The sports activities trade is in a state of shock following the arrest of greater than 30 folks concerned with the Nationwide Basketball Affiliation (NBA).

The investigation, described as “mind-boggling” by the FBI Director Kash Patel, has spanned 11 states and entails hundreds of thousands of {dollars} allegedly made by means of unlawful betting and sport rigging in the course of the 2023–2024 season.

In response to the prosecutors, the scheme concerned insider data and arranged crime exercise, damaging the fame of the league on a number of fronts.

Given the scope of the issue, the query for traders with publicity to the sports activities trade is easy: What shares to look at after the NBA’s betting scandal?

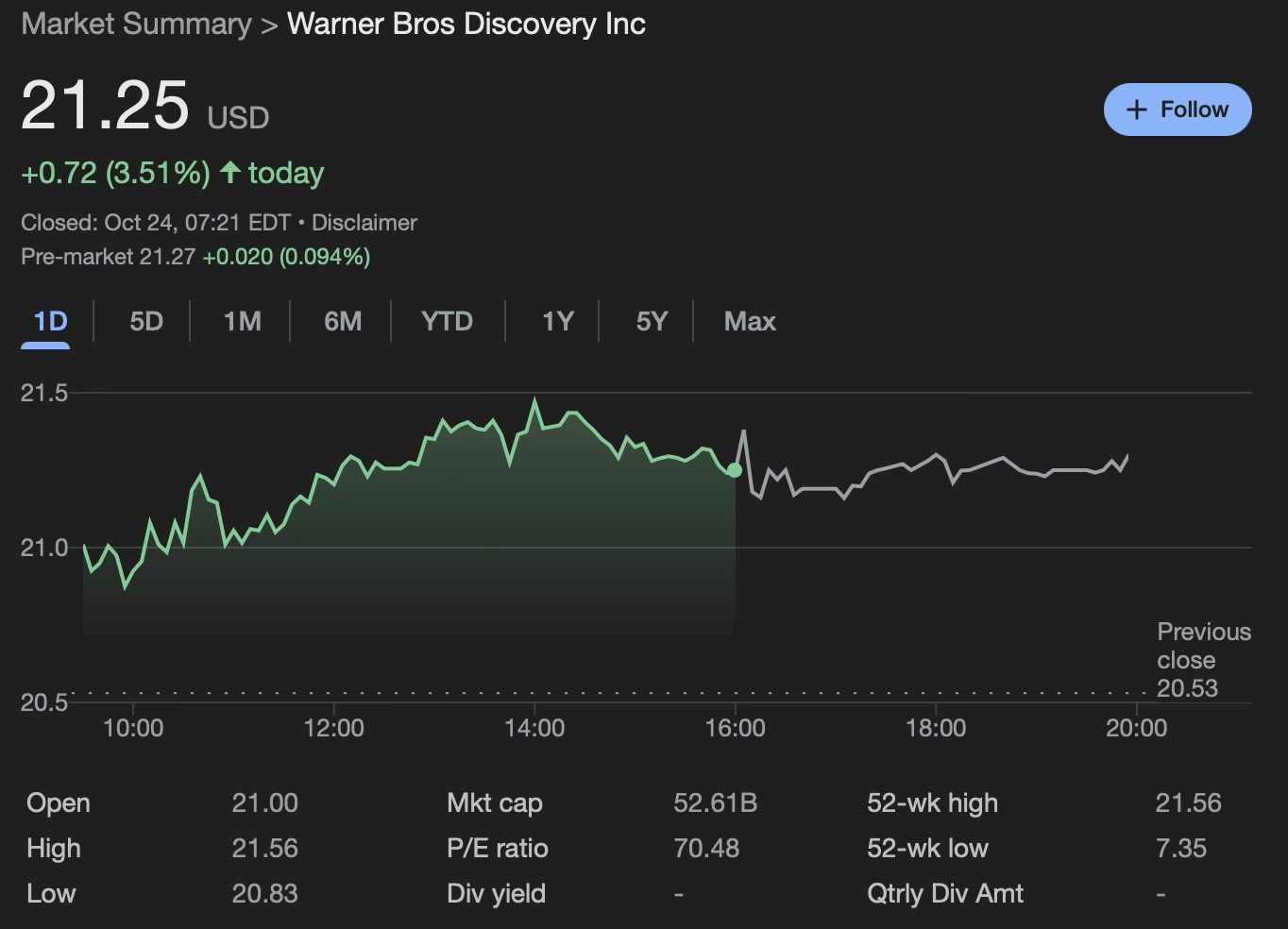

Warner Bros (WBD)

