The whole crypto market capitalization rose right now, amid anticipated Shopper Value Index (CPI) information and excessive optimism for a Fed price lower subsequent week.

Nonetheless, the market rebound proved disastrous for merchants betting in opposition to it. The truth is, one Hyperliquid dealer, recognized by the pockets handle 0xa523, has now surpassed the losses of high-risk merchants like James Wynn, turning into the highest loser.

The Hyperliquid Loser Who Misplaced $43 Million — What Went Flawed?

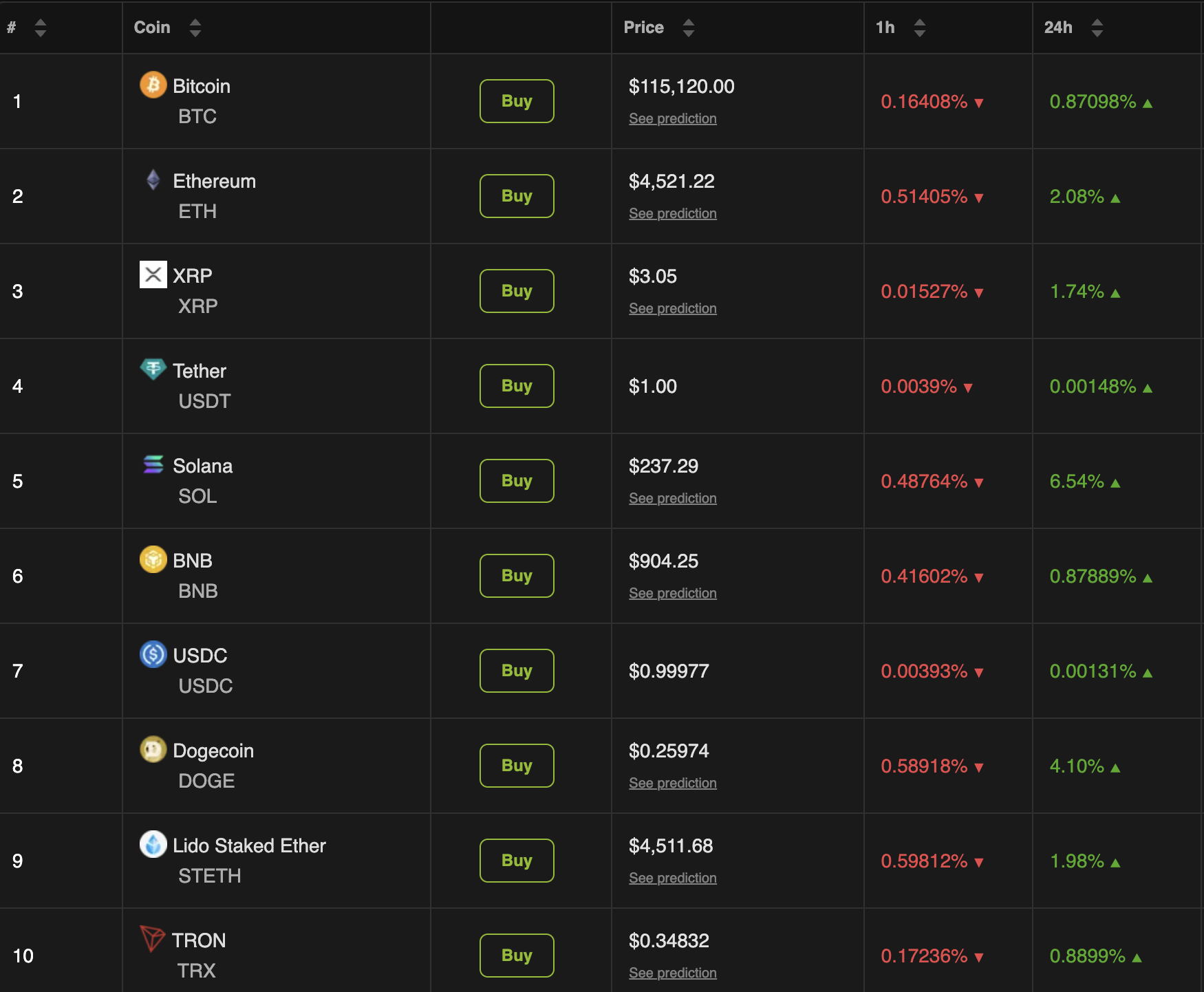

BeInCrypto Markets information confirmed that over the previous 24 hours, the cryptocurrency market was up 1.34%, with all high ten cash within the inexperienced.

Crypto Market Efficiency. Supply: BeInCrypto Markets

Bitcoin (BTC) briefly surged previous $116,000 in early Asian buying and selling hours. In the meantime, Ethereum (ETH) additionally crossed $4,500, highlighting the market-wide rally.

