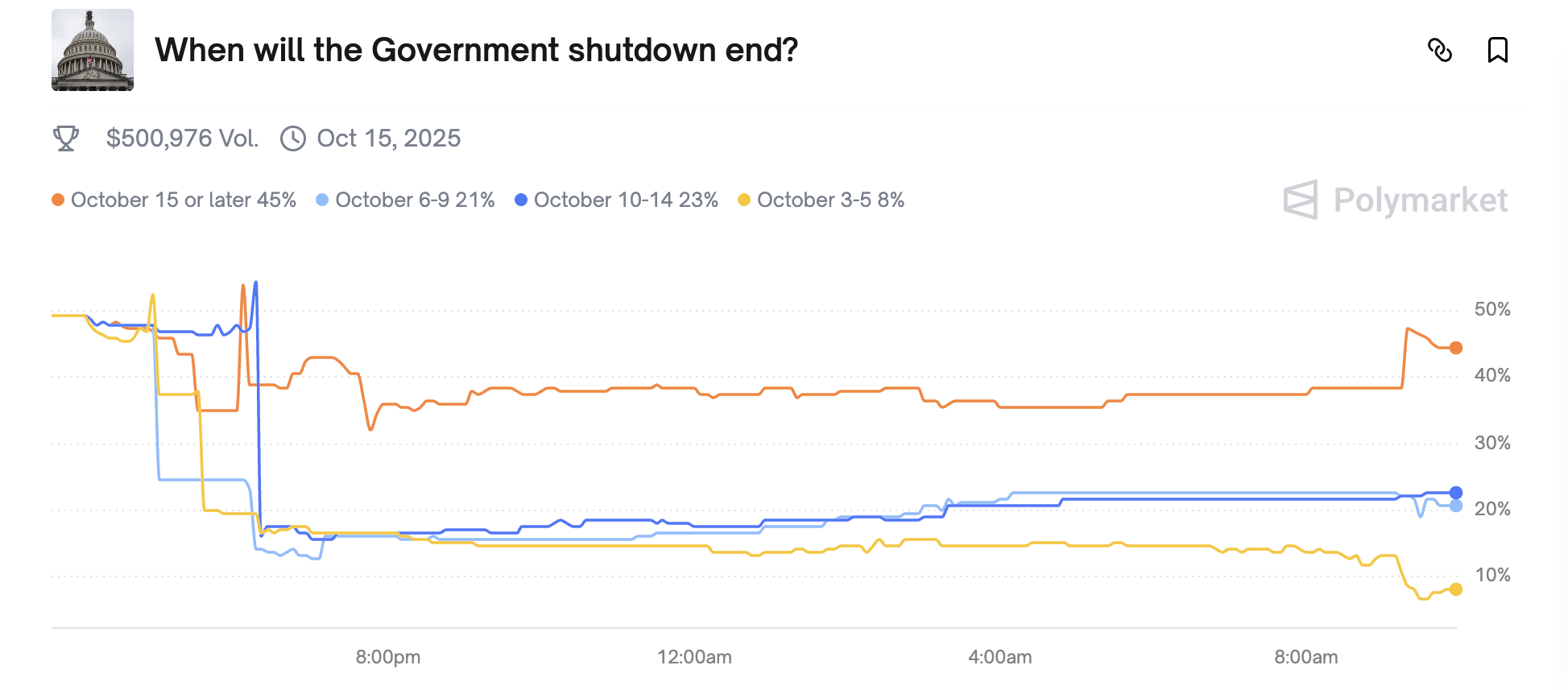

Particularly, analysts decided that the common US authorities shutdown solely lasted eight days. Nevertheless, Trump’s 2018 impasse is a serious outlier; at 35 days, it skewed your complete information set considerably upwards.

Proper now, as economists have famous, prediction markets imagine that this shutdown will final two weeks or longer:

Prediction Markets Assess Shutdown Size. Supply: Polymarket

After all, Polymarket isn’t all the time proper, nevertheless it serves as a vital barometer for market sentiment. If a plurality of traders imagine that this shutdown will go far longer than common, it may additional spur a credit score downgrade.

This bearish sign would possibly trigger any variety of downstream results.

All that’s to say, crypto’s excessive efficiency on the shutdown’s first day is a vital indicator too. There’s a variety of controversy over how Bitcoin will fare in an extended recession, however now we have a vital alternative to assemble some laborious information right here.

If token markets proceed rising by means of a shutdown and a credit score downgrade, that will represent a powerful sign that crypto will probably be a helpful recession hedge.

The submit Might a Authorities Shutdown Downgrade the US Credit score Score? appeared first on BeInCrypto.