One of many NBA’s main broadcasting companions, Warner Bros (NASDAQ: WBD) seems fully unshaken by the federal probe. Quite the opposite, it has been posting nothing however positive factors this yr, its inventory having almost doubled since January and buying and selling at $21.25 on the time of writing, up one other 3.5% on the each day chart.

Nevertheless, the corporate’s future trajectory now lies in a steadiness, as a number of candidates are reportedly seeking to purchase a portion or all the agency. As an example, Warner Bros has already rejected three Paramount Skydance takeover provides, the final of which got here in at slightly below $24 per share.

The administration informed CNBC on Tuesday, October 21, that it will proceed reviewing all coming bids, whereas on the identical time shifting forward with the present plans to separate into two separate entities, particularly a streaming and studios enterprise platform and a worldwide networks enterprise.

This method, mentioned CEO David Zaslav, will permit the media large “to determine one of the best path ahead” and “unlock the total worth of our belongings.” Regardless of the future would possibly convey, WBD is thus undoubtedly price maintaining a tally of.

Madison Sq. Backyard Sports activities (MSGS)

Madison Sq. Backyard Sports activities (NYSE: MSGS) is a number one sports activities holding firm managing the New York Knicks. Whereas not as robust as Warner Bros, MSGS has additionally been on an upward development, the inventory climbing almost 18% over the previous six months and buying and selling at $226.16 at press time, up 0.29% on the day and 0.24% in pre-market.

MSGS is a very attention-grabbing case as its Q3 earnings report is quick approaching, scheduled for November 7. Whereas the Knicks don’t seem like concerned within the betting controversy instantly, a perceived decline in confidence towards the league at massive may theoretically stress the inventory, as may any new, doubtlessly detrimental discoveries on the investigators’ half.

Nevertheless, it’s also price noting that the workforce’s efficiency this season has probably not affected the supervisor’s inventory that a lot. Specifically, the Knicks noticed their first Japanese Convention Finals look in 25 years, however even with the 2026 title now in play, Madison Sq. Backyard Sports activities shares have solely climbed 3.4% over the previous yr.

What’s extra, the working margins stay slim. The corporate reported a mixed $22.6 million loss on the finish of the earlier fiscal yr, regardless of playoff income. Additionally, the 2 groups are price round $13.5 billion in complete, whereas MSGS trades at solely $6.6 billion in enterprise worth.

That’s, MSGS provides publicity to the NBA at a deep low cost, and the share costs may go up if the hole between private and non-private valuations manages to shut, particularly if the desires of a brand new title are realized, however there are a variety of things at play now, making it tough to foretell how the scenario may develop. Nonetheless, the inventory is price watching within the weeks to return.