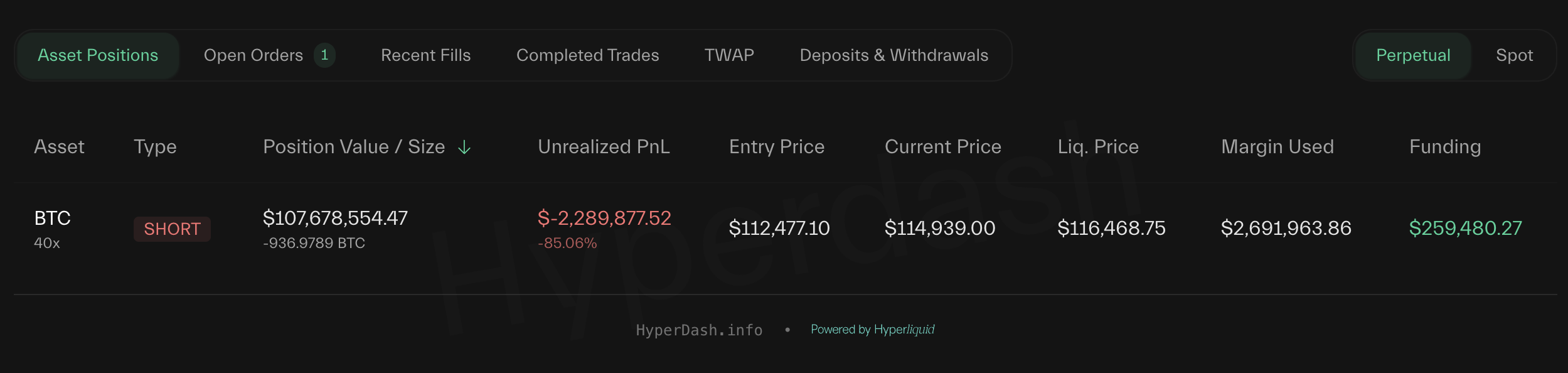

Amid this, Lookonchain, a blockchain analytics agency, reported that whale 0xa523 had closely leveraged quick positions on BTC, betting for a worth lower. When the market as a substitute moved upward, the place got here underneath stress.

To scale back the chance of liquidation, Lookonchain famous that the dealer offered 152 ETH (value about $679,000) to extend margin and was compelled to shut a part of the Bitcoin quick positions at a loss.

“Shorting Bitcoin in a bull market is all the time harmful,” Sensible Recommendation wrote.

This isn’t the primary main setback for whale 0xa523 — his observe report of losses is putting. Earlier this week, the agency highlighted that the dealer offered 886,287 HYPE tokens for $39.66 million at one level at a loss. Had he held onto them, the place would have mirrored an unrealized revenue of round $9 million now.

The whale later misplaced greater than $35 million on a protracted place in ETH. Switching methods, he opened an ETH quick however suffered one other $614,000 loss.

Based on the newest information from HyperDash, his present BTC quick can be within the purple, with unrealized losses totaling about $2.28 million.

“In only one month, he has now misplaced $43.4 million, surpassing @AguilaTrades, @qwatio, and @JamesWynnReal to turn into the largest loser on Hyperliquid,” the publish learn.

0xa523 BTC Quick Place. Supply: HyperDash

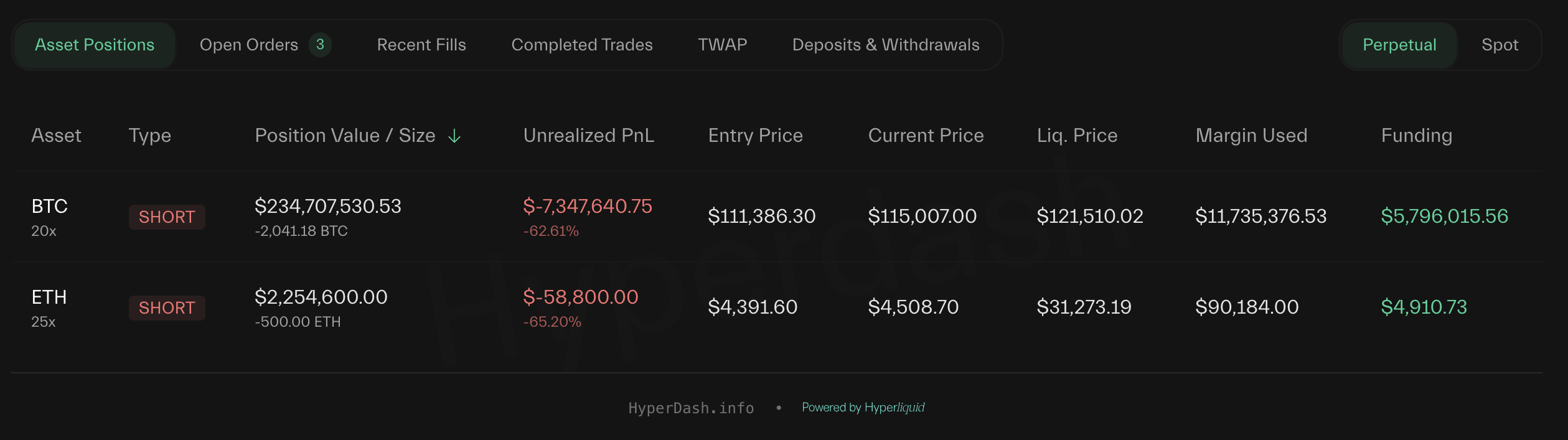

In addition to this whale, the market rebound additionally caught one other dealer (0x5D2F) off guard. He’s sitting on over $7.42 million in losses on quick positions in BTC and ETH. Lookonchain reported that, in an effort to stop liquidation, he injected 8 million USDC into his account to spice up margin.

0x5D2F Open Positions. Supply: HyperDash

Each merchants illustrate the numerous dangers related to high-leverage buying and selling, the place abrupt worth fluctuations can escalate into compelled liquidations. Related conditions have been noticed with James Wynn, AguilaTrades, Qwatio, and even influencer Andrew Tate, emphasizing that leveraged buying and selling carries appreciable publicity to losses no matter status or market standing.

The publish Transfer Over, James Wynn: This Hyperliquid Whale Simply Claimed the Loss Crown appeared first on BeInCrypto.