Japan’s long-dormant inflation is roaring again to life, rippling by way of the nation’s bond markets and monetary projections. Amid rising considerations, Metaplanet, a reasonably unlikely firm, has captured the market’s consideration and skepticism.

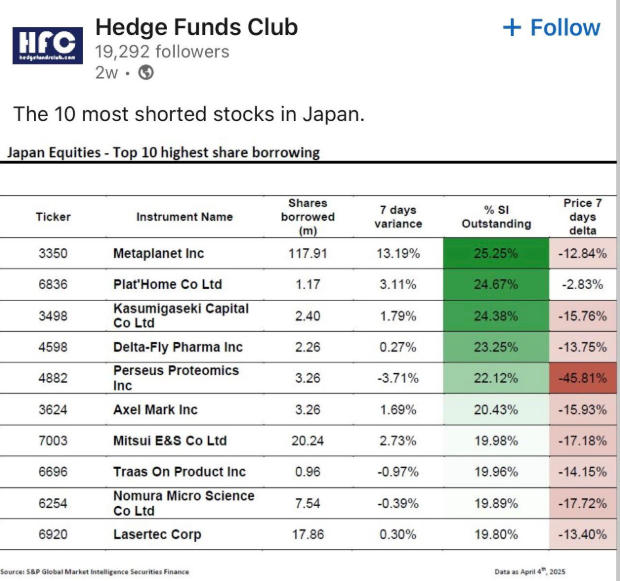

Metaplanet, the Tokyo-listed agency that skyrocketed over 5,000% in 2024 following its daring Bitcoin treasury technique, is now probably the most shorted inventory in Japan, in keeping with its CEO.

Metaplanet: Japan’s Most Shorted Inventory Amid Monetary Turmoil

The rise briefly positions towards Metaplanet comes amid an unraveling in Japan’s long-term debt market. Inflation within the nation has reached 3.6%, now exceeding the US Shopper Worth Index (CPI).

“Apparently, Metaplanet is probably the most shorted inventory in Japan. Do they actually assume betting towards Bitcoin is a successful technique?” CEO Simon Gerovich posted.

Probably the most shorted shares in Japan. Supply: Simon Gerovich on X

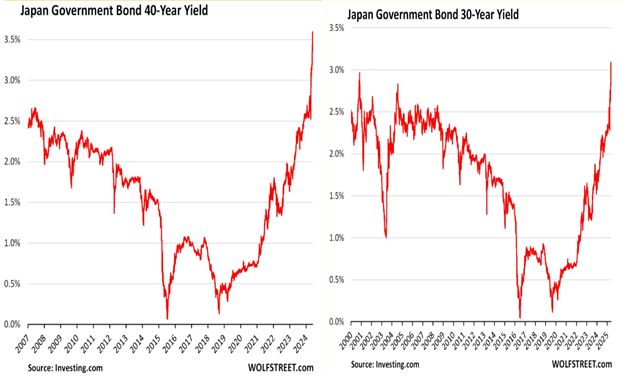

Excessive inflation has triggered an unprecedented selloff in Japanese authorities bonds (JGBs). The 40-year yields surged 1% since April to a staggering 3.56%, the best in over twenty years. Equally, the 30-year yields have skyrocketed to a 25-year excessive.

“It’s not only a ‘promote America’ commerce that’s driving yields greater. In Japan, 30-year yields surged to the best ranges in 25 years after a really weak bond public sale. The Prime Minister [Shigeru Ishiba] referred to as Japan’s fiscal scenario extraordinarily poor, worse than Greece’s,” wrote Lisa Abramowicz, co-host at Bloomberg Surveillance.

Japan Authorities Bond 40-year and 30-year yields. Supply: ThuanCapital on X

In opposition to this backdrop, the Financial institution of Japan (BoJ) has begun aggressively reducing bond purchases, offloading 25 trillion yen ($172 billion) because the begin of 2024.

Regardless of this tightening, actual yields stay adverse. Traders who beforehand purchased low-yield JGBs endure steep losses, prompting a shift in capital flows.

“Japan’s long-term bond market is in free fall, inflicting yields to spike, losses to unfold, and international fallout,” Thuan Capital famous in a submit.

The structural shift in Japanese bond demand has additionally raised alarms overseas, significantly within the US, the place Japan holds $1.13 trillion in Treasuries.

A sustained retreat from US debt might additional stress the already fragile American bond markets.

