BlackRock’s first tokenized cash market fund has paid out $100 million in cumulative dividends since its launch, highlighting the rising real-world use of tokenized securities amid rising institutional adoption.

The milestone for the BlackRock USD Institutional Digital Liquidity Fund (BUIDL) was introduced Monday by Securitize, which serves because the fund’s issuer and tokenization companion, overseeing onchain issuance and investor onboarding.

Supply: Securitize

Launched in March 2024, BUIDL was initially issued on the Ethereum blockchain. The fund invests in short-term, US greenback–denominated belongings, together with US Treasury payments, repurchase agreements and money equivalents, providing institutional traders a blockchain-based automobile to earn yield whereas sustaining liquidity.

Traders buy BUIDL tokens pegged to the U.S. greenback and obtain dividend distributions immediately onchain, reflecting earnings generated from the underlying belongings.

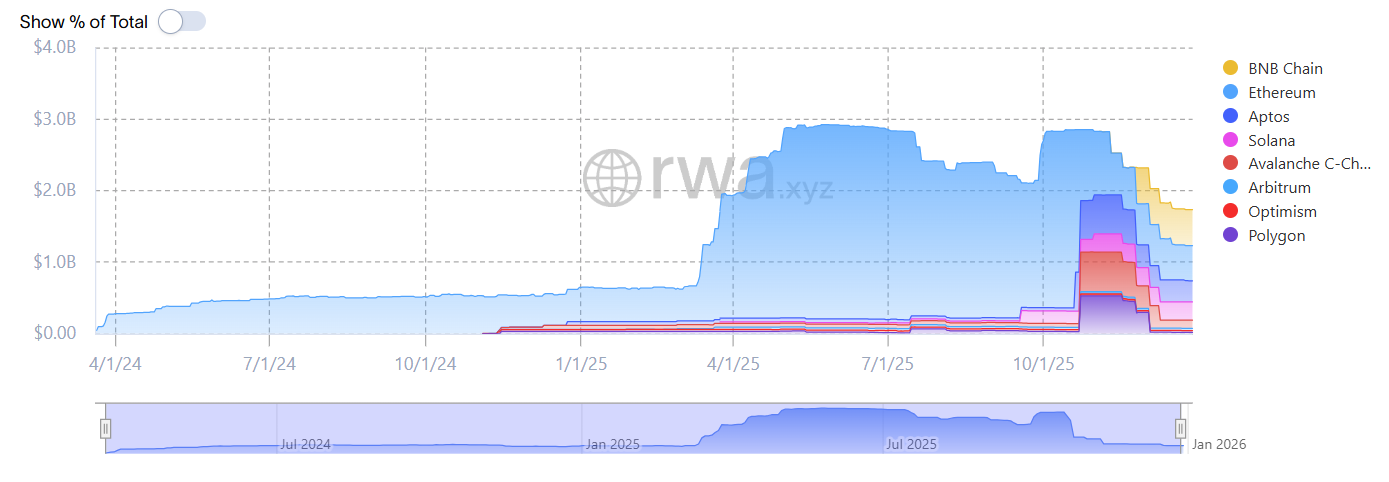

Since its debut on Ethereum, BUIDL has expanded to 6 extra blockchains, together with Solana, Aptos, Avalanche and Optimism.

The $100 million milestone is notable as a result of it represents lifetime payouts derived from precise Treasury yields distributed to holders of onchain fund tokens. It demonstrates that tokenized securities can function at scale whereas mirroring the core features of conventional monetary merchandise.

The event additionally underscores the operational efficiencies enabled by blockchain expertise, together with quicker settlement, clear possession data and programmable distributions, options which are more and more drawing curiosity from giant asset managers and institutional traders exploring tokenized real-world belongings.

BUIDL, particularly, has seen sturdy adoption, with the worth of the tokenized fund surpassing $2 billion earlier this 12 months.

At its peak in October, BUIDL held greater than $2.8 billion in belongings. Supply: RWA.xyz

Associated: Fragmentation drains as much as $1.3B a 12 months from tokenized belongings: Report

Tokenized cash market funds acquire traction and scrutiny

Tokenized cash market funds have rapidly emerged as one of many fastest-growing segments of the onchain RWA market, and for good purpose. Their enchantment lies of their capacity to ship cash market–model returns with larger operational effectivity, a dynamic that has begun to attract consideration from conventional monetary establishments.

Some market contributors view these merchandise as a possible counterweight to the anticipated progress of stablecoins.

In July, J.P. Morgan strategist Teresa Ho mentioned tokenized cash market funds protect the longstanding enchantment of “money as an asset,” whilst regulatory developments such because the approval of the GENIUS Act had been anticipated to speed up stablecoin adoption and probably erode the position of cash-like devices.

Regardless of their speedy progress, tokenized cash market funds have additionally attracted trade scrutiny. The Financial institution for Worldwide Settlements just lately warned that such merchandise may introduce operational and liquidity dangers, notably as they change into an more and more essential supply of collateral throughout the digital asset ecosystem.

Associated: Actual-world belongings prime DEXs to change into Fifth-largest class in DeFi by TVL