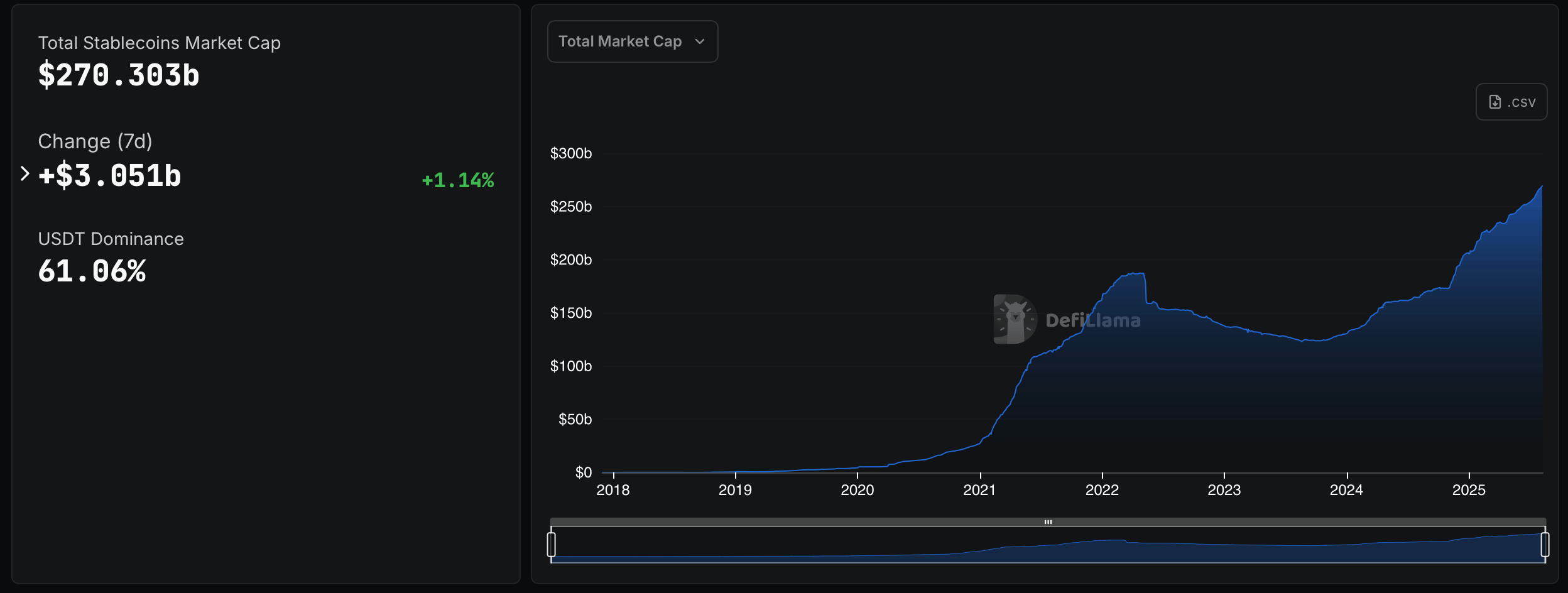

The stablecoin market’s whole worth has surpassed $270 billion, marking a brand new milestone for the sector, in response to stats collected by defillama.com and artemisanalytics.com.

Stablecoin Financial system Climbs as Exercise Broadens

Over the past seven days, mixture stablecoin capitalization rose by $3.051 billion, a 1.14% acquire, per defillama’s dashboard. The brand new whole locations the asset class nearby of its prior peak and extends a gradual climb that carried by means of 2024 and 2025. The determine displays circulating provide multiplied by worth and focuses on dollar-pegged tokens.

