Sigil Fund is betting on stablecoins and says Circle is the one funding available on the market that permits it to take action.

Stablecoins have gotten mainstream, in keeping with Sigil Fund, an early backer of Circle. On Tuesday, June 10, Sigil Fund shared particulars of its funding within the USDC stablecoin issuer. The monetary agency instructed buyers it had already achieved a 4x return on its $5 billion pre-initial public providing funding.

“Sigil Core invested in Circle in July 2024, effectively earlier than its public debut. On IPO day alone, this place delivered a +9% achieve to the fund’s NAV — and the entire return has now reached ~4x inside a 12 months,” Sigil Fund.

The Circle IPO was wildly profitable, highlighting that conventional buyers have an urge for food for crypto companies. The corporate started buying and selling on June 4 with a share worth of $31. By June 10, it was buying and selling at $115.25, marking a 271% worth enhance in lower than per week.

You may additionally like: Circle’s stellar IPO fuels ProShares and Bitwise ETF filings tied to CRCL shares

Why Sigil invested in Circle

Sigil Fund defined its funding in Circle was pushed by its perception within the strategic significance of stablecoins. In keeping with the fund, stablecoins are “the silent spine of crypto,” bridging conventional finance (tradFi) and decentralized finance. Moreover, Sigil famous that even massive tech corporations are exploring the potential of issuing their very own stablecoins.

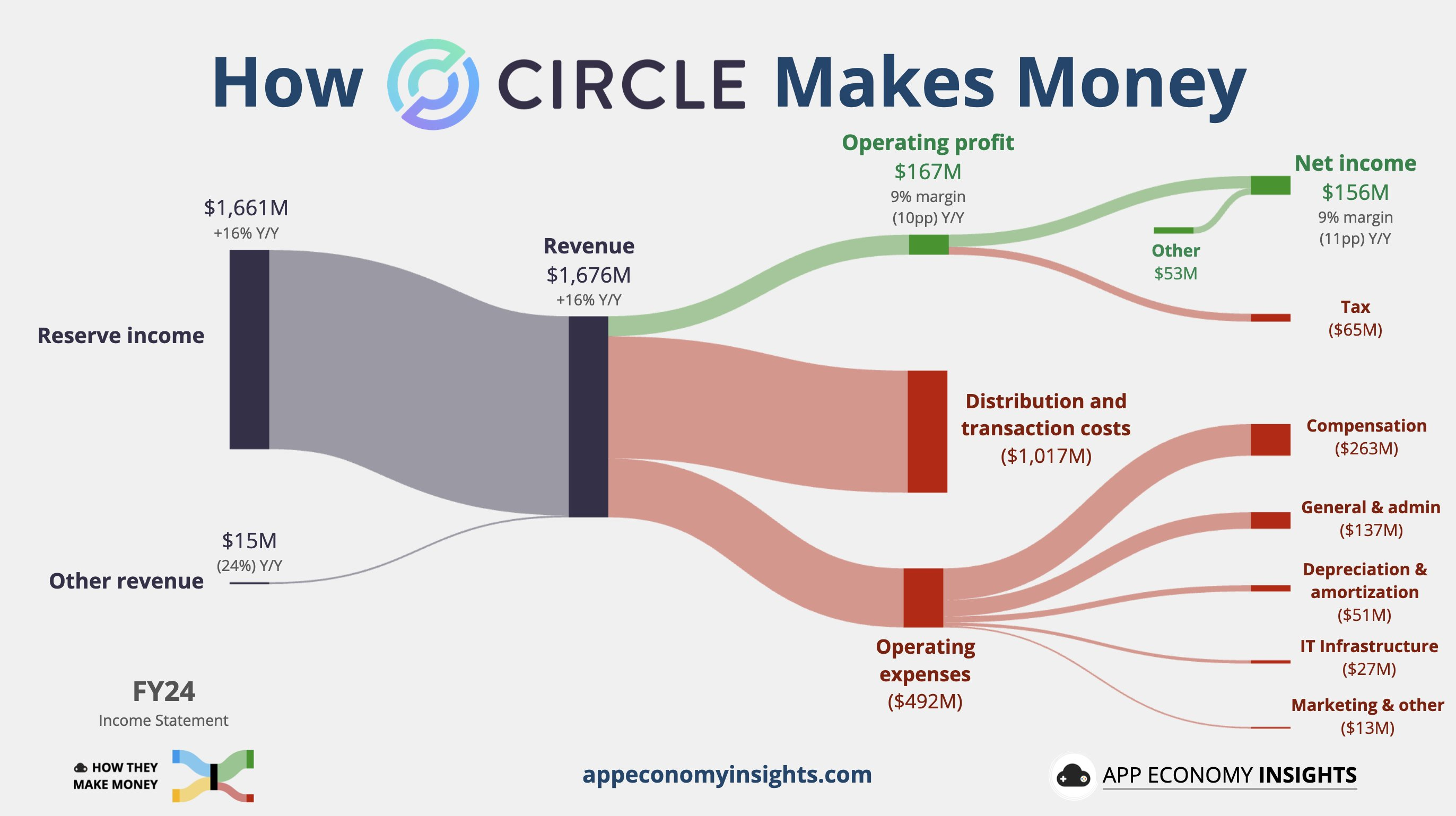

A chart explaining Circle’s revenues, prices, and revenue | Supply: X

Circle earns income primarily from the reserves backing its stablecoins on a one-to-one foundation. These reserves are largely held in short-term Treasuries and repo agreements, each of which generate yield. In consequence, the extra stablecoins Circle points, the higher the potential complete return.

You may additionally like: Circle inventory worth could crash quickly: right here’s why

At present, Circle holds $33 billion in reserves, together with $11 billion in short-term Treasuries and $16 billion in repo agreements. This construction generates $1.46 billion in web income for the agency. Because the USDC market cap will increase, so too will Circle’s revenues and earnings.

In keeping with Sigil Fund, Circle stays the one “clear investable” possibility on the inventory marketplace for publicity to stablecoins. For instance, Tether, the most important stablecoin issuer, is a personal firm, which means there aren’t any Tether shares out there for public funding.

Learn extra: Uphold weighs IPO or sale at $1.5B+ valuation