TradFi’s relationship with Bitcoin continues to evolve, with 34 public companies now holding a mixed 699,387 BTC—price over $72 billion. MicroStrategy stays the undisputed chief, holding 555,450 BTC alone.

Whereas some view Bitcoin treasury methods as bullish catalysts, the information tells a extra nuanced story: including BTC to a steadiness sheet isn’t a assured inventory booster. Outliers like Metaplanet have surged over 3,000% since their BTC entry, however many others have seen much more modest good points, and even declines.

Metaplanet Inc.

Metaplanet is a Japanese public firm that has shortly reworked from a standard enterprise—previously concerned in lodge operations—into one in all Asia’s most aggressive Bitcoin-focused companies. Its transformation exhibits how some TradFi gamers are reshaping their fashions round digital belongings.

Since launching its Bitcoin Revenue Era technique in late 2024, the corporate has pivoted sharply towards crypto, with 88% of its Q1 FY2025 income—¥770 million ($5.2 million)—coming from Bitcoin possibility premium harvesting.

Metaplanet first added Bitcoin to its steadiness sheet in April 2024 and now holds 5,555 BTC price roughly $576.8 million. Since that preliminary transfer, the corporate’s inventory has soared over 3,000%, with current filings displaying a 15x improve in share value year-to-date.

METAPLANET Worth Evaluation. Supply: TradingView.

The agency’s aggressive BTC accumulation technique—focusing on 10,000 BTC by year-end—has drawn rising investor curiosity, increasing its shareholder base by 500% in a 12 months.

Regardless of short-term valuation losses attributable to Bitcoin value fluctuations, Metaplanet reported ¥13.5 billion in unrealized BTC good points as of Could 12, signaling robust confidence in its long-term crypto positioning.