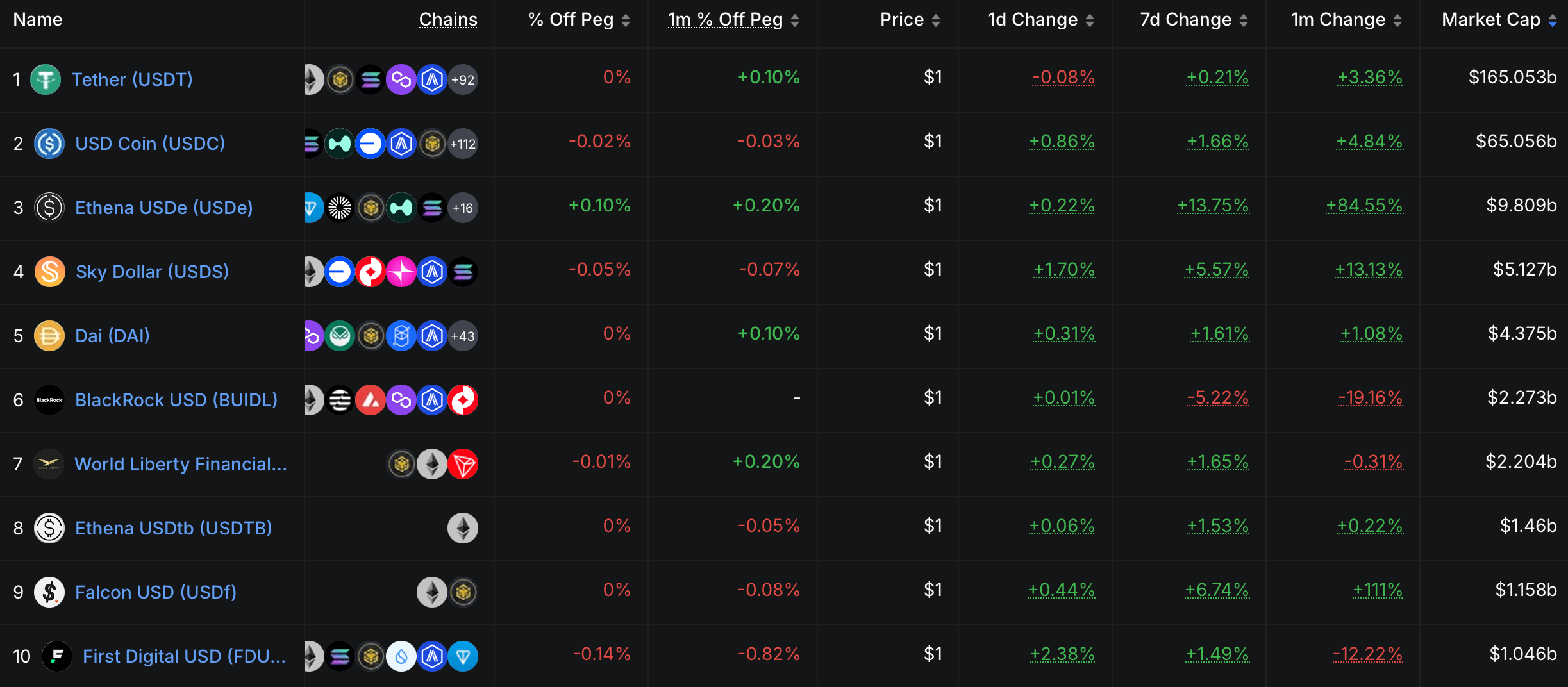

Presently, tether ( USDT) stays the market chief with 61.06% dominance. USDC is the second-largest element, whereas a mixture of opponents, together with Ethena’s USDe, Sky’s USDS and DAI, and Blackrock’s BUIDL, account for single-digit shares. Artemis Terminal’s market-share chart reveals USDT holding a large lead in 2025 and USDC’s portion trending increased this yr.

Supply: Defillama.com

Exercise stays broad. Artemis reviews 42.8 million addresses interacted with stablecoins during the last month, down 15.2% from the prior 30 days, but nonetheless close to the excessive finish of a five-year vary. Handle exercise by chain has widened, with notable participation on BNB Chain, Tron, Base, Arbitrum, Solana, and OP Mainnet alongside Ethereum.

