By Omkar Godbole (All instances ET until indicated in any other case)

Because the crypto market reels below U.S. stagflation issues, merchants on the decentralized platform Polymarket are seeing a greater than 50% likelihood of bitcoin

Shares within the Sure facet of Polymarket’s “Will bitcoin dip beneath $100K earlier than 2026” contract traded at 55 cents, implying a 55% chance. That pricing appears to be like justified towards the backdrop of current financial knowledge.

“With each manufacturing and companies ISMs now weaker than essentially the most bearish forecasts, the market is coming to phrases with one thing darker: Job progress could possibly be rolling over laborious,” Stephen Innes, managing accomplice at SPI Asset Administration, wrote in a put up on FXStreet.

“In case you weigh these surveys collectively by their financial footprint, the implications are staggering — potential NFP prints dropping by over 100,000. Not simply mushy, however recessionary-soft. But the kicker? Inflation’s nonetheless sticky the place it counts.”

Curiosity-rate merchants have already ramped up bets on a Fed discount. Nonetheless, observers are divided on whether or not price cuts fueled by financial weak spot bode nicely for danger property, together with cryptocurrencies.

Whereas decrease charges typically make riskier property extra enticing, Wall Road seems to count on some ache, and momentum merchants have shifted to promoting, based on Innes. The identical is true of bitcoin, with Deribit-listed short-term places now costing greater than calls, reflecting draw back issues.

Even so, the choices market sees a decrease likelihood of a sub-$100K bitcoin by year-end than Polymarket. That is evident from the -0.25 delta of the December expiry $100K put. Delta refers back to the sensitivity of the choice’s value to a change within the underlying asset and represents the chance of the choice expiring in revenue.

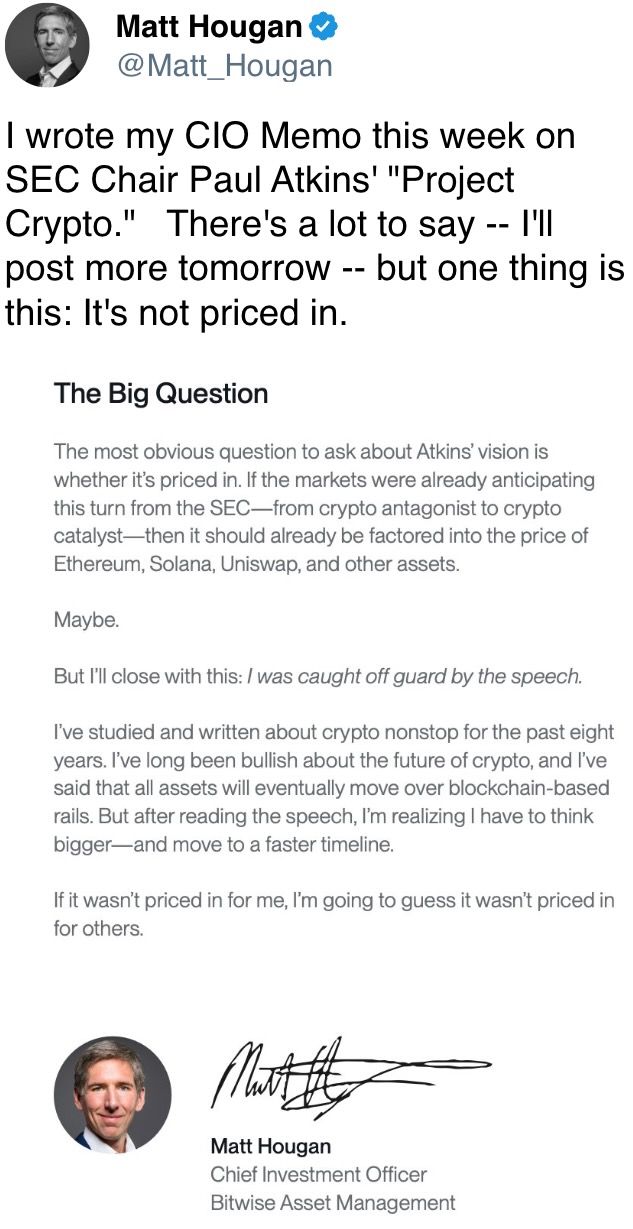

The outlook for ether (ETH) appears extra constructive for the reason that SEC mentioned staking actions and the receipt of tokens, below sure circumstances, don’t represent securities choices. The steering clears the best way for the regulatory approval of spot ether ETFs with staking, which is predicted to spice up the cryptocurrency’s attraction as a type of web bond.