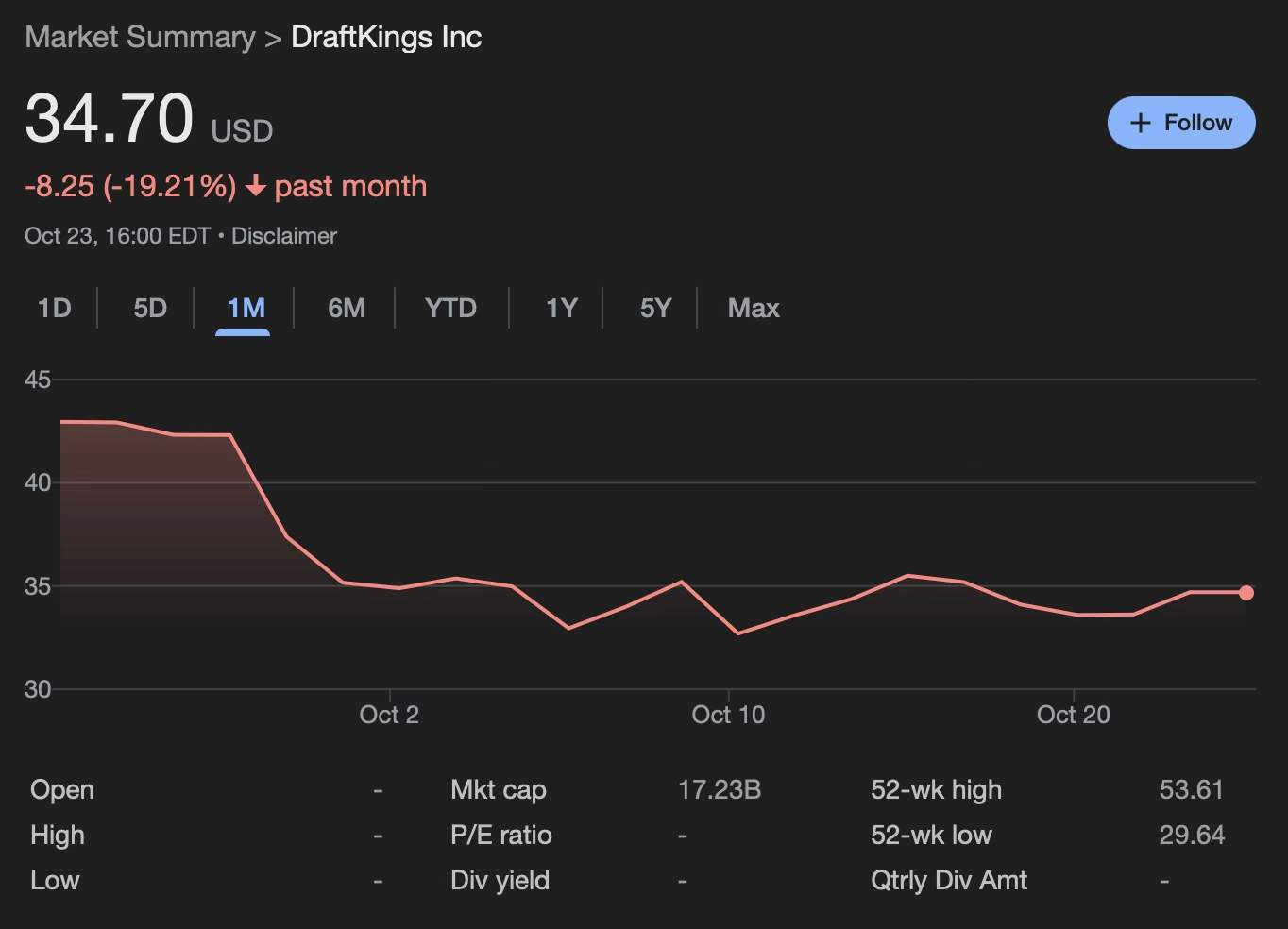

DraftKings (DKNG)

DraftKings (NASDAQ: DKNG), a well-liked Boston-based betting firm masking the NBA and different main American sports activities leagues, has been struggling in current weeks, its inventory plummeting almost 20% on the month-to-month chart and buying and selling at $34.70 at publication time.

With the integrity of sports activities betting now severely impacted, DraftKings finds itself in an much more precarious place, its shares being susceptible to additional losses. Nonetheless, some current strikes are drawing renewed investor consideration, most notably the corporate’s first main foray into prediction markets by means of a strategic partnership with Polymarket.

Congrats to @DraftKings on their acquisition of @RailbirdHQ.

We’re proud for Polymarket Clearing to be their designated clearinghouse as they enter the prediction market area.

— Shayne Coplan 🦅 (@shayne_coplan) October 22, 2025

Extra exactly, DraftKings plans to launch its new DraftKings Predictions cell app within the coming months, masking markets throughout finance, tradition, and leisure. Polymarket itself is at present in early talks to boost capital at a $12–15 billion valuation, a considerable improve from the June 2025 valuation of $1 billion. Expectedly, present backers and potential new traders alike are paying shut consideration to the betting platform.

Featured picture through Shutterstock