Dow Jones fell on Trump’s threats towards extra nations, tech shares fared higher, whereas the crypto market noticed a bull run.

Shares are down as Trump as soon as once more escalated commerce tensions, whereas crypto is doing nice. On Friday, July 11, the Dow Jones was down 286 factors, or 0.64%, whereas the S&P 500 slipped 0.30%. The tech-heavy Nasdaq misplaced simply 0.08% as crypto and tech shares did comparatively higher.

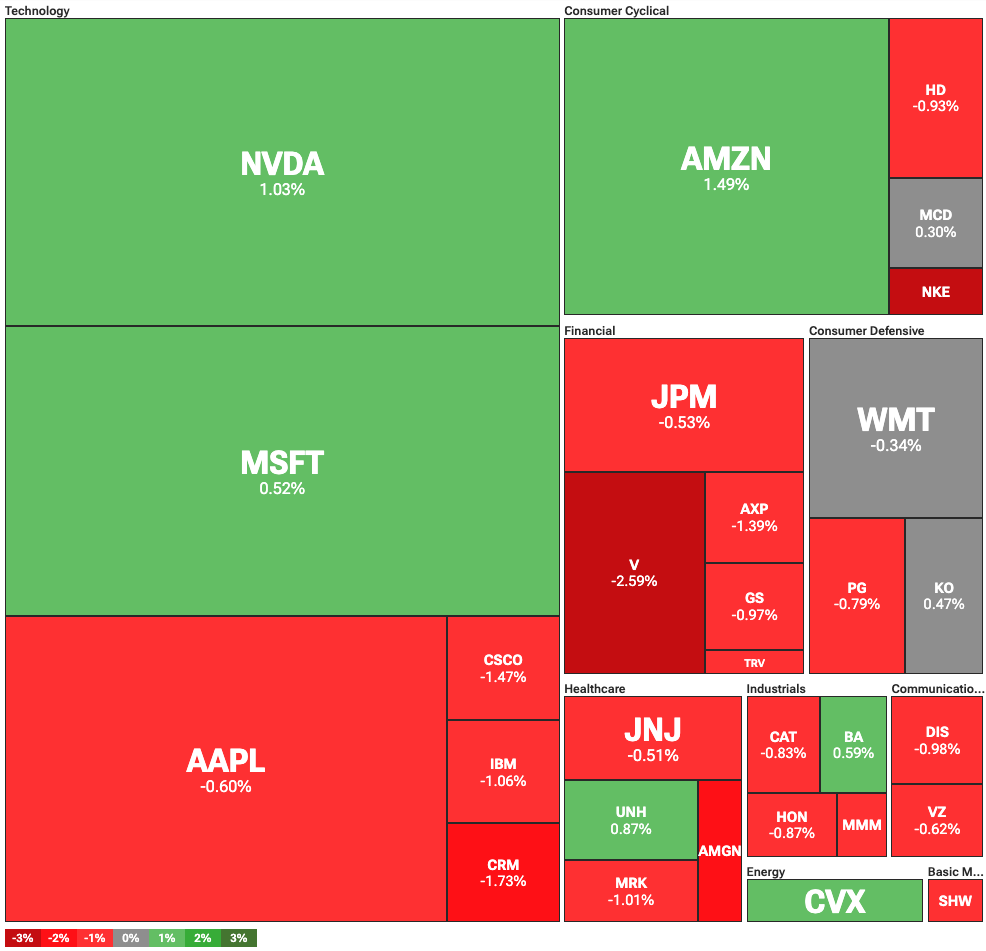

Dow Jones Industrial Common heatmap on July 11 | Supply: TipRanks

Curiously, Bitcoin (BTC) was rather more resilient than the inventory market. The token reached a brand new all-time excessive for a 3rd day in a row at $118,856, and rallied 4% in 24 hours. Altcoins corresponding to Ethereum (ETH) outperformed, with XRP (XRP), Dogecoin (DOGE), and Cardano (ADA) posting double-digit good points.

You may additionally like: Russian oil corporations depend on Bitcoin, Ethereum, and stablecoins for trades with China and India: report

Trump threatens new tariffs on Canada

Buyers have been involved concerning the results of President Donald Trump’s newest threats towards Canada. Trump introduced a 35% tariff on Canadian items, which at present face a 25% price. Nonetheless, some items will likely be exempt, together with oil, fuel, and potash.

These key industrial items are at present regulated below the USMCA settlement and are topic to a ten% tariff. Canada is likely one of the largest U.S. buying and selling companions and a key exporter of vitality and uncooked supplies to the nation.

You may additionally like: How falling crude oil costs may enhance the crypto market

In different tariff information, reviews surfaced that Vietnam’s authorities was shocked by Trump’s 20% tariff announcement towards the nation. In accordance with Bloomberg, the nation is hoping to convey the speed decrease, presumably within the 10-15% vary.

Vietnam is a serious exporter to the U.S., with the third-largest commerce surplus with the nation. Over time, it has taken over a number of export industries to the U.S. from China, with electronics, textiles, and footwear as main classes. Earlier administrations noticed this transfer as a bonus, as Vietnam is extra geopolitically aligned with the U.S. than China.

Learn extra: Stablecoins and oil are Trump’s macro weapons, says DeVere CEO