- Cango’s Bitcoin reserve is valued at about $700 million, exceeding its inventory market capitalization.

- December manufacturing rose 4.1% to 569 BTC, lifting whole holdings to 7,528.3 BTC.

- The miner controls roughly 5.4% of worldwide hashrate and is ready for a $10.5 million shareholder funding increase.

Cango Inc.’s Bitcoin treasury is now value greater than the corporate’s complete inventory market capitalization, returning consideration to previous “severely undervalued” assessments of the agency’s inventory valuation by HCW and Greenridge analysts final month.

The Dallas-based miner introduced on Monday, January 5, 2025, that it produced 569 Bitcoins in December, which is a 4.1% month-on-month improve that introduced its whole holdings to 7,528.3 BTC.

With present market costs undulating round $93,000 per Bitcoin, the corporate’s digital asset reserves are valued at roughly $700 million, which is greater than its New York Inventory Alternate (NYSE) market capitalization of over $568 million, as of the time of writing.

The disparity highlights the disconnect between Bitcoin miners’ operational property and their fairness valuations, particularly as many members within the sector proceed to face declining profitability and growing operational prices.

Cango’s CANG inventory is up 16% pre-market at this time, January 6. It is usually up double-digits since its growth into cryptocurrency mining, which it entered solely in November 2024.

Cango’s inventory defies mining business struggles

Cango’s December efficiency stands out in opposition to a backdrop of mounting strain on Bitcoin miners globally.

The corporate maintained a median working hashrate of 43.36 exahashes per second (EH/s) through the month, with a deployed capability of fifty EH/s, which is round 5.4% of the overall world Bitcoin community hashrate, in keeping with the corporate.

“All through 2025, Cango delivered robust and constant operational progress,” mentioned Paul Yu, the corporate’s CEO and a director. “In December, because of beneficial community problem changes, we maintained secure working hashrate ranges and achieved larger each day bitcoin manufacturing, bringing our whole bitcoin holdings to 7,528.3 BTC.”

The corporate’s manufacturing beneficial properties come as different miners have struggled with profitability issues. Trade information from Hashrate Index signifies that whereas community problem has stabilized, many operations are working at or close to breakeven ranges, elevating questions on potential miner capitulation.