Metaplanet’s Bitcoin Guess Attracts Quick Sellers in Japan’s Disaster

Amid this macroeconomic upheaval, Japanese traders are in search of refuge. For a lot of youthful residents cautious of conventional salaryman paths, Bitcoin, and by extension, Metaplanet, has emerged as a radical various.

“Youthful Japanese are in search of an escape hatch to keep away from toiling as salarymen until the grave,” one person quipped on X.

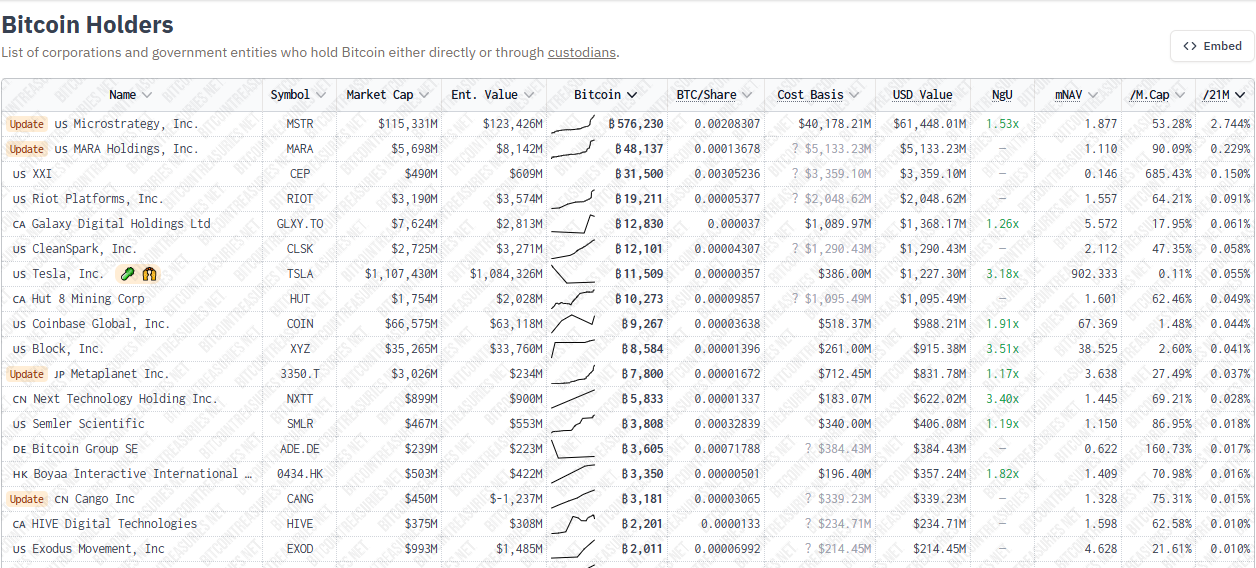

Metaplanet’s Bitcoin-centric technique, harking back to MicroStrategy’s within the US, has made it a standout. BeInCrypto reported that its inventory, MTPLF, hit a three-month excessive after a $104 million Bitcoin buy.

Equally, its Q1 income hit $6 million, with Bitcoin earnings contributing 88%. The agency additionally surpassed El Salvador on metrics of Bitcoin holdings following a current BTC buy value $126.7 million.

Metaplanet Bitcoin holdings. Supply: Bitcoin Treasuries

Nevertheless, its rise has drawn heavy scrutiny from hedge funds and institutional merchants. Some analysts counsel the brief positions could also be a part of subtle arbitrage methods.

“Promote meta / purchase MSTR! Or promote meta / purchase BTC spreads alone will appear like shorts however actually are spreads — it’s too vast,” investor Gary Cardone defined.

This means merchants exploit valuation differentials between Metaplanet, Bitcoin, and Bitcoin proxy shares like MicroStrategy. These dynamics mirror the Jim Chanos playbook, shorting MSTR whereas going lengthy BTC.

As BeInCrypto reported, he cited an unsustainable premium within the inventory relative to Bitcoin itself. But others view the shorts with disbelief.

“Japanese hedge funds wager towards a Bitcoin treasury within the land of yield curve management and 263% debt-to-GDP? You actually can’t make this up,” remarked finance analyst Peruvian Bull.

Japan is teetering on the sting of a sovereign debt disaster. In the meantime, Metaplanet has grow to be a lightning rod for home monetary nervousness and a broader ideological conflict between fiat fragility and crypto conviction.

“The Japanese bond market is imploding, and Metaplanet is the exit,” mentioned Joe Burnett, director of market analysis at UnChained.

Whether or not the shorts are opportunistic or misguided, Metaplanet has grow to be floor zero in Japan’s historic monetary reset.