This can be a section from the Empire publication. To learn full editions, subscribe.

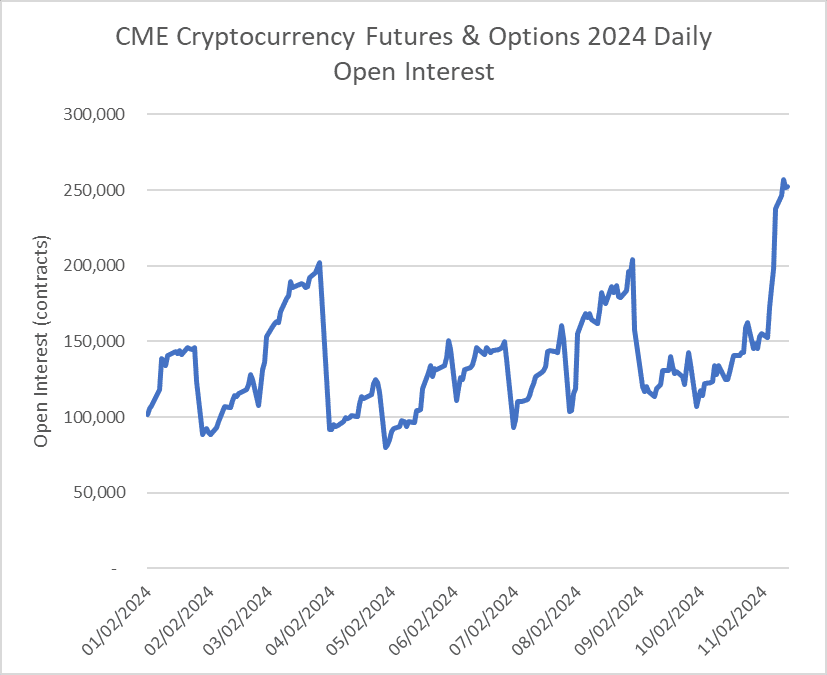

We’re simply barely midway by means of the month and CME’s crypto unit is already logging its finest month because it launched bitcoin futures contracts manner again in 2017.

As many loyal Empire readers know, I like to have a look at CME information to know the place merchants and establishments are placing their cash.

So, yesterday I caught up with Gio Vicioso, CME’s head of crypto. Seems, the agency is averaging “slightly bit over $10 billion a day throughout our futures suite.”

“Simply evaluating November this 12 months to final, our quantity and contract phrases are up greater than 5x … after which we’re additionally seeing will increase or information by way of open curiosity, the place November can be the file month, averaging greater than 166,000 contracts. And that’s up 60% in comparison with October, and up over 3x in comparison with November 2023,” Vicioso stated.

The massive bitcoin contracts supplied by CME have gotten so massive that buyers — primarily retail — are turning to CME’s micro bitcoin contracts.

