Coinbase cofounder and CEO Brian Armstrong has laughed off claims that he’s not bullish on the corporate after it was revealed that he has been promoting the corporate’s inventory by way of his 10b5-1 plan with out making any purchases.

The controversy emerged after Armstrong responded to a put up by Nick Prince, product lead at Base. The put up was celebrating one in all Coinbase’s newest options, which permits customers to put money into shares straight from the platform.

Armstrong remarked, “Shopping for Coinbase by Coinbase feels good.” Though he notes that regulatory restrictions forestall him from doing so straight utilizing Coinbase as a Part 16 officer, he claims to make use of a 10b5-1 buying and selling plan.

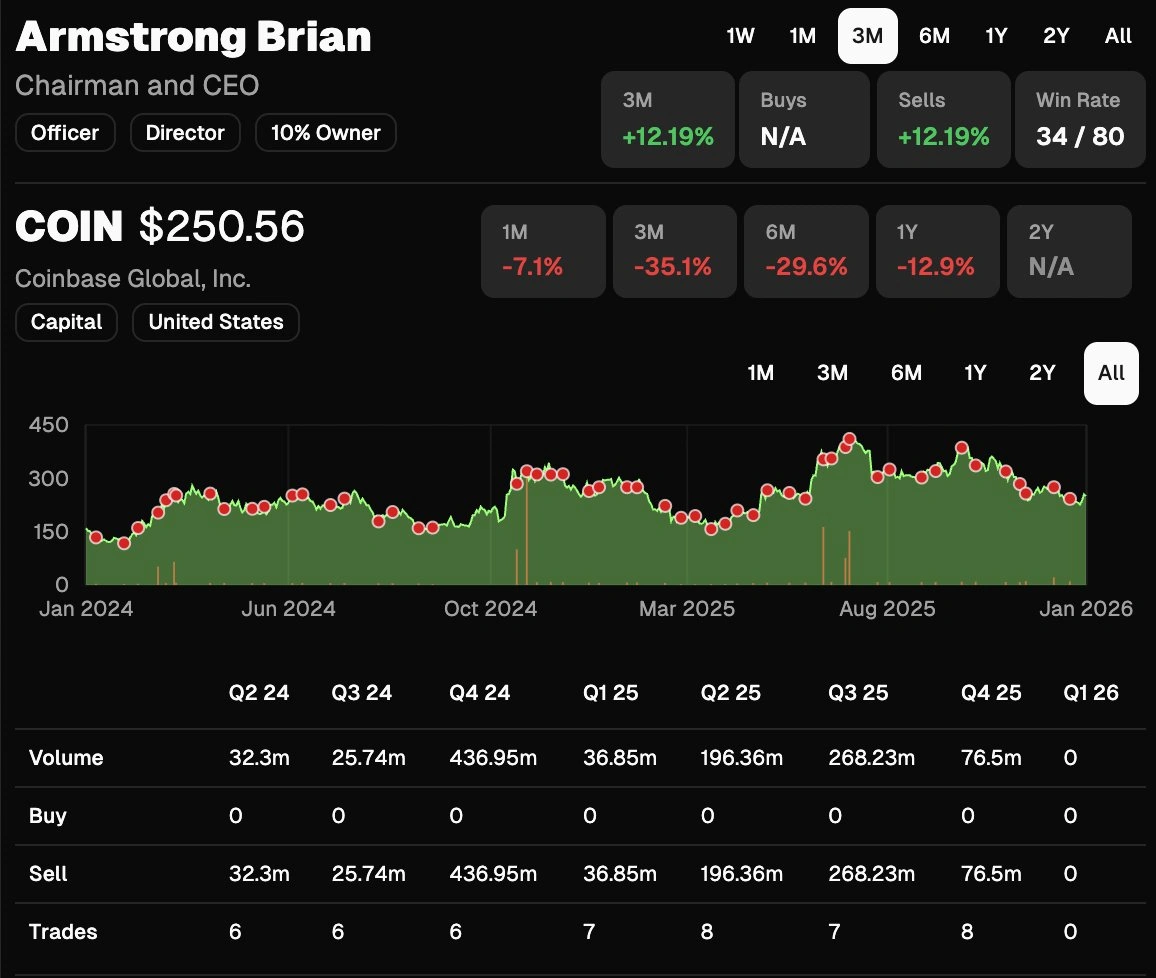

CEO Watcher, a platform that tracks insider buying and selling exercise, rapidly utilized the context that Armstrong has executed 88 gross sales of Coinbase inventory by his plan, however zero purchases.

Armstrong acknowledged the statement on X, writing, “Hah – you’re not flawed. It will be slightly loopy after 13 years to have 99.999% of your web value in a single inventory, no? So there is just one course to go.”

The Coinbase co-founder insisted he nonetheless maintains the overwhelming majority of his web value in Coinbase’s inventory and stays “tremendous lengthy” on the enterprise, including that he has used proceeds from gross sales to “assist begin extra corporations as effectively.”

Does Brian Armstrong purchase Coinbase inventory?

Armstrong’s current buying and selling exercise illustrates the regular divestment sample. On January 5, he offered $9.9 million value of Coinbase inventory, which was disclosed in an SEC submitting. On December 22, 2025, he offered 40,000 firm shares value round $10.2 million.

Supply: CEO Watcher on X

Commerce trackers have proven that Armstrong offered as much as $9.9 million in Class A typical inventory on January 5.

There has been a sequence of gross sales, with important quantities offered within the third quarter of 2025. Armstrong adopted his present 10b5-1 plan on 15 August 2024.

Market notion and focus risokay

While buyers often low cost gross sales made by way of preset plans, the magnitude of Armstrong’s transactions continues to draw scrutiny from monitoring platforms and market observers.

The irony of the state of affairs, Armstrong selling the flexibility to purchase Coinbase inventory on Coinbase whereas being unable to buy his personal firm’s shares on the platform and even shopping for by way of the route accessible to him, has not been misplaced on commentators.

Monetary analysts say that after spending greater than a decade constructing Coinbase, concentrating nearly all private wealth in a single fairness holding could be an idiosyncratic danger, no matter confidence within the firm’s prospects.

And it appears Armstrong understands that, as he identified that among the proceeds from these gross sales have gone into different corporations.

Coinbase pursues formidable all the pieces change vision

The change over Armstrong’s buying and selling historical past comes as Coinbase pursues an formidable growth past cryptocurrency. In his 2026 roadmap, Armstrong outlined plans to remodel Coinbase into an “all the pieces change” providing entry to crypto, equities, prediction markets, and commodities, a imaginative and prescient that features the just lately launched conventional inventory buying and selling function that sparked the preliminary dialogue.

The corporate has additionally developed partnerships for prediction markets and continues constructing out its Base Layer-2 community alongside its stablecoins and funds infrastructure.

Coinbase will not be the one change increasing past crypto buying and selling. Bitget is pushing into 2026 as a common change (UEX), whereas Binance continues to develop its providing, launching perpetual contracts on gold and silver earlier at this time, as reported by Cryptopolitan.