Crypto funding merchandise logged a 3rd straight week of outflows, although the tempo of promoting eased markedly as digital asset costs steadied after a pointy downturn.

Crypto exchange-traded merchandise (ETPs) recorded $187 million in outflows in the course of the week, a pointy drop from the $3.43 billion seen over the earlier two weeks, CoinShares reported on Monday.

The slowdown got here as Bitcoin (BTC) fell to its lowest degree since November 2024, with the value touching $60,000 on Coinbase final Thursday.

“Whereas flows usually transfer according to crypto costs, modifications within the tempo of outflows have traditionally been extra informative, typically signaling inflection factors in investor sentiment,” mentioned James Butterfill, CoinShares’ head of analysis.

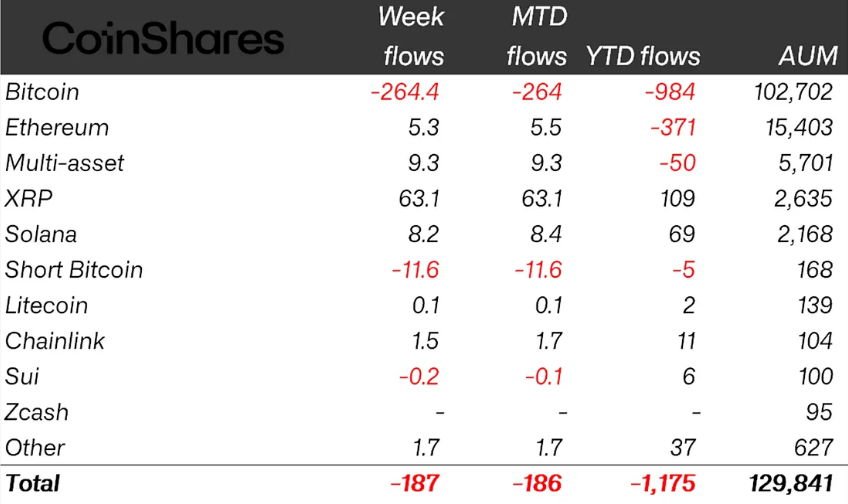

Bitcoin ETPs solely to publish main losses, whereas $XRP leads inflows

Bitcoin funding merchandise had been the one ETP group to undergo important losses final week, with outflows totaling $264.4 million.

$XRP ($XRP) funds led inflows, attracting $63 million, whereas different altcoin ETPs, equivalent to these monitoring Ether (ETH) and Solana (SOL), posted modest positive factors of $5.3 million and $8.2 million, respectively.

Weekly crypto ETP flows by asset as of Friday (in hundreds of thousands of US {dollars}). Supply: CoinShares

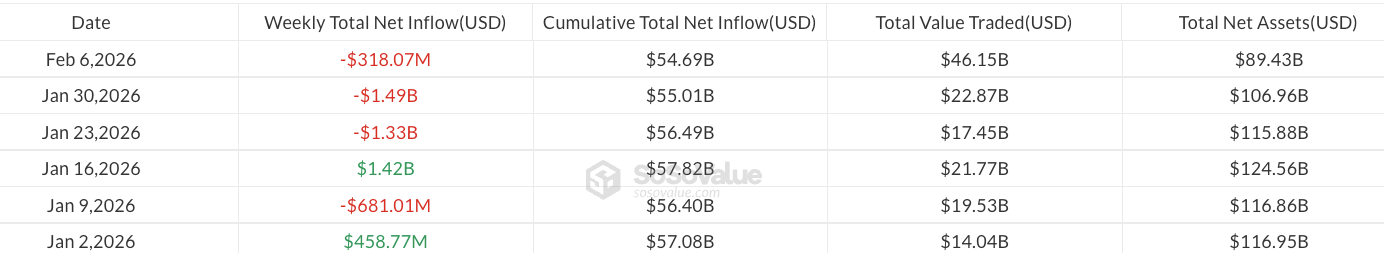

Spot Bitcoin exchange-traded funds (ETFs) accounted for a big portion of Bitcoin ETP outflows final week, amounting to $318 million, in accordance with SoSoValue information.

ETP volumes hit file $63 billion in weekly buying and selling

Addressing final week’s slowdown in outflows, Butterfill recommended {that a} “potential market nadir might have been reached,” implying {that a} attainable backside may have fashioned for ETPs.

Regardless of the easing of outflows, final week marked a milestone in buying and selling exercise. In line with Butterfill, ETP volumes reached a file $63.1 billion, surpassing the earlier excessive of $56.4 billion set in October final yr.

Associated: BlackRock’s IBIT hits every day quantity file of $10B amid Bitcoin crash

Belongings beneath administration (AUM) in Bitcoin ETPs stood at $102.7 billion by the tip of the week, whereas ETF AUM fell under $90 billion.

Weekly Bitcoin ETF flows year-to-date. Supply: SoSoValue

In the meantime, world crypto ETP AUM declined to $129 billion, the bottom degree since March 2025, Butterfill famous.

Following three consecutive weeks of outflows, crypto ETPs have misplaced a complete of $1.2 billion year-to-date, in contrast with $1.9 billion of outflows in Bitcoin ETFs.

In different trade information, main crypto fund issuer 21Shares filed final week with the US Securities and Change Fee for an ETF monitoring Ondo (ONDO).

Journal: How crypto legal guidelines modified in 2025 — and the way they’ll change in 2026