As gold and silver proceed to hit new report highs, smaller-cap metals similar to copper are additionally attracting capital inflows. Blockchain know-how may function a bridge, enabling this capital to enter the crypto market by tokenization.

A number of indicators recommend that copper could also be getting into a rally just like silver, and tokenized copper may see explosive development in 2026.

Copper Demand Might Preserve Rising Sharply Over the Subsequent 15 Years

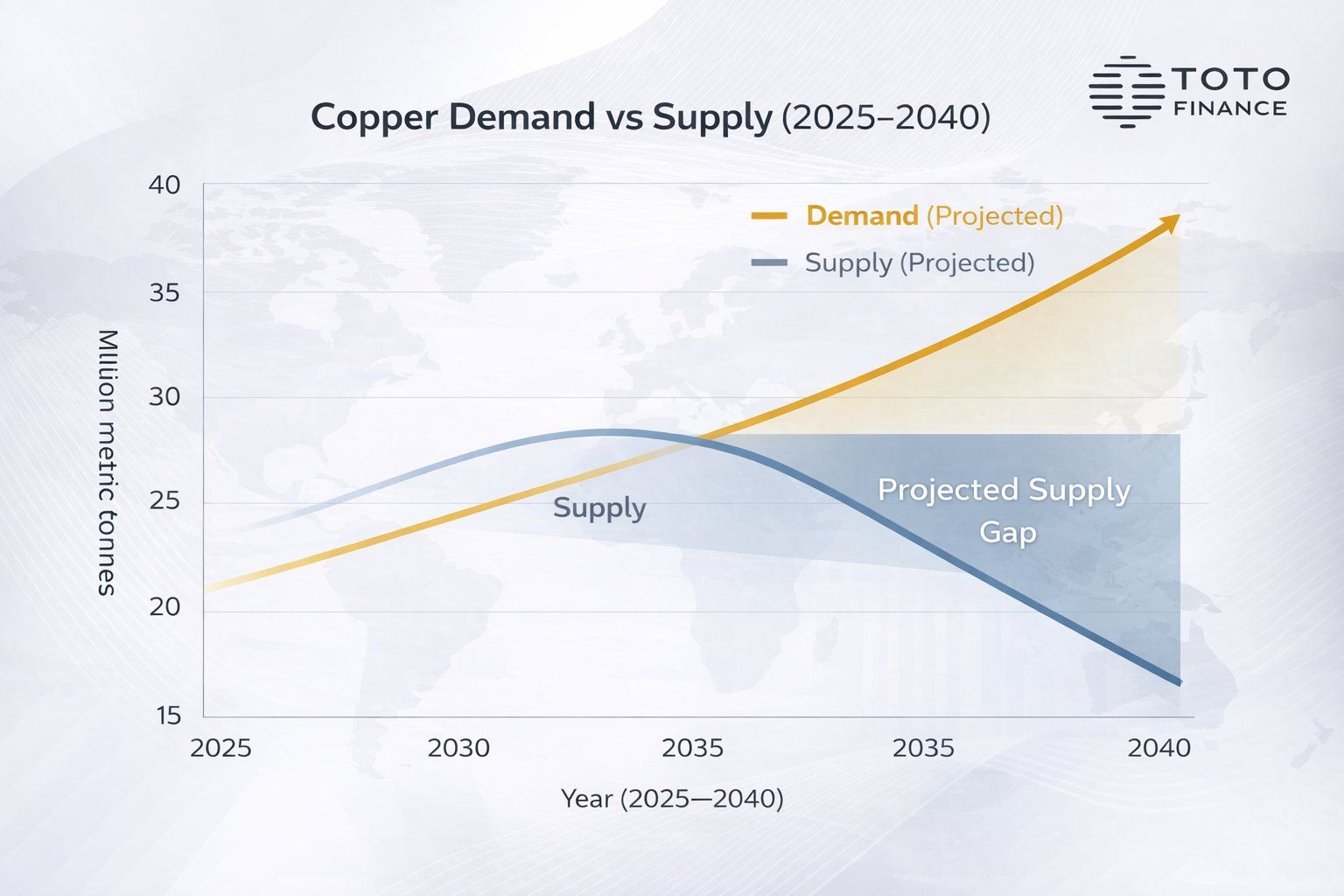

Toto Finance, an institutional commodity tokenization platform, forecasts that world copper demand may attain round 42 million tons by 2040. In the meantime, provide is predicted to peak round 2030 after which decline.

