Ethereum (ETH) retains flowing into whale wallets. On-chain information reveals whales added 800K ETH in a single week, probably resulting in a breakout for ETH.

Ethereum whales added 800K ETH prior to now week, in one other spherical of robust accumulation. The shopping for extends the development from the previous weeks, the place whales spent as much as $1.19B on ETH in a single day.

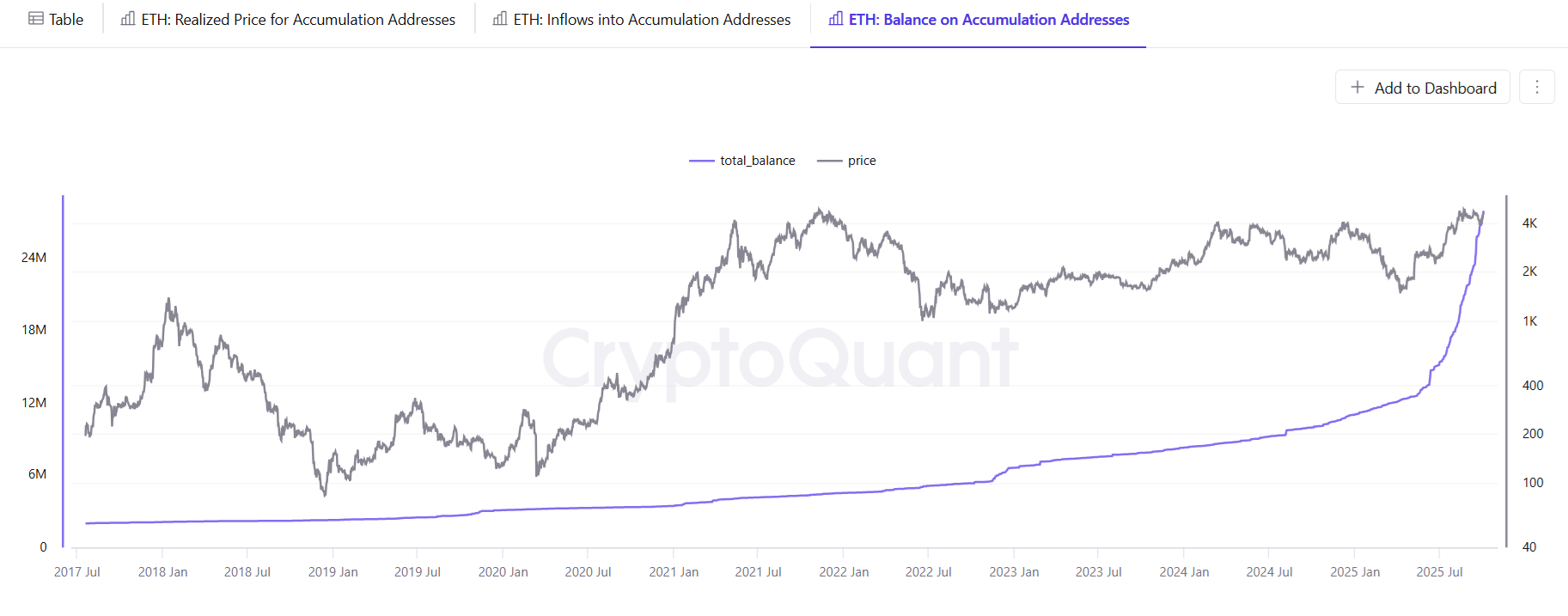

Whale accumulation elevated within the second a part of September and continued in October, probably main ETH to a year-end rally. Traditionally, whale accumulation has preceded bullish market cycles. ETH whales additionally strategically promote for profit-taking, however the total development for ETH is to movement into no-sell accumulation wallets with a complete steadiness of over 27M ETH.

Whales accelerated their shopping for in September, boosting inflows to wallets with over 10K ETH. | Supply: Cryptoquant

Spot accumulation and whale shopping for set up value flooring for ETH, displaying a readiness to carry for the long term. Many of the ETH speculative exercise occurs on by-product markets, whereas spot merchants depend on accumulation and staking.

The quickest development of loading up on ETH comes from wallets with 10K to 100K ETH balances. The buildup accelerated prior to now month, taking extra ETH off the market. Whale exercise turned extra notable within the third quarter, persevering with into a possible year-end rally.

Will ETH value comply with the buildup development?

Regardless of the continued accumulation of ETH, the token’s value stays caught in a variety. Whereas BTC made new value data above $125,000, ETH has remained under its peak.