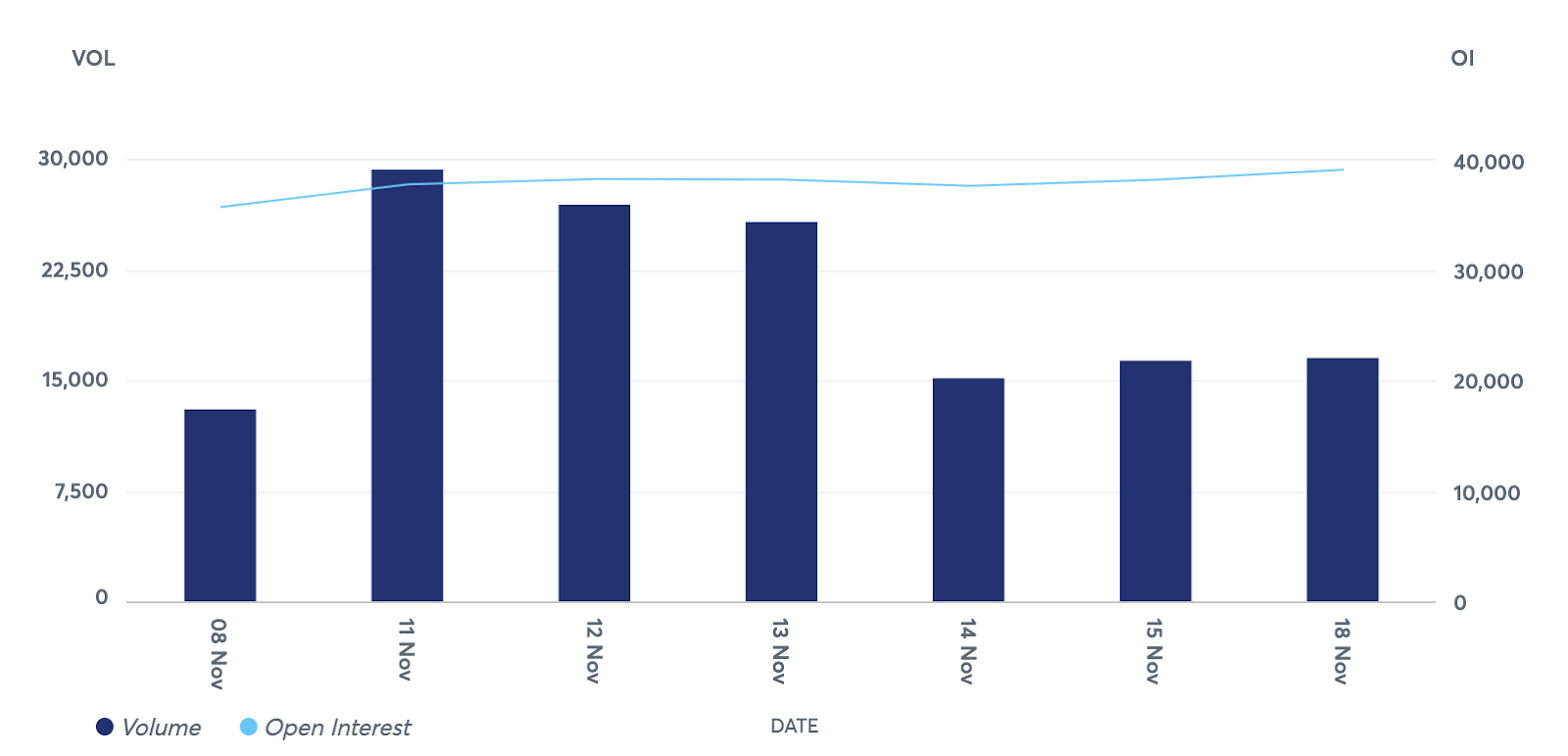

A have a look at the quantity CME’s seen for the reason that election

“Now we’re seeing a rise in quantity by way of our micro contracts, the place these contracts, over the past couple weeks, have been averaging greater than a billion {dollars} a day. Once we have a look at the 12 months, our micro bitcoin contract was averaging between $200 to $300 million per day, and we’re additionally seeing an uptick by way of the illustration of that smaller contract to the bigger contract, whereas for the 12 months, micro bitcoin futures quantity represented roughly 6% of bitcoin volumes,” he stated.

“Over the previous few buying and selling classes, we’ve seen a micro contract signify now north of 15% or so of the big bitcoin contracts. We’ve actually seen will increase throughout the board.”

The make-up of contributors is blended, Vicioso famous. Micro contracts are seeing a reasonably even unfold of retail and institutional consumers provided that the margin is a extra “manageable” quantity. The readthrough for establishments, in that case, is that they could possibly be testing out contemporary methods and finetuning their publicity.

Supply: CME

With all of this curiosity, there’s a pickup in volatility throughout each ether and bitcoin. Vicioso stated it’s “par for the course” and isn’t terribly fearful. However he famous that the momentum we’ve seen from bitcoin has carried by means of a variety of this 12 months and it appears to be a unbroken pattern.

Open curiosity — which implies any entity holding over 25 contracts — is hovering. As of final Friday, CME recorded a file of round 600 giant open curiosity holders of their futures contracts.

“So each our customary BTC and ETH contracts, in addition to our micro BTC and ETH contracts, all achieved information by way of the variety of giant open curiosity holders holding these contracts,” Vicioso stated.