Bitcoin has lately skilled heightened volatility by setting a contemporary all-time excessive. Nonetheless, the worth has shortly reversed, indicating a bull lure, growing the chance of a sideways consolidation throughout the $116K-$124K vary.

Technical Evaluation

By ShayanMarkets

The Every day Chart

On the every day timeframe, Bitcoin patrons efficiently pushed the asset above its earlier all-time excessive, recording a brand new peak at $124.4K. Nonetheless, this breakout was short-lived, as heavy promoting strain swiftly reversed the transfer, trapping late lengthy entries, a basic bull lure.

The retracement has now introduced BTC again towards a key confluence assist zone round $118K, aligning intently with the ascending channel’s decrease boundary. This space shall be essential in figuring out whether or not the long-term bullish development stays intact. A decisive breakdown from this stage may open the trail towards deeper helps, whereas a rebound right here may reignite bullish momentum.

The 4-Hour Chart

Within the 4-hour timeframe, the latest motion clearly reveals a basic liquidity hunt, value swept above the latest excessive (BSL), triggering breakout buys and stop-loss orders, earlier than reversing sharply. Subsequently, the asset skilled a cascade, breaking beneath the latest swing low (MSS), signaling the early indicators of a possible market construction shift.

At the moment, Bitcoin seems to be consolidating inside a spread between $116K and $124K. Till value breaks convincingly out of this vary, short-term actions are more likely to stay uneven, with merchants specializing in liquidity swimming pools at each vary boundaries.

On-chain Evaluation

By ShayanMarkets

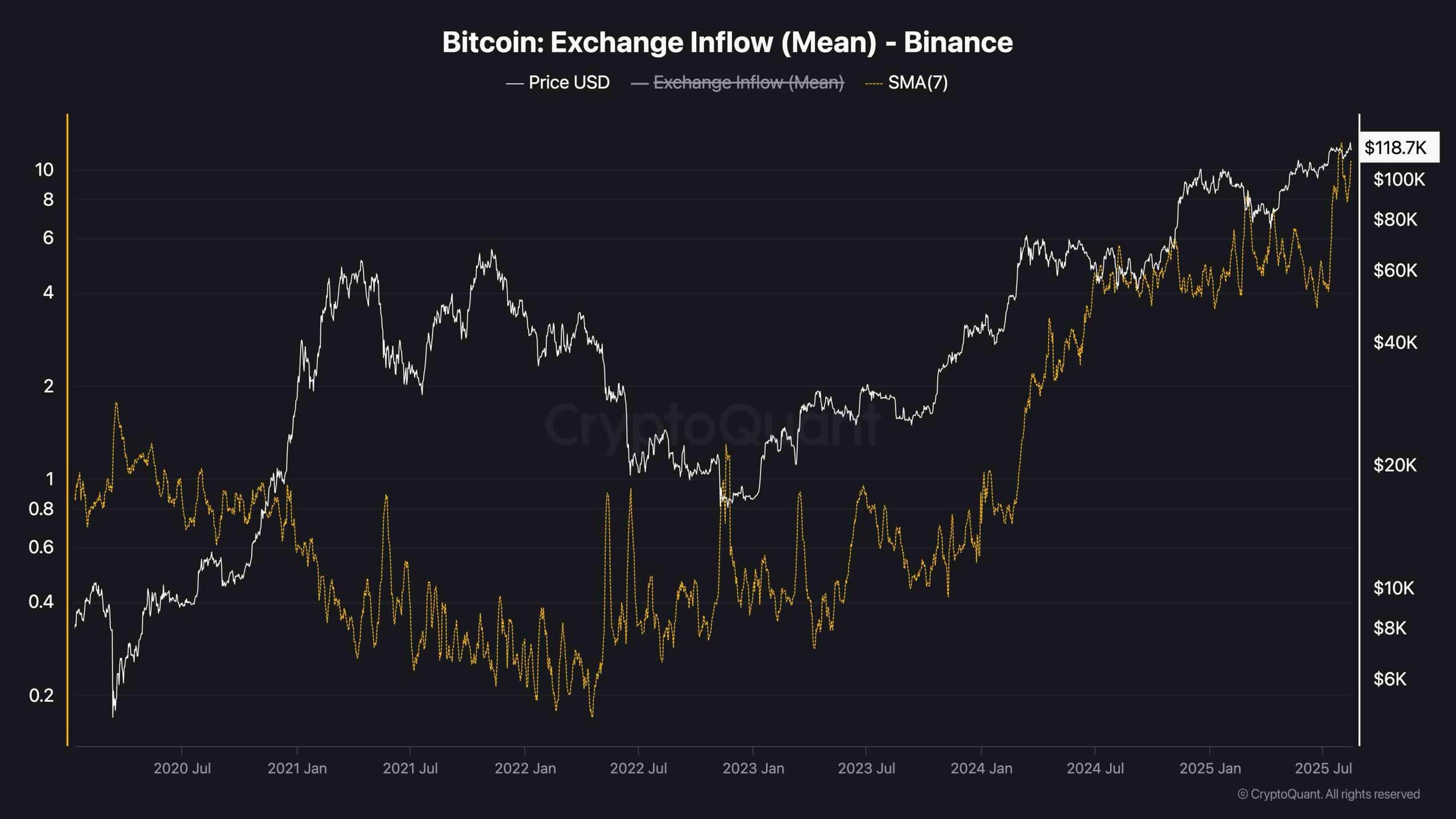

Latest on-chain knowledge reveals a pointy spike in Binance’s Imply Influx (7-day SMA), reaching one of many highest readings in latest months. This metric tracks the typical quantity of BTC being deposited to the change, and such jumps typically align with preparation for promoting, collateralizing margin positions, or institutional portfolio rebalancing.

Sustained excessive inflows point out that extra BTC is being transferred from exterior wallets into Binance’s buying and selling wallets. Traditionally, important influx surges — when not met with equally robust shopping for demand have typically preceded durations of short-term promoting strain.

Supporting this sign, constructive netflow (inflows exceeding outflows) has additionally risen, confirming that Binance’s complete BTC steadiness is growing quite than being offset by withdrawals. With out matching spot demand, this imbalance can tilt the market towards short-term draw back volatility, significantly if massive holders are getting ready to promote or hedge positions through derivatives.