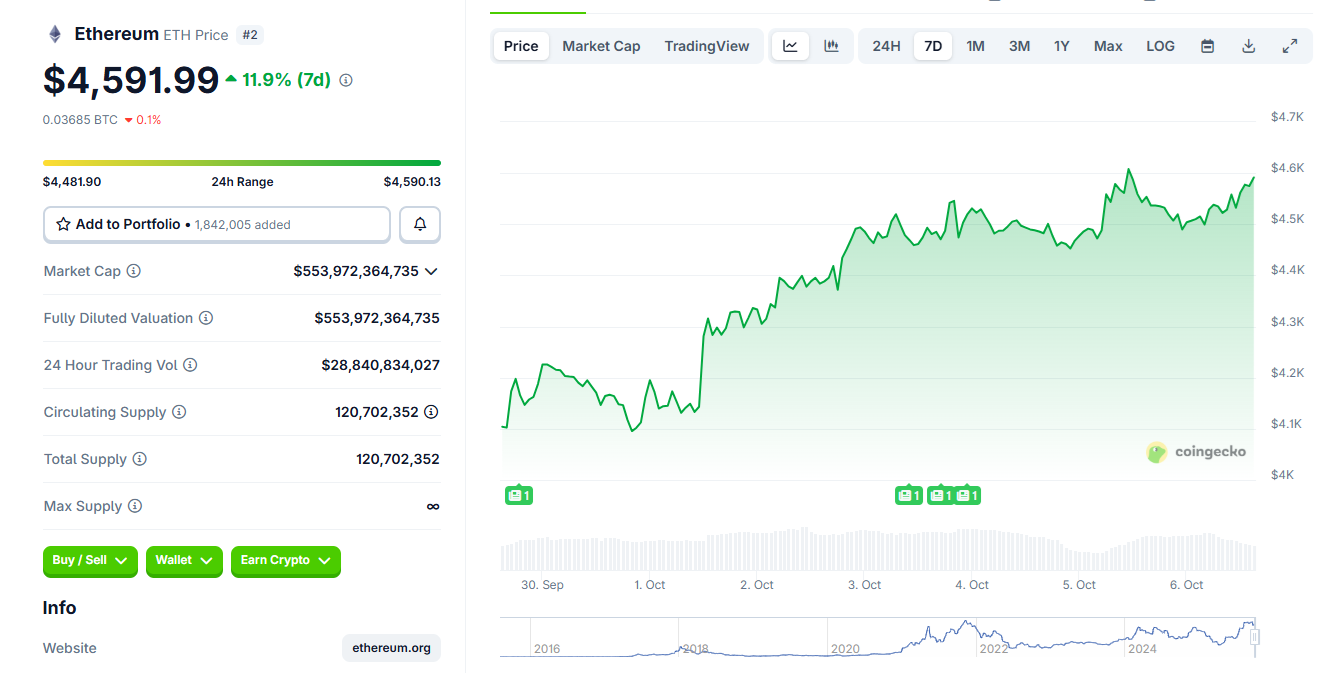

ETH expanded prior to now week, although nonetheless buying and selling removed from its all-time peak. | Supply: Coingecko

ETH traded at $4,573.13 as of October 6, nonetheless awaiting a breakout. ETH expects a better value vary above $6,000 primarily based on bullish predictions. Nonetheless, short-term buying and selling could trigger a crash to $4,100 or decrease.

Based mostly on potential liquidatable positions, ETH is in a variety between $4,700 and $4,400 on the draw back. ETH continues to be rebuilding liquidity after a day of the best liquidations for the reason that 2021 bull market.

Whales additionally put promoting strain on ETH

Whereas accumulation is ongoing, short-term promoting for revenue could sway the market. Just lately, Traits Analysis despatched ETH to Binance, presumably on the market.

Development Analysis deposited one other 77,491 $ETH($354.5M) into #Binance on the market prior to now 10 hours.

Over the previous 4 days, they’ve deposited 143,124 $ETH($642M) into #Binance.https://t.co/Oh2Nr7xOtG pic.twitter.com/yITKkuzykv

— Lookonchain (@lookonchain) October 5, 2025

Extra promoting strain got here from an older ETH pockets promoting 1,800 tokens.

Whereas large-scale wallets are shopping for, the market nonetheless has to soak up promoting from retail. The general bearish stance of retail has led to a turnover of ETH. In accordance with Market Prophit indicators, crowd cash is rather more bearish on ETH in comparison with good cash.

Retail promoting places extra strain on the value, and whales can’t all the time compensate. ETH can be dealing with demand from treasury corporations and ETFs. Within the brief time period, ETH is dealing with a major promote wall at costs main as much as $4,900 and above, with the potential for short-term value resistance.