After Donald Trump introduced his Liberation Day tariffs, Bitcoin and most altcoins outperformed shares.

Bitcoin (BTC) remained between $80,000 and $90,000, whereas Ethereum (ETH) was caught barely beneath $2,000. The entire market cap of all cryptocurrencies dropped from $2.7 trillion to $2.6 trillion.

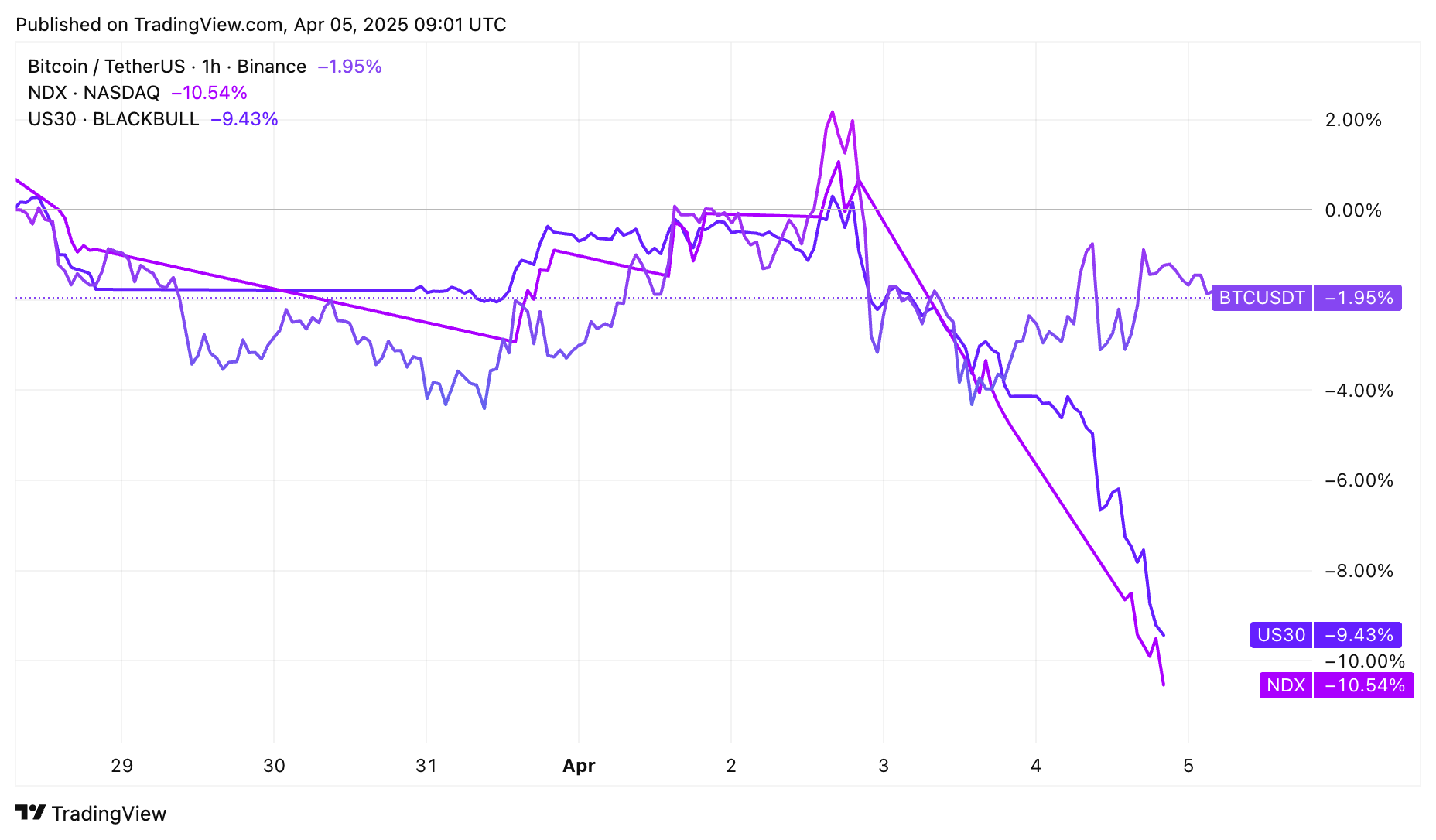

In the meantime, the inventory market had its worst week since 2020. The blue-chip Nasdaq 100, S&P 500, and Dow Jones slumped right into a correction.

Bitcoin vs Dow Jones vs Nasdaq 100 | Supply: crypto.information

Shock Fed warning on stagflation

Bitcoin, altcoins might come below stress after the Federal Reserve chairman Jerome Powell warned that Trump’s tariffs will possible result in increased inflation and slower progress for the U.S. economic system.

“Our obligation is to maintain longer-term inflation expectations properly anchored and to make sure {that a} one-time enhance within the worth degree doesn’t develop into an ongoing inflation drawback,” Powell stated Friday.

Excessive inflation and excessive unemployment can create stagflation, which is tough to handle as a result of actions to repair one situation—like reducing rates of interest to spice up progress—can worsen one other, resembling inflation, and vice versa.

Powell warned that he was not in a rush to chop rates of interest, since inflation remained excessive. His assertion mirrored that of different officers like Raphael Bostic and Adriana Kugler, who’ve supported increased charges for longer to fight inflation.

Trump, nevertheless, disagrees.

“This is able to be a PERFECT time for Fed Chairman Jerome Powell to chop Curiosity Charges,” Trump wrote on his social media platform, accusing Powell of “taking part in politics.”

The Fed’s Board of Governors is an unbiased authorities company.

Observers word {that a} extra hawkish Fed, at a time when analysts are predicting a recession, would negatively influence Bitcoin, altcoins, and inventory costs. Traditionally, these property do properly when the Fed is reducing rates of interest.

Finally test Saturday, Bitcoin was buying and selling at roughly $83,435. See beneath.

Supply: CoinGecko

You may additionally like: Bitcoin holds regular amid inventory market crash, says Unchained analyst

Bond market and crude oil costs provide a cushion

On the optimistic aspect, prime flash indicators trace that the Federal Reserve will reduce rates of interest sooner.

Crude oil costs have crashed up to now few days, with Brent, the worldwide benchmark, crashed to $64 on Friday. The West Texas Intermediate dropped to $62.

Moreover, copper, which is commonly seen as a barometer of the world economic system, additionally nosedived. These property level to a possible recession as demand from people and firms wane.

The bond market is sending the identical message, with the 10-year and 2-year yields plunging to three.95% and three.5%, respectively.

Right here is my nomination for probably the most fascinating chart of the week.

* Arguably, the inventory market crashed this week

* JP Morgan is saying 60% chance of a recession

* Report uncertainty

* Unprecedented Authorities coverage on tariffs.So, given the checklist above, what’s 10-year… pic.twitter.com/CtM3t0BLWw

— Jim Bianco (@biancoresearch) April 5, 2025

These indicators level to a possible dovish Fed, which might begin reducing rates of interest quickly. In an announcement earlier this week, Goldman Sachs raised the U.S. recession odds and predicted that the Fed will ship no less than three cuts later this yr.

Historical past reveals that dangerous property like shares, Bitcoin, and altcoins do properly when the Fed cuts charges. For instance, all of them surged in 2020 when the Fed delivered an emergency price reduce on the onset of the pandemic. Shares additionally had a decade-long rally when the Fed slashed charges throughout the International Monetary Disaster.

Learn extra: Bitcoin worth might rise as U.S. bond yields, worry and greed index fall