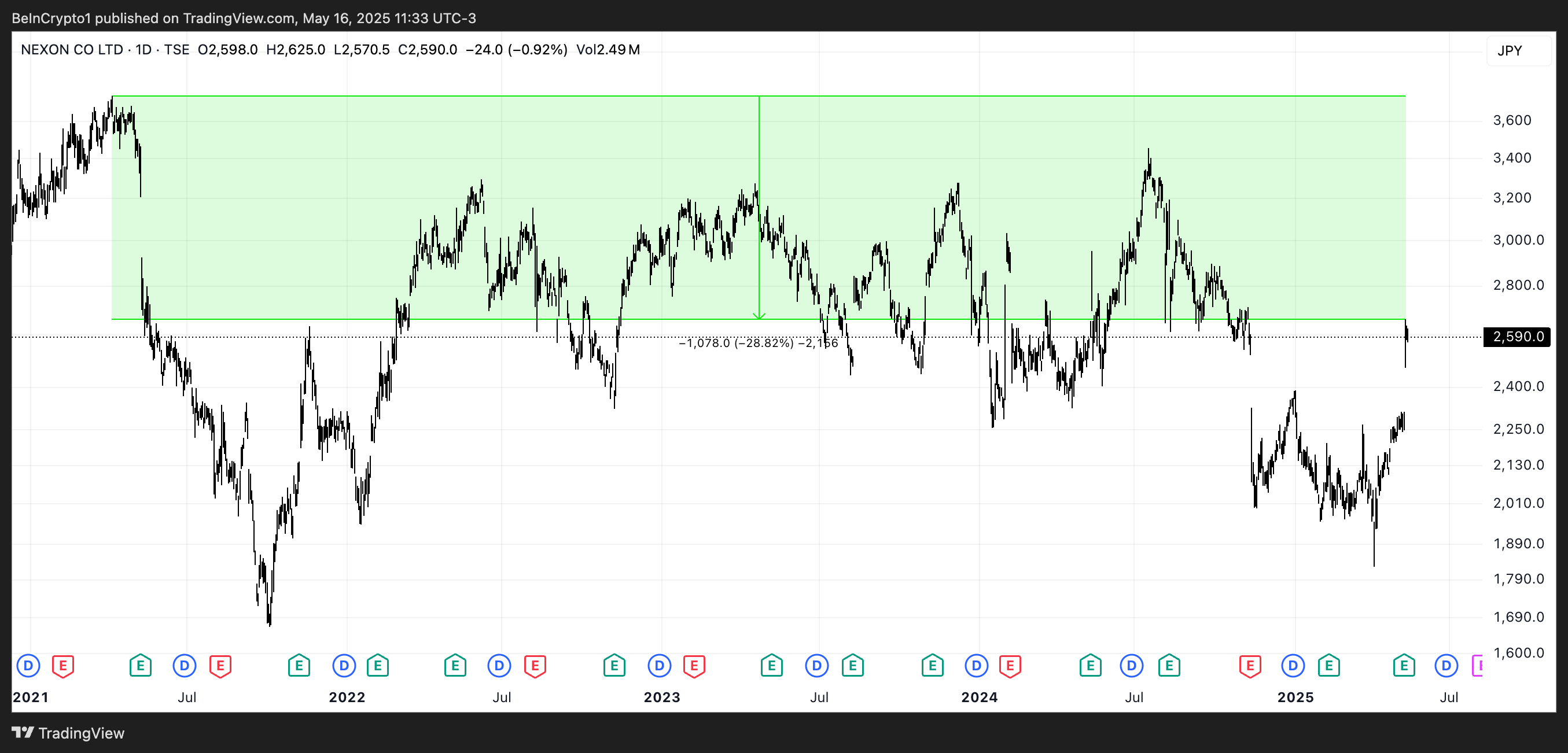

NEXON

Nexon, a serious Japanese gaming firm behind international hits like Dungeon&Fighter and MapleStory, added Bitcoin to its steadiness sheet in April 2021 and at the moment holds 1,717 BTC—price roughly $178.3 million.

Regardless of this sizable allocation, the transfer hasn’t paid off by way of market efficiency, as Nexon’s inventory is down practically 29% for the reason that buy, displaying how, for a lot of TradFi companies, crypto publicity doesn’t essentially translate into fairness good points.

NEXON Worth Evaluation. Supply: TradingView.

Not like different companies that noticed main investor enthusiasm from Bitcoin publicity, Nexon’s worth stays extra intently tied to the efficiency of its gaming franchises.

In its Q1 2025 earnings report, Nexon reported income of ¥113.9 billion, up 5% 12 months over 12 months, and working earnings leaping 43% to ¥41.6 billion, pushed by robust efficiency from core titles and decrease prices.

Semler Scientific (SMLR)

Semler Scientific made its first Bitcoin buy in Could 2024 and at the moment holds 1,273 BTC, valued at roughly $132.2 million.

Since adopting Bitcoin as its main treasury reserve asset, the corporate’s inventory has climbed over 55%.

Whereas smaller in scale in comparison with high crypto treasury holders, Semler’s aggressive accumulation and efficiency have positioned it as a notable participant within the Bitcoin company adoption narrative.

SMLR Worth Evaluation. Supply: TradingView.

In its Q1 2025 earnings name, Semler Scientific reported a combined efficiency. Income dropped 44% year-over-year to $8.8 million, pushed by declines in its healthcare section, whereas working losses widened to $31.1 million amid $39.9 million in bills.

A web lack of $64.7 million was largely attributable to an unrealized lack of $41.8 million from Bitcoin value fluctuations.

Regardless of these setbacks, the corporate reaffirmed its dedication to increasing its BTC holdings by way of a $500 million ATM program and a $100 million convertible word.

