Bitcoin miners simply triggered one of many largest retreats in years, and virtually nobody is speaking about it. Hashrate has fallen by over 40% from its all-time excessive, which some specialists are calling the largest failure of miners since China’s ban in 2021.

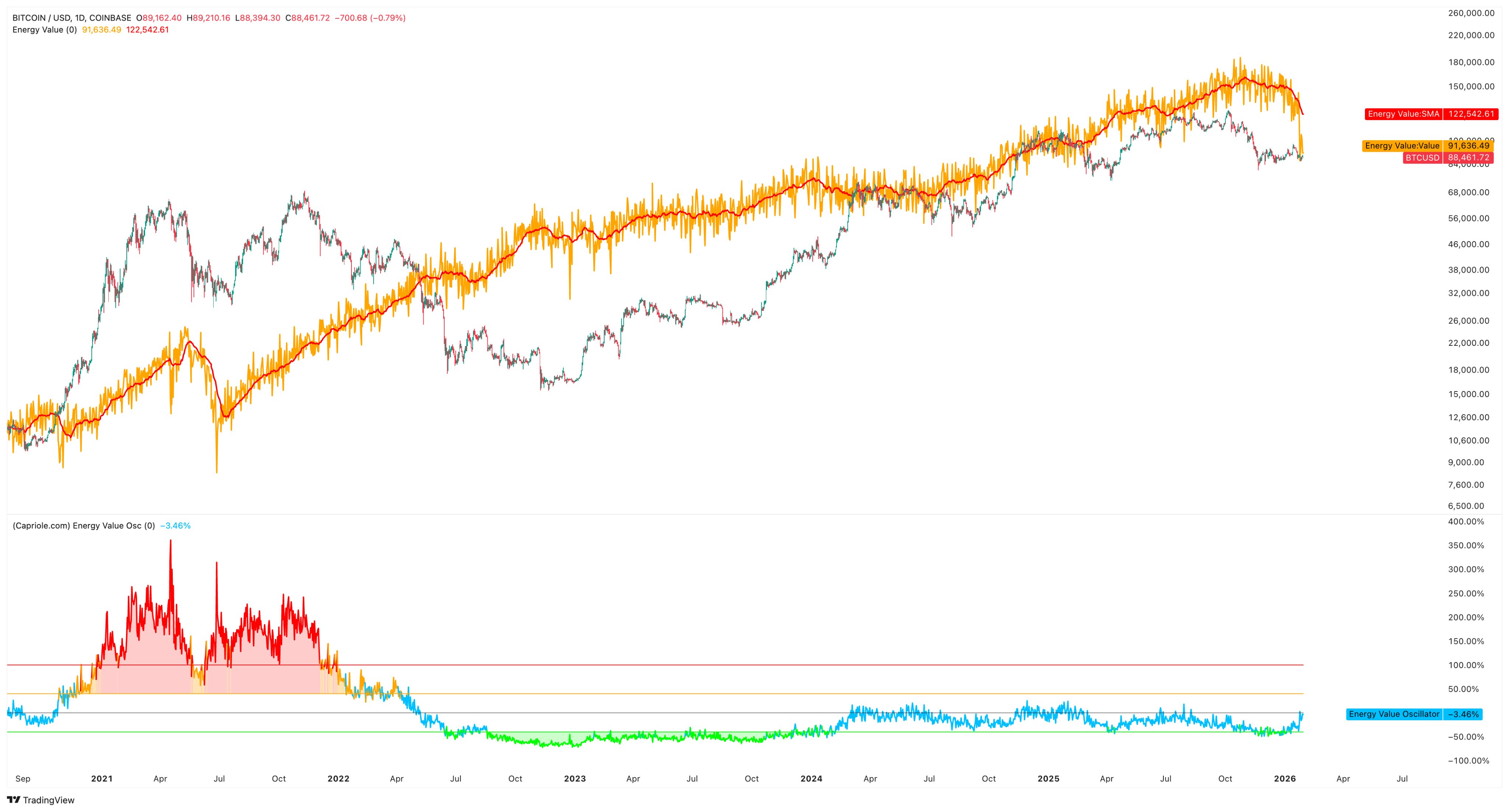

The crimson flag? Bitcoin’s Vitality Worth, a metric that doesn’t get a lot consideration however is definitely fairly predictive — simply took a tough dive with it.

Charles Edwards, creator of the Vitality Worth mannequin, sounded the alarm first. His take is that main BTC miners are shutting down. Once more, not scaling again, however leaving en masse.

The indicator, which hyperlinks hashrate and power prices to honest worth, now reveals Bitcoin priced virtually 4% under its energy-derived baseline. And the shifting common has turned over for the primary time in over a yr.

However not everyone seems to be shopping for into the doom.

“Crypto winter” remains to be winter

The opposing camp says the hashrate drop shouldn’t be capitulation — simply winter. Energy costs throughout the key U.S. grids shot as much as over $100/MWh as Winter Storm Fern messed with provide and led to load curtailments. On this model, miners didn’t stop, they simply paused.

So, it could come that almost all of that hashrate will bounce again inside two weeks, and Edward’s chart simply captured a climate occasion.

Others see rising power prices as a chance, not a menace. With the smaller gamers now out of the sport, the large industrial-scale miners are capable of get their fingers on extra of the market share, and at higher margins. That modifications Edwards’s bearish take right into a miner consolidation thesis.

Even so, the dimensions of the drop is tough to disregard. The final time Vitality Worth fell this difficult and quick, the cryptocurrency spent six months in a dying spiral earlier than discovering the underside. That doesn’t imply we’re heading for a repeat of the previous, although. At the moment’s atmosphere consists of ETFs, nation-state patrons and structurally greater demand.

However the warning signal is flashing once more.