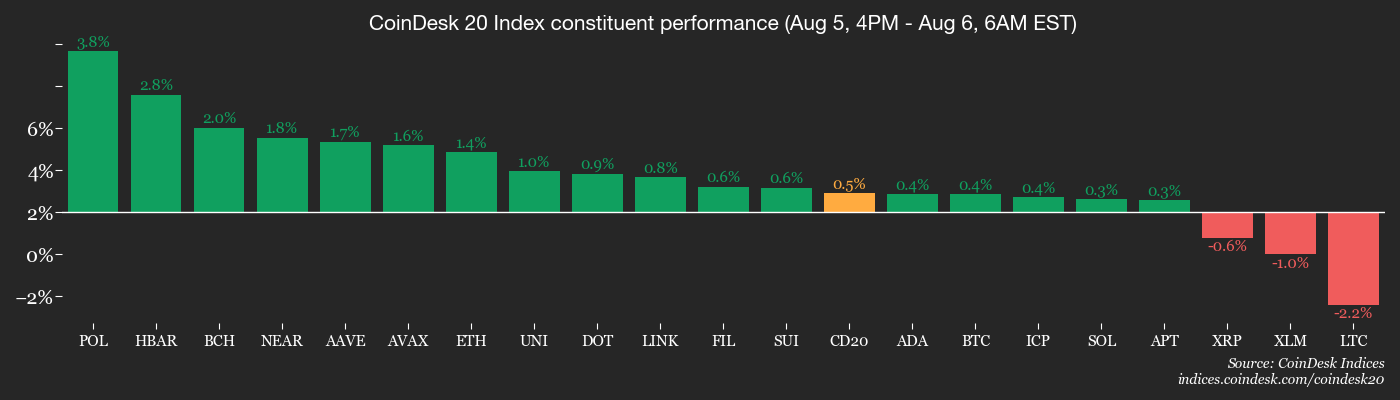

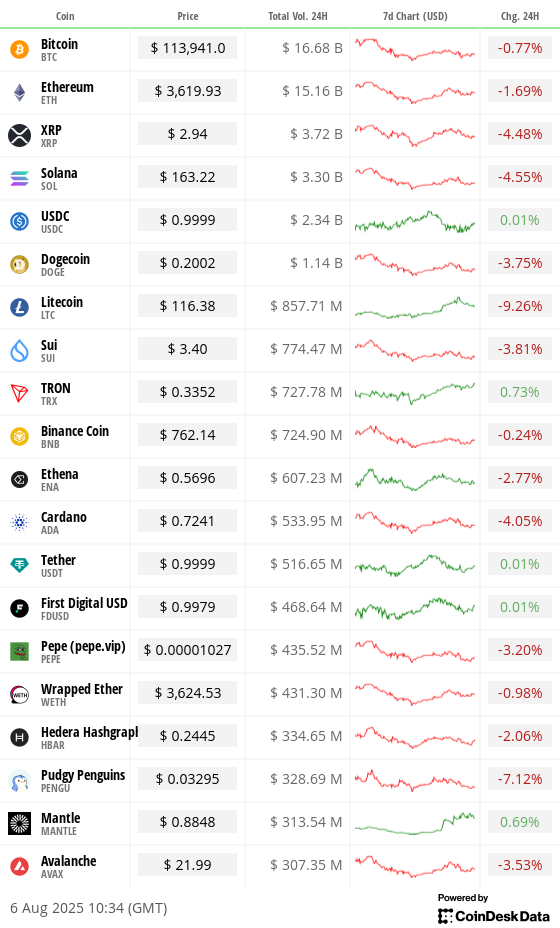

Talking of the broader market, altcoins appeared weak in contrast with majors. The CoinDesk 80 Index traded 2.9% decrease over 24 hours, barely greater than CoinDesk 20 Index’s 2.3%.

In different information, Japan’s largest financial institution, SBI, introduced an ETF tied to bitcoin and XRP. A governance proposal circulating within the Metamask neighborhood revealed the pockets’s plan to launch a “MetaMask USD” stablecoin via a partnership with Stripe’s fee infrastructure.

In conventional markets, futures tied to the S&P 500 traded 0.2% increased, indicating a touch optimistic open on Wall Road whereas the greenback index was flat round 98.70. Keep alert!

What to Watch

- Crypto

- Aug. 7, 10 a.m.: Circle will host a webinar, “The GENIUS Act Period Begins,” that includes Dante Disparte and Corey Then. The session will focus on the primary U.S. federal fee stablecoin framework and its influence on crypto innovation and regulation.

- Aug. 15: Document date for the subsequent FTX distribution to holders of allowed Class 5 Buyer Entitlement, Class 6 Normal Unsecured and Comfort Claims who meet pre-distribution necessities.

- Aug. 18: Coinbase Derivatives will launch nano SOL and nano XRP U.S. perpetual-style futures.

- Macro

- Aug. 6, 2 p.m.: Fed Governor Lisa D. Cook dinner will ship a speech titled “U.S. and World Financial system”. Livestream hyperlink.

- Aug. 7, 12:01 a.m.: New U.S. reciprocal tariffs outlined in President Trump’s July 31 govt order develop into efficient for a broad vary of buying and selling companions that didn’t safe offers by the Aug. 1 deadline. These tariffs vary from 15% to 41%, relying on the nation.

- Aug. 7, 8 a.m.: Mexico’s Nationwide Institute of Statistics and Geography releases July client value inflation knowledge.

- Core Inflation Charge MoM Prev. 0.39%

- Core Inflation Charge YoY Prev. 4.24%

- Inflation Charge MoM Prev. 0.28%

- Inflation Charge YoY Prev. 4.32%

- Aug. 7, 3 p.m.: Mexico’s central financial institution, Banco de México, proclaims its financial coverage determination.