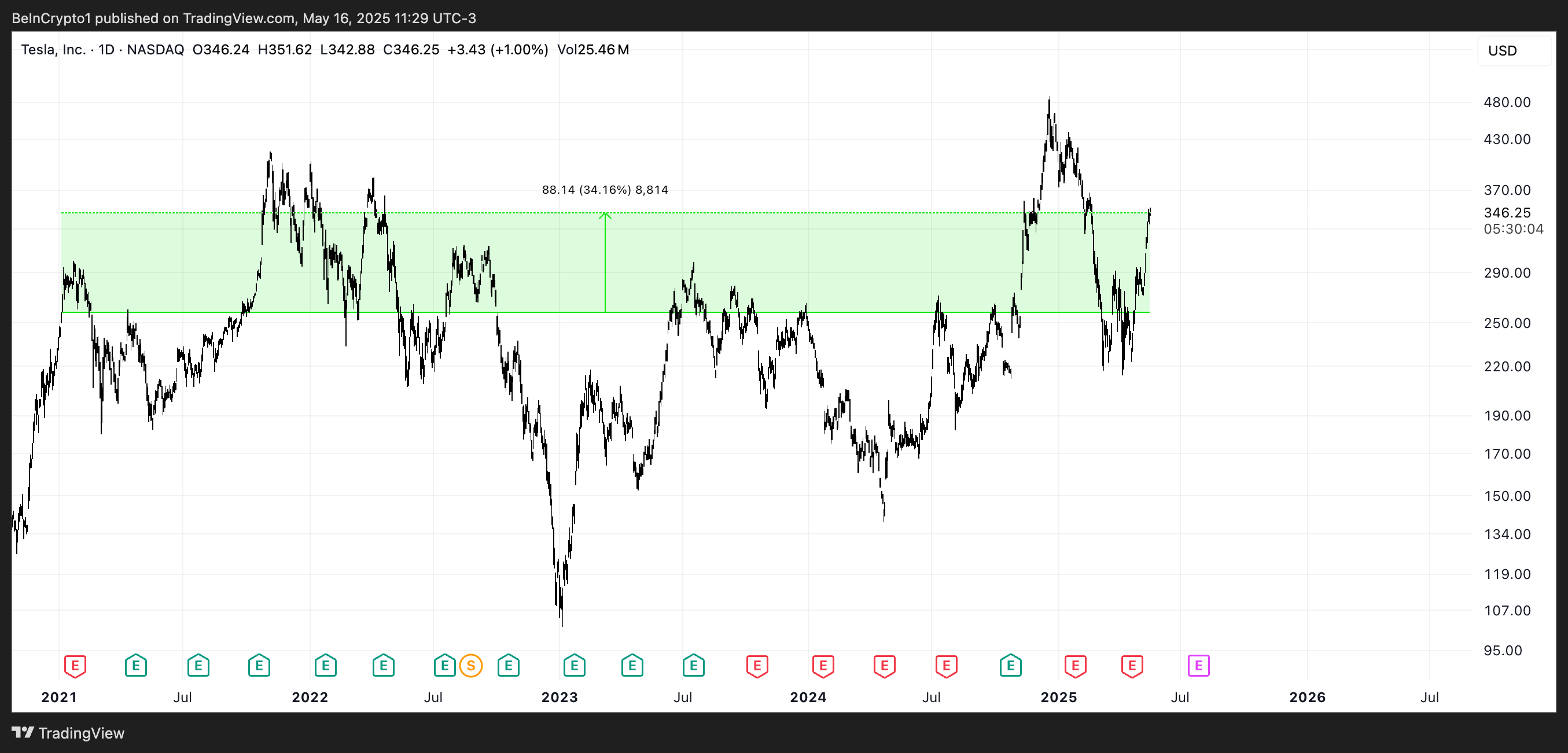

Tesla (TSLA)

Tesla, led by Elon Musk, has had a fancy and headline-grabbing relationship with Bitcoin since including it to its steadiness sheet in January 2021.

Musk, a long-time crypto fanatic, has influenced market sentiment by way of each Tesla’s actions and his private commentary on digital belongings like BTC and Dogecoin. Tesla’s inventory is up 34% since that preliminary Bitcoin purchase, however the path has been risky—peaking close to $480 in late 2024 earlier than collapsing under $107 in early 2023.

Regardless of the swings, Musk’s Bitcoin advocacy and Tesla’s early crypto publicity helped place the corporate as a bellwether for institutional adoption of crypto. Its journey displays the volatility and complexity of crypto publicity inside giant TradFi corporations, as BTC is up 212% in the identical interval.

TSLA Worth Evaluation. Supply: TradingView.

In its newest Q1 2025 earnings, nonetheless, Tesla posted disappointing outcomes. Automotive income dropped 20% year-over-year to $14 billion, dragging complete income down 9% to $19.34 billion, properly under Wall Road estimates.

Internet earnings plummeted 71% to $409 million, and working margin collapsed to 2.1% as manufacturing upgrades, value cuts, and political uncertainty—together with rising tariffs—weighed closely on efficiency.

Amid declining deliveries and intensifying international competitors, Tesla highlighted progress in vitality storage and AI infrastructure.

Nonetheless, with shares down 41% year-to-date and Musk’s rising political involvement drawing additional scrutiny, buyers stay cautious as the corporate prepares for a possible robotaxi launch in June.

