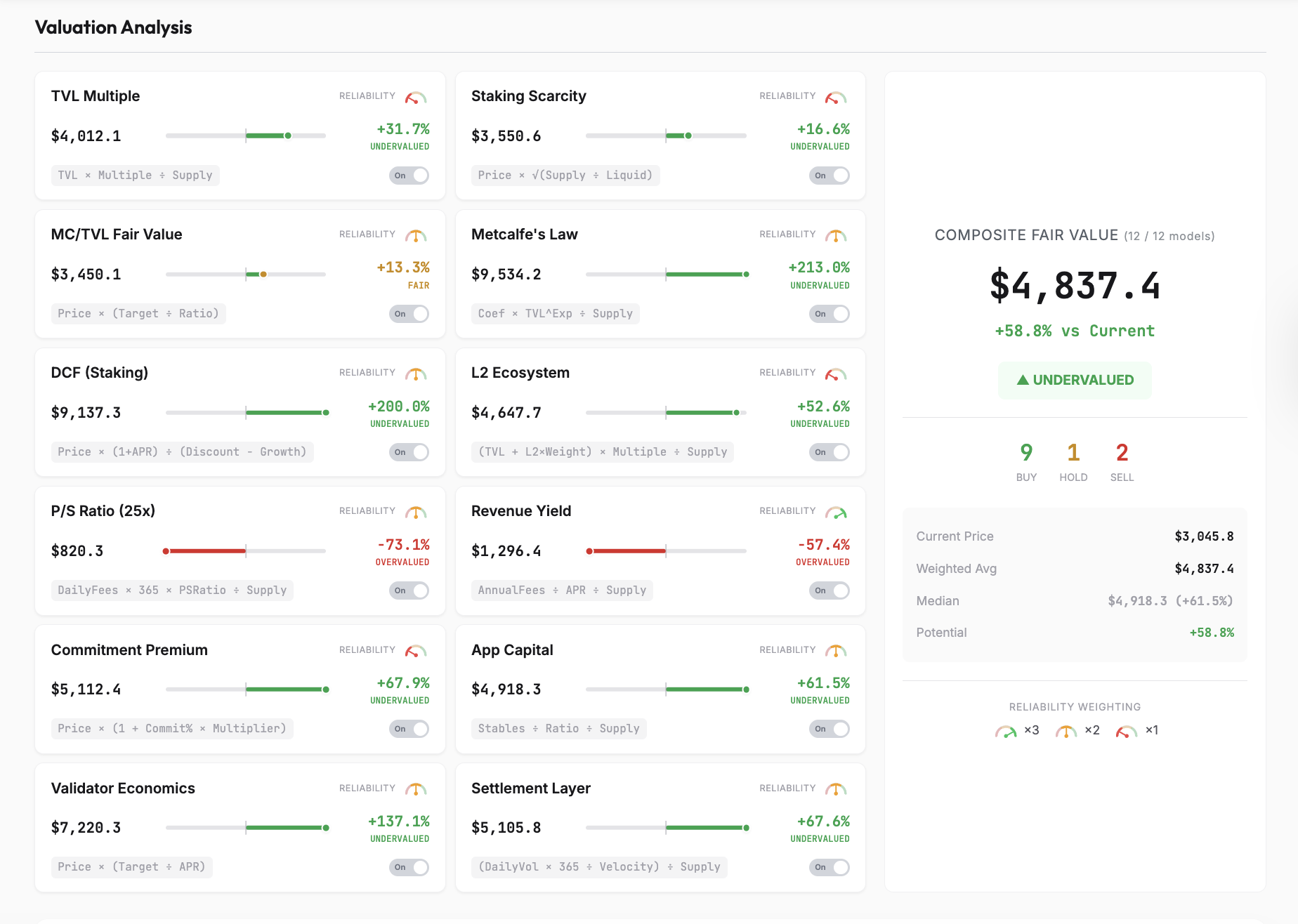

The native token of the Ethereum community, Ether (ETH), is undervalued in 9 out of 12 generally used valuation fashions, based on Ki Younger Ju, a market analyst and CEO of crypto market evaluation platform CryptoQuant.

A composite “honest worth” utilizing all 12 valuation fashions costs ETH at about $4,836, an over 58% achieve in comparison with its value on the time of this writing.

Every valuation mannequin was rated on a three-tiered scale for reliability, with three being essentially the most dependable. Eight out of the 12 fashions characteristic a reliability ranking of a minimum of two. “These fashions have been constructed by trusted consultants throughout academia and conventional finance,” Ju mentioned.

12 totally different ETH valuation fashions sign that ETH is undervalued at present market costs simply north of $3,000. Supply: ETHval

The App Capital valuation mannequin, which accounts for whole on-chain belongings, together with stablecoins, ERC-20 tokens, non-fungible tokens (NFTs), real-world tokenized belongings (RWAs), and bridged belongings, costs ETH at a good worth of $4,918, based on ETHval.

Utilizing Metcalfe’s Regulation, which states that the worth of a community grows in proportion to the sq. of actual lively customers or the variety of nodes within the community, initiatives an ETH value of $9,484, which means the asset is over 211% undervalued, based on the mannequin.

Valuing ETH via the Layer-2 (L2) framework, which accounts for the whole worth locked (TVL) in Ethereum’s layer-2 scaling community ecosystem, initiatives a value of $4,633 per ETH, which means that ETH is about 52% undervalued.

The composite honest worth of ETH over one 12 months. Supply: ETHval

The Ethereum group and analysts proceed to debate how you can worth the world’s first sensible contract platform correctly, with many saying that conventional valuation fashions aren’t enough to worth nascent digital belongings and decentralized blockchain networks.

Associated: Ethereum ICO whale cashes out $60M after 9,500x achieve as high 1% hold shopping for ETH

Regardless of the principally rosy outlook, one valuation mannequin says ETH is grossly overvalued

The Income Yield valuation mannequin, which values ETH by the annual income generated by the community, divided by the staking yield on ETH, says that ETH at present costs of over $3,000 is overvalued by over 57%.

ETH is overvalued, based on the Income Yield valuation mannequin. Supply: ETHval

Income Yield is essentially the most dependable valuation mannequin for precisely pricing ETH, based on ETHval’s standards and methodology.

ETH ought to carry a price ticket of about $1,296, based on the mannequin, highlighting the Ethereum community’s dwindling income technology as charges attain file lows and competing networks take up a few of its market share.

Journal: TradFi is constructing Ethereum L2s to tokenize trillions in RWAs: Inside story