Greater than half of rich Asian buyers in a current survey say they plan to extend their portfolio publicity to cryptocurrency over the following few years.

Sygnum’s APAC HNWI Report 2025 discovered that 6 in 10 of the surveyed Asian high-net-worth people (HNWIs) are ready to extend their crypto allocations based mostly on a powerful two- to five-year outlook.

It polled 270 HNWIs with greater than $1 million in investable belongings {and professional} buyers with over ten years of expertise throughout ten APAC nations, primarily in Singapore, however together with Hong Kong, Indonesia, South Korea and Thailand.

The findings additionally revealed that an amazing 90% of surveyed HNWIs view digital belongings as “essential for long-term wealth preservation and legacy planning, not purely hypothesis.”

“Digital belongings at the moment are firmly embedded inside APAC’s non-public wealth ecosystem,” stated Gerald Goh, Sygnum co-founder and APAC CEO.

“Regardless of near-term macro uncertainty, we proceed to see accelerating adoption pushed by strategic portfolio diversification, intergenerational wealth planning, and demand for institutional-grade merchandise.”

This represents a elementary shift from crypto as a speculative asset to an institutional wealth administration product.

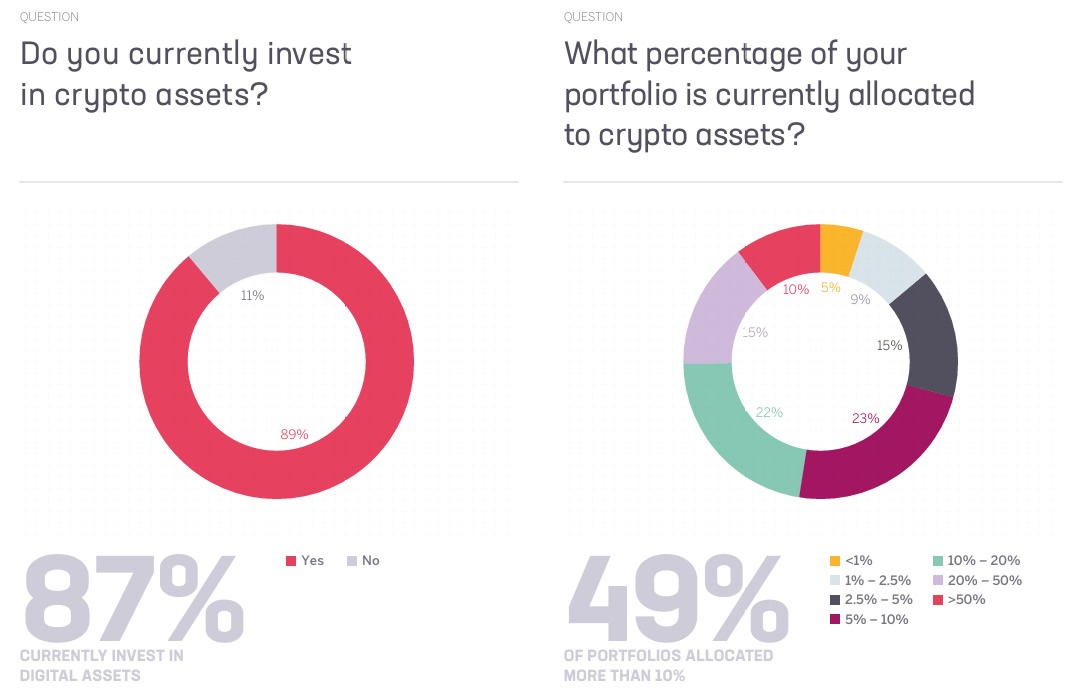

Greater than half of portfolios maintain over 10% crypto

The survey reported 87% of Asian HNWIs surveyed already maintain crypto, and round half have an allocation of greater than 10%. The typical portfolio allocation is round 17%.

87% of buyers additionally stated they’d ask their non-public financial institution or adviser so as to add crypto companies if provided by way of regulated companions.

In the meantime, 80% of these actively investing reported holdings in blockchain protocol tokens, resembling Bitcoin (BTC), Ether (ETH) and Solana (SOL). The commonest purpose for investing, in response to 56% of respondents, was portfolio diversification.

Practically half of the portfolios maintain greater than 10% in crypto. Supply: Sygnum

Goh stated the 17% portfolio allocation exhibits that HNWI have a “totally different psychology” than “2017’s ‘get wealthy fast’ mentality.”

“These aren’t speculators — they’re buyers with 10-20 12 months time horizons enthusiastic about intergenerational wealth switch,” he instructed Cointelegraph.

APAC laws foster stronger institutional involvement

Requested whether or not Asia’s crypto laws have been extra restrictive, Goh argued that Asia’s crypto regulation has been extra “particular and deliberate” than that of different jurisdictions.

“MAS in Singapore has been terribly considerate. Sure, they’ve tightened licensing necessities, elevated capital buffers, and restricted retail entry.”

“However they’ve additionally created real readability on custody requirements, operational necessities, and investor protections.

“What appears to be like ‘restrictive’ is definitely rigorous institution-building. The tradeoff is fewer service suppliers can meet the bar—however the ones that do are genuinely institutional-grade,” he stated, including that Hong Kong is now on an identical path.