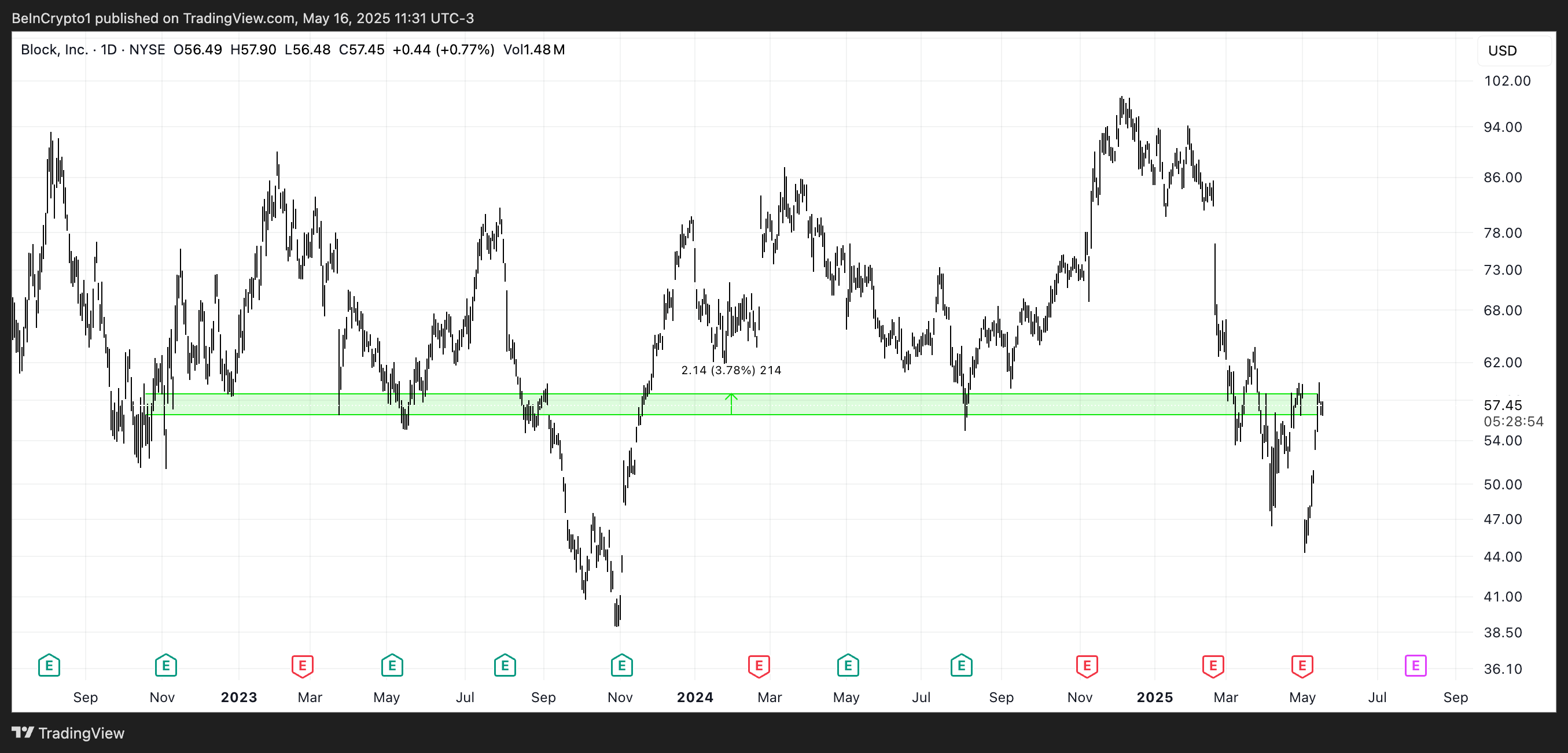

Block Inc. (Previously Sq.)

Block Inc., co-founded by Jack Dorsey, added Bitcoin to its steadiness sheet in October 2022 and at the moment holds 8,485 BTC, price roughly $881 million.

Recognized for its early embrace of Bitcoin and crypto integration by way of Money App, Block has positioned itself as one of the distinguished company Bitcoin holders.

Since its preliminary BTC acquisition, the inventory has risen simply 3.8%, reflecting a turbulent journey, peaking above $100 in December 2024, but additionally dropping to round $38.5 in November 2023 amid broader tech sector volatility and macroeconomic headwinds for TradFi.

XYZ Worth Evaluation. Supply: TradingView.

Block’s Q1 2025 earnings revealed a combined image. The corporate missed each income and revenue expectations, posting $5.77 billion in income versus the $6.2 billion anticipated.

Regardless of a 9% rise in gross revenue to $2.29 billion, steering for the remainder of the 12 months was reduce attributable to macro uncertainty, together with the influence of recent tariffs.

Money App’s gross revenue rose 10% to $1.38 billion, due to the launch of Afterpay’s buy-now-pay-later characteristic and the growth of its lending program beneath FDIC approval.

Nevertheless, gross fee quantity elevated, and worldwide publicity now accounts for 18% of the full quantity.

Whereas Block posted its most worthwhile quarter thus far, shares are down 31% year-to-date, and buyers stay cautious as the corporate prepares to ship its first Bitcoin mining chips later this 12 months.