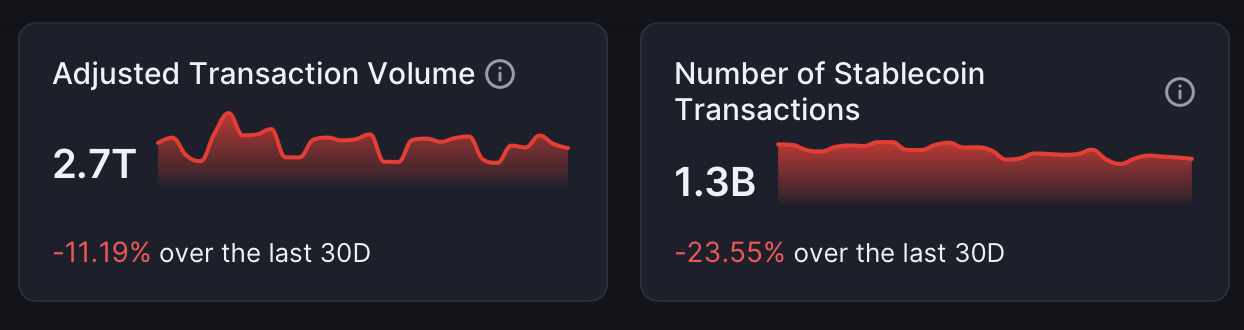

Turnover is heavy. Artemis figures estimate $2.7 trillion in adjusted stablecoin switch quantity during the last 30 days, even after an 11.19% month-over-month decline. The terminal’s multi-year view reveals rolling adjusted quantity within the $1 trillion vary for a lot of 2024–2025, typically near Visa’s degree and effectively above Paypal and international remittance totals on a like-for-like foundation.

Supply: Artemis Terminal

Transaction counts stay elevated at 1.3 billion during the last 30 days, down 23.55% from the earlier interval. That tally spans main networks and factors to repeated use for funds, settlement, buying and selling, and pockets funding throughout centralized and onchain venues.

