Satoshi Nakamoto, the nameless creator of Bitcoin, ranks because the eleventh richest particular person on earth in the event you rely his unspent cash as a liquid fortune.

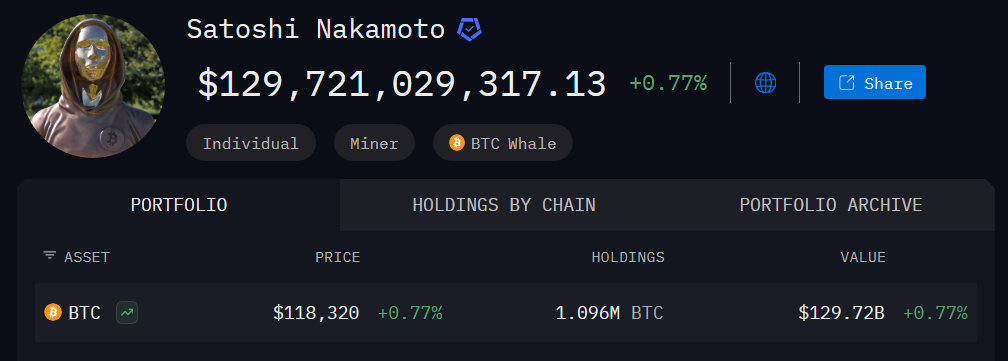

He holds about 1.096 million BTC, which works out to roughly $129 billion based mostly on figures from Arkham Intelligence. That may edge him simply forward of Michael Dell’s $125 billion and go away him trailing Sergey Brin’s $140 billion.

Satoshi’s Fortune In Figures

Based on Arkham Intelligence, these 1.096 million BTC haven’t moved since they had been mined in Bitcoin’s early days. At as we speak’s value, they sit at about $129.23 billion.

Supply: Arkham Intelligence

For context, that sum would slot Satoshi above Dell and under Brin on an actual‑time billionaire checklist. That checklist doesn’t formally embody Satoshi, however plugging his holdings into Forbes’s tracker paints a transparent image of the place he’d fall.

Bitcoin’s value has hovered close to $118,000 in current classes. If it stays there, Satoshi’s stake stays paper wealth—there’s no signal he plans to promote. Oiling these cash into the market may crash costs, so his fortune might keep caught on the high of a ledger moderately than in a financial institution.

Value Goal At $400,000

Primarily based on experiences from an nameless dealer often known as apsk32, Bitcoin may climb to $400,000. That decision comes from a 3‑plot mannequin evaluating Bitcoin’s market cap to gold’s historical past. Gold as soon as peaked at $3,500 an oz, and apsk32 argues Bitcoin follows an analogous sample if you measure each in models of gold.

The primary plot within the mannequin traces gold’s value per ounce over time. The second exhibits Bitcoin’s market cap plotted in opposition to these gold‑based mostly values. A straight development line emerges, which apsk32 ties to Metcalfe’s Legislation—a principle that community worth grows roughly with the sq. of its customers.

The third plot is a log chart, just like Bitcoin’s properly‑identified Rainbow chart, nevertheless it layers on “years‑forward” help bands from zero to 5 years forward of the implied value line.

Mannequin And Market Caveats

Based on that framework, Bitcoin has by no means pierced the 5‑years‑forward band, even in previous bubbles. Proper now, the one‑12 months‑forward line sits close to $400,000.

If historical past holds, BTC may respect that band as a ceiling or ground, relying on market temper and macro elements like Federal Reserve coverage or world demand.

Even when Bitcoin did hit $400,000, that soar represents greater than a 200 % rise from as we speak’s ranges. Forecasts are guesses dressed up in charts. They assist spot doable paths, however markets typically shock everybody.

Featured picture from Getty Photos, chart from TradingView

Editorial Course of for is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our staff of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.