Copper Demand vs Provide (2025–2040). Supply: Toto Finance

In response to Toto Finance’s “Copper Demand vs Provide (2025–2040)” chart, demand steadily rises to almost 40 million tons by 2040. In distinction, the provision curve peaks at round 28–30 million tons in 2030 after which drops sharply. This creates an more and more broad supply-demand hole.

This isn’t a brief cycle. It represents a structural imbalance, making copper a strategic useful resource. Toto Finance emphasizes that tokenization will turn into a brand new solution to entry, personal, and add liquidity to copper, turning it right into a digital asset that may be traded extra simply.

“This isn’t a cycle, it’s a structural hole. As copper turns into strategic, tokenization is how entry, possession, and liquidity evolve,” Toto Finance predicted.

Many analysts imagine that copper shortage has formally begun and can possible worsen over time. Mike Investing argues that over the following 18 years, the quantity of copper that must be mined will equal the quantity extracted over the earlier 10,000 years. He believes copper costs may rise 2–5 occasions throughout the subsequent 14 months.

10,000 years of #Copper will probably be mined over the following 18 years.

The copper scarcity has formally begun, & will constantly worsen.

Breaking out of a 20 yr resistance Copper costs are about to skyrocket.

That is a simple 2-5x throughout the subsequent 14 months.

Save this for later… pic.twitter.com/N87gA7jBzK

— Mike Investing (@MrMikeInvesting) January 30, 2026

AI and Grid Enlargement Are Main Drivers

One of many key drivers of rising copper demand is the AI growth and the enlargement of worldwide energy grids. Katusa Analysis notes that demand from AI infrastructure and electrification will make copper more and more scarce.

Copper demand from new information facilities alone is projected to succeed in roughly 400,000 metric tons per yr by 2035. Electrical automobiles additionally require 3 times as a lot copper as conventional inside combustion engine automobiles.

Trendy protection techniques and drones are additional growing demand for electronics, pushing world provide towards dangerously low ranges.

New mining tasks can take as much as 17 years earlier than reaching manufacturing. On the identical time, ore high quality is declining, and main mines are shutting down. These components are deepening the supply-demand imbalance.

Early Indicators Rising within the Crypto Market

Crypto investor publicity to tokenized copper and copper-related real-world belongings (RWAs) stays restricted. Nonetheless, buying and selling demand for tokenized gold and silver has lately proven indicators of development.