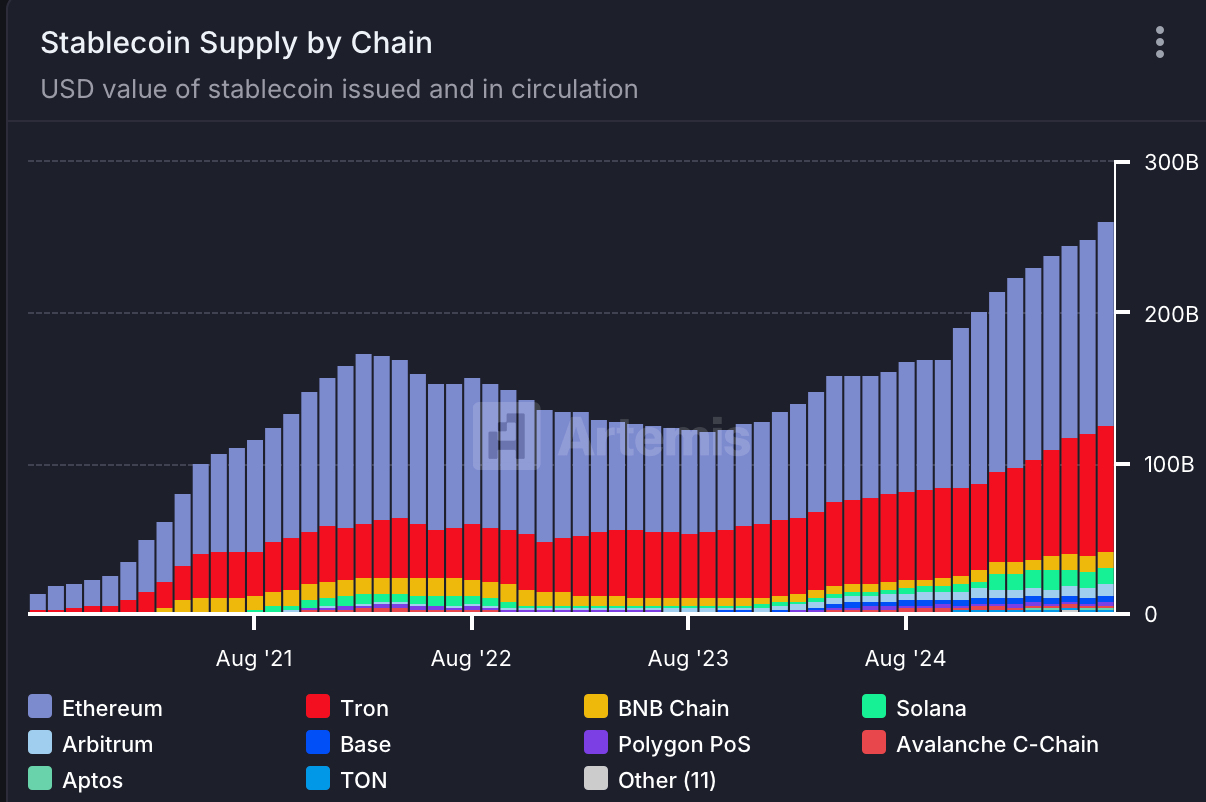

Provide composition skews decisively to the U.S. greenback. Artemis’s foreign money breakdown reveals issuance overwhelmingly in USD phrases, with euro, pound, and different fiat pegs representing an especially skinny slice of mixture provide. U.S. greenback tokens proceed to anchor crypto pricing and collateral practices throughout main exchanges and lending platforms.

Chains matter. Artemis’s supply-by-chain chart reveals Ethereum and Tron holding the most important excellent balances so far, adopted by BNB Chain, Solana, Base, and Arbitrum. A five-year view of internet provide change ranks Ethereum first by absolute development, with Tron second. Rising contributions from Base and Solana spotlight extra venues for issuance and circulation.

Supply: Artemis Terminal

By token, the five-year net-change desk locations USDT far forward in added provide, with USDC subsequent. USDe and USDS contribute smaller however notable will increase, whereas DAI and BUIDL add incremental quantities. The combination suggests incumbents nonetheless dominate issuance, whilst new devices goal onchain money administration or delta-neutral yield methods.

Regional stream is diversified. Utilizing a timezone-based methodology on Ethereum and Solana, Artemis attributes a big share of adjusted transactions to North America and Asia, with Europe’s share lifting since 2024. Latin America, Southeast Asia, and Africa register smaller however very seen parts, signaling adoption by each retail and institutional customers.

Energetic-address charts by token spotlight USDT and USDC as main drivers, with handle counts and interactions posting new highs into 2025. Smaller issuers, together with PYUSD and different area of interest pegs, present restricted however regular engagement. The breadth of handle participation factors to stablecoins’ function as a crypto gateway and settlement medium.

The info from defillama.com and Artemis Terminal each level to a system that’s bigger, extremely lively, and geographically distributed. The $270.303 billion headline determine caps a interval of constant growth, whereas liquidity concentrates in a handful of issuers and blockchains. The asset class capabilities as a bridge between buying and selling venues, wallets, and conventional finance, together with centralized exchanges and onchain protocols.

Supply: Defillama.com

As the whole float reaches the $270 billion threshold, liquidity situations on exchanges and in decentralized finance (DeFi) stay carefully linked to dollar-pegged belongings. Month-to-month rhythms fluctuate, but the mix of dominant issuers, multi-chain distribution, and deep handle exercise signifies persistent demand for tokenized {dollars} throughout buying and selling, remittances, and settlement.

For context, Defillama lists whole stablecoin market cap historical past climbing from underneath $10 billion in 2019 to above $250 billion by late 2021, adopted by a drawdown and a gradual restoration into 2025. Right this moment’s $270.303 billion studying locations the float at a brand new excessive for the interval.