Cango closes in on top-10 Bitcoin treasury spot

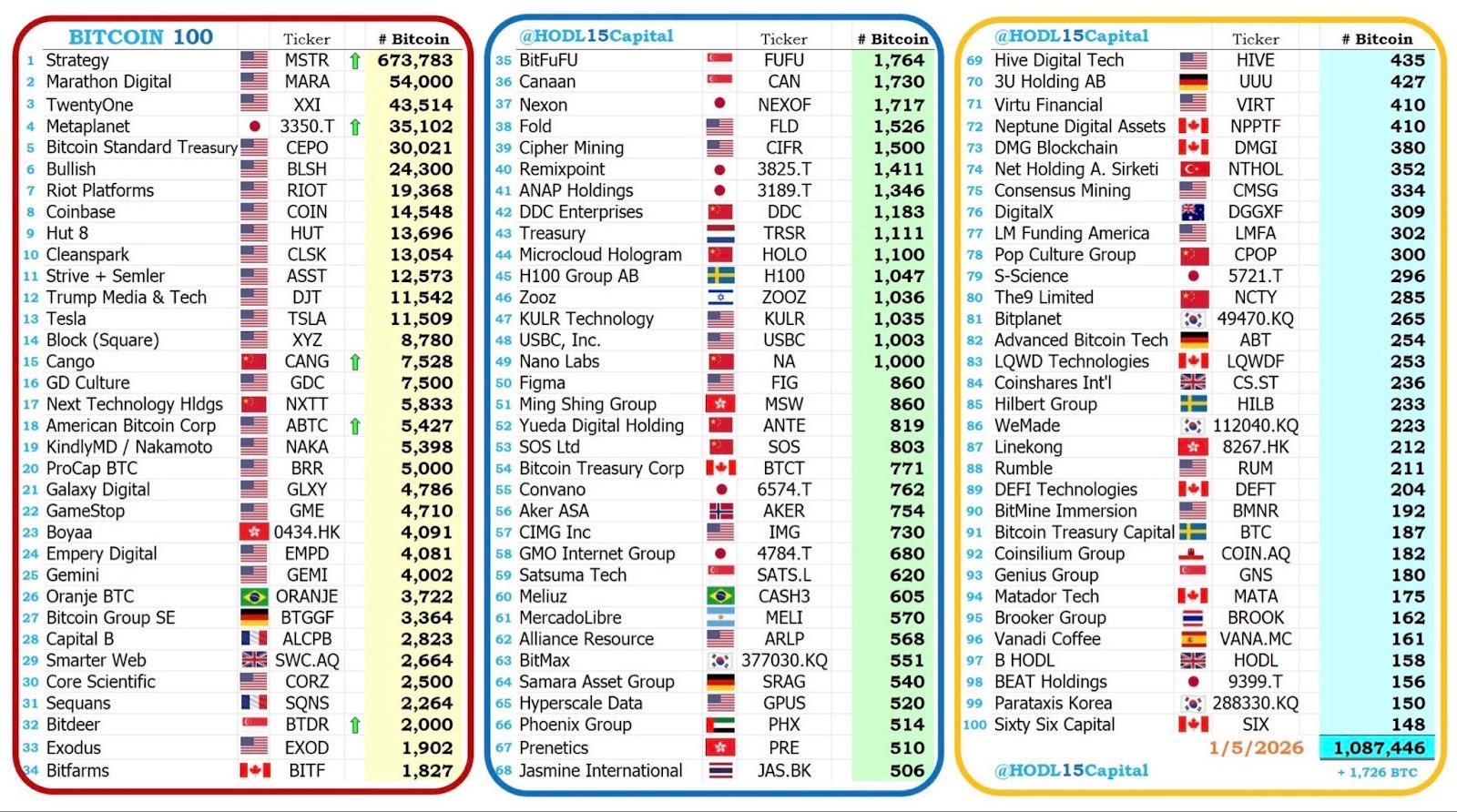

Cango has already surpassed GD Tradition, changing into the fifteenth listed bitcoin reserve firm. The corporate has adopted a “HODL” technique, explicitly stating it doesn’t at the moment intend to promote any of its Bitcoin holdings.

Nevertheless, in contrast to heavyweights like Technique, previously MicroStrategy, which have embraced this technique, Cango’s considerably smaller market capitalization creates a extra pronounced valuation dynamic, with its Bitcoin holdings alone representing roughly 140% of its fairness worth.

The corporate acquired a vote of confidence with traders committing funds for the corporate.

In line with Yu, “in late December, a serious shareholder determined to extend its funding in Cango with a US$10.5 million dedication, which is anticipated to shut in January 2026, representing a strong vote of confidence in our strategic roadmap.”

Cryptopolitan reported in December that Enduring Wealth Capital Restricted (EWCL) made a $10.5 million dedication to Bitcoin miner Cango following an earlier $70 million funding deal introduced in June 2025.

Yu added that the funding would assist Cango “drive higher bitcoin mining effectivity, and speed up the parallel growth of our vitality and AI compute platform in 2026.”

Diversification past mining

Identical to many miners who’ve confronted the latest challenges of the mining sector and embraced diversification, Cango is pursuing a diversified technique.

The corporate operates greater than 40 mining websites spanning North America, the Center East, South America and East Africa, whereas additionally growing pilot tasks in built-in vitality options and distributed synthetic intelligence computing.

Cango additionally continues to take care of its authentic enterprise line, AutoCango.com, a global used automotive export platform, representing an uncommon hybrid company construction throughout the cryptocurrency mining sector.

For now, analysts are on the lookout for indicators that Cango can bridge the hole between its Bitcoin treasury worth and market capitalization.

Nevertheless, the success of its Bitcoin mining enterprise is indeniable, which spilled over to the inventory aspect because it rose by as a lot as 13% yesterday, closing in on the $2 mark following the announcement.

As of mid-December, HCW analysts made a case for the CANG inventory hitting $3 as whereas Greenridge analysts had been extra bullish, with a $4 goal worth for Cango.

AI ambitions transfer up on precedence checklist

Cango has constantly hinted at plans to change into a globally distributed AI-compute community. The agency is already working in the direction of this purpose by leveraging its present compute infrastructure and entry to gigawatts of permitted, grid-connected energy capability throughout its world footprint.

“The character of competitors in AI has shifted from software program algorithms to the shortage of energy and house,” Juliet Ye, the corporate’s IR Director, defined to Cryptopolitan.

Cango is growing what it describes as an modern, plug-and-play AI infrastructure answer designed to allow Bitcoin mining websites to transition into services able to working AI inference workloads with out the prohibitively costly infrastructure upgrades that usually price tens of hundreds of thousands of {dollars} and have a tendency to discourage such conversions.

The corporate has already validated its answer in real-world environments, “Plans are underway to copy this mannequin throughout a number of mining websites inside this 12 months,” added Juliet.

Cango’s technique addresses rising demand from the long-tail inference marketplace for geographically distributed computing energy nearer to information sources. It additionally helps quite a few small and medium-sized BTC mining websites worldwide to transition to AI with out worrying in regards to the attendant infrastructural price.

Within the close to time period, the corporate goals to unlock the total worth of its 50 EH/s mining capability whereas selectively coming into the GPU compute leasing market, with medium-term plans to develop regional AI networks and long-term ambitions of constructing a globally distributed compute grid backed by multi-year compute offtake agreements.