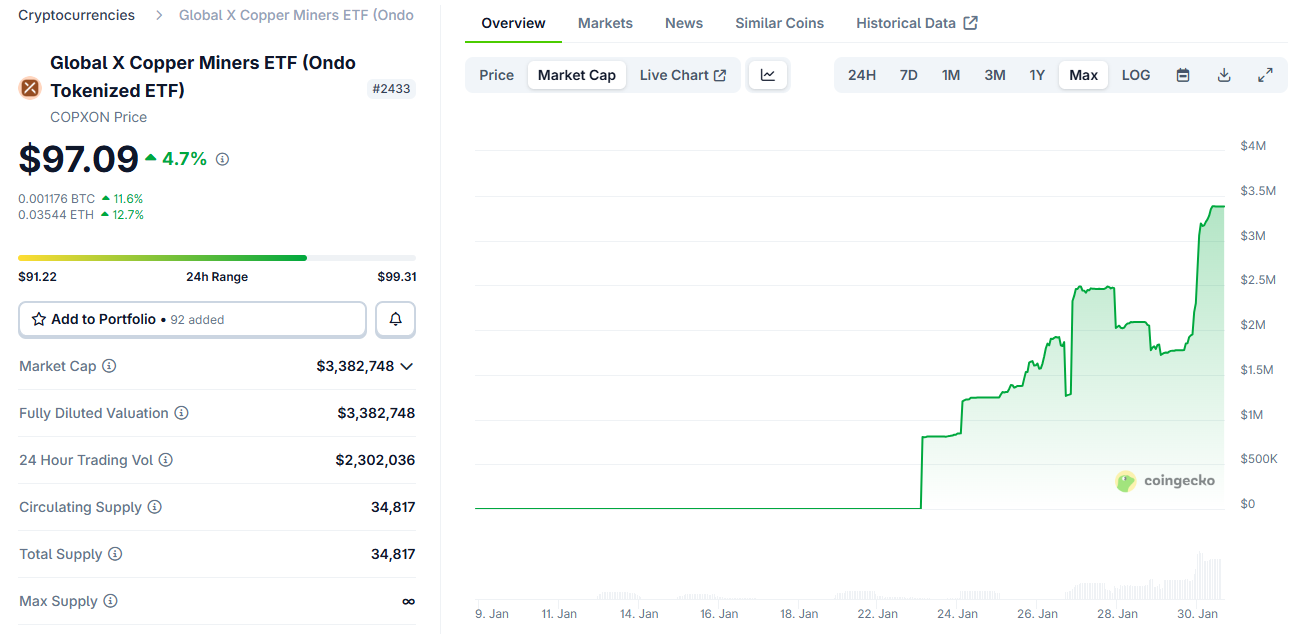

Some early indicators are already showing. Ondo’s tokenized model of the International X Copper Miners ETF (COPXON) noticed its market capitalization increase in January. COPXON shortly reached a $3 million market cap in its first week.

International X Copper Miners ETF (COPXON) Market Cap. Supply: Coingeko

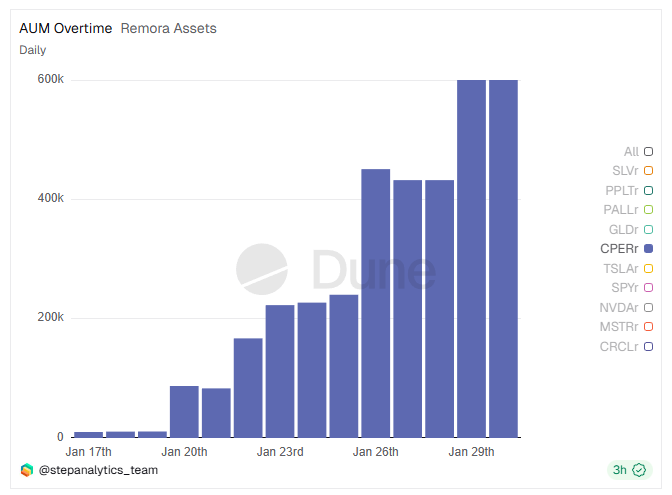

Remora Markets, a platform for buying and selling tokenized shares on Solana, additionally reported income development reaching $110 million. This enhance was pushed by demand for tokenized NASDAQ shares and metals-related belongings.

Copper rStock (CPERr) AUM Over Time. Supply: Dune

The overall worth of Copper rStock (CPERr) on Remora Markets surged through the closing week of January. The numbers stay small, however this may increasingly characterize an early signal of how crypto buyers need publicity to metallic belongings similar to copper.

Tokenization can also be a theme that trade leaders anticipate to speed up in 2026. This might create alternatives for brand new startup concepts and open new prospects for merchants.

The put up Indicators That Tokenized Copper Demand Might Surge in 2026 appeared first on BeInCrypto.