- In a single day Interbank Goal Charge Est. 7.75% vs. Prev. 8%

- Aug. 8: Federal Reserve Governor Adriana D. Kugler’s resignation turns into efficient, creating an early emptiness on the Board of Governors that enables President Trump to appoint a successor.

- Earnings (Estimates based mostly on FactSet knowledge)

- Aug. 7: Block (XYZ), post-market, $0.67

- Aug. 7: CleanSpark (CLSK), post-market, $0.19

- Aug. 7: Coincheck Group (CNCK), post-market

- Aug. 7: Cipher Mining (CIFR), pre-market

- Aug. 7: Hut 8 (HUT), pre-market, -$0.08

- Aug. 8: TeraWulf (WULF), pre-market, -$0.06

- Aug. 11: Exodus Motion (EXOD), post-market

- Aug. 12: Bitfarms (BITF), pre-market

- Aug. 12: Fold Holdings (FLD), post-market

Token Occasions

- Governance votes & calls

- Arbitrum DAO is voting to resume its partnership with Entropy Advisors for 2 extra years, beginning September 2025. The proposal consists of $6 million in funding and 15 million ARB for incentives for Entropy to concentrate on treasury administration, incentive design, knowledge infrastructure, and ecosystem progress. Voting ends Aug. 7.

- BendDAO is voting on a plan to stabilize BEND by burning 50% of treasury tokens, restarting lender rewards and launching month-to-month buybacks utilizing 20% of protocol income. Voting ends Aug. 10.

- 1inch DAO is voting on a $1.88 million grant to fund its participation in 9 international crypto occasions via late 2025. The proposal goals to spice up developer engagement, develop institutional ties and increase adoption throughout ecosystems like Ethereum and Solana. Voting ends Aug. 10.

- Aug. 6, 1 p.m.: Livepeer to host a fireplace on Twitter and Discord.

- Aug. 7, 12 p.m.: Celo to host a governance name.

- Aug. 8, 11:30 a.m.: Axie Infinity to host a city corridor on Discord.

- Unlocks

- Aug. 9: Immutable (IMX) to unlock 1.3% of its circulating provide value $12.32 million.

- Aug. 12: Aptos to unlock 1.73% of its circulating provide value $48.18 million.

- Aug. 15: Avalanche to unlock 0.39% of its circulating provide value $36.87 million.

- Aug. 15: Starknet (STRK) to unlock 3.53% of its circulating provide value $14.77 million.

- Aug. 15: Sei to unlock 0.96% of its circulating provide value $15.92 million.

- Aug. 16: Arbitrum to unlock 1.8% of its circulating provide value $35.82 million.

- Aug. 18: Fasttoken to unlock 4.64% of its circulating provide value $91.4 million.

- Token Launches

- Aug. 6: Worldcoin to be listed on Binance.US.

Conferences

The CoinDesk Coverage & Regulation convention (previously often known as State of Crypto) is a one-day boutique occasion held in Washington on Sept. 10 that enables common counsels, compliance officers and regulatory executives to fulfill with public officers accountable for crypto laws and regulatory oversight. Area is proscribed. Use code CDB10 for 10% off your registration via Aug. 31.

- Day 3 of three: The Science of Blockchain Convention 2025 (Berkeley, California)

- Day 1 of two: Blockchain Rio 2025 (Rio de Janeiro, Brazil)

- Day 1 of 5: Uncommon EVO (Las Vegas)

- Aug. 7-8: bitcoin++ (Riga, Latvia)

- Aug. 9-10: Baltic Honeybadger 2025 (Riga, Latvia)

- Aug. 9-10: Conviction 2025 (Ho Chi Minh Metropolis, Vietnam)

- Aug. 11: Paraguay Blockchain Summit 2025 (Asuncion)

- Aug. 11-13: AIBB 2025 (Istanbul)

- Aug. 11-17: Ethereum NYC (New York)

Token Speak

By Shaurya Malwa

- Pump.enjoyable reclaimed the lead in Solana token launches with 13,690 new tokens in 24 hours, barely forward of LetsBonk.enjoyable’s 13,392, based on Dune Analytics knowledge.

- Regardless of trailing in token rely, LetsBonk retained the sting in day by day buying and selling quantity at $87.7 million, in contrast with Pump’s $82.4 million.

- The resurgence in Pump’s exercise coincides with renewed momentum for its native PUMP token, which has rebounded 17.8% over the previous week to $0.003247. It is nonetheless down 52% from its post-ICO peak.

- Pump raised $600 million in 12 minutes throughout final months’ ICO and has begun a multimillion-dollar buyback, based on on-chain knowledge — a transfer that could be stabilizing sentiment.

- LetsBonk, backed by the Bonk neighborhood and built-in with Raydium’s LaunchLab, channels half of its price income into BONK token burns, whereas additionally supporting BONKsol and different Solana ecosystem initiatives.

- Solana, for its half, faces aggressive stress from Base, the place token launch exercise has surpassed Solana in uncooked numbers. That is pushed by the Base App’s integration