As capital flows sharply out of the crypto market in early 2026 and investor sentiment stays at excessive worry ranges, enterprise capital allocation selections have develop into a useful sign. These strikes assist retail buyers determine sectors that will nonetheless maintain potential throughout a bear market.

Latest studies point out that the crypto market setting has modified. The sectors attracting VC funding have shifted accordingly.

VCs Make investments Over $2 Billion in Crypto in Early 2026

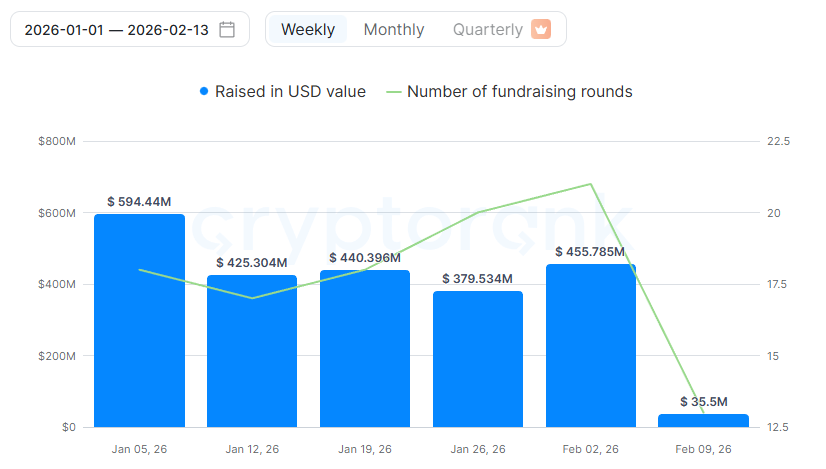

Knowledge from CryptoRank reveals that enterprise capital companies have invested greater than $2 billion into crypto initiatives for the reason that starting of the yr. On common, weekly inflows have exceeded $400 million.

Crypto Fundraising in Early 2026. Supply: CryptoRank

A number of giant offers stand out. Rain raised $250 million to construct enterprise-grade stablecoin cost infrastructure. BitGo secured $212.8 million by its IPO, reinforcing its function as a digital asset custodian and safety supplier for institutional purchasers.

BlackOpal additionally raised $200 million for its GemStone product, an investment-grade automobile backed by tokenized Brazilian bank card receivables.

High Funding Rounds For Crypto VCs in Early 2026. Supply: Alex Dulub

Past these offers, Ripple invested $150 million in buying and selling platform LMAX. The transfer helps the combination of RLUSD as a core collateral asset inside institutional buying and selling infrastructure. Tether additionally made a $150 million strategic funding in Gold.com, increasing world entry to each tokenized and bodily gold.

Analyst Milk Highway notes that capital is now not flowing into Layer 1 blockchains, meme cash, or AI integrations. As a substitute, stablecoin infrastructure, custody options, and real-world asset (RWA) tokenization have emerged because the dominant funding themes.

Market knowledge helps this shift. For the reason that begin of the yr, complete crypto market capitalization has fallen by roughly $1 trillion. In distinction, stablecoin market capitalization has remained above $300 billion. The entire worth of tokenized RWAs has reached an all-time excessive of over $24 billion.

What Does the Shift in VC Urge for food Sign?

Ryan Kim, founding associate at Hashed, argues that VC expectations have essentially modified. The shift displays a brand new funding commonplace throughout the business.

In 2021, buyers targeted on tokenomics, neighborhood progress, and narrative-driven initiatives. By 2026, VCs will prioritize actual income, regulatory benefits, and institutional purchasers.

“Discover what’s absent? No L1s. No DEXs. No ‘community-driven’ something. Each greenback went to infrastructure and compliance,” Ryan Kim said.

The biggest offers listed above contain infrastructure builders reasonably than token-driven initiatives designed to generate value hypothesis. Consequently, the market lacks the weather that beforehand fueled hype cycles and FOMO.

“Not on hypothesis. Not on hype cycles. They’re trying on the pipes, rails, and compliance layers,” analyst Milk Highway mentioned.

Nonetheless, analyst Lukas (Miya) presents a extra pessimistic view. He argues that crypto enterprise capital is in a state of collapse, citing a pointy, sustained decline in restricted associate commitments.

He factors to a number of warning indicators. Excessive-profile companies akin to Mechanism and Tangent have shifted away from crypto. Many companies are quietly unwinding their positions.

It might nonetheless be too early to declare the collapse of crypto VC, on condition that greater than $2 billion has flowed into the sector for the reason that begin of the yr. At a minimal, these adjustments recommend that crypto is integrating extra deeply with the standard monetary system, a possible signal of long-term maturation.

The submit The place Are Crypto Enterprise Capital Funds Investing in Early 2026? appeared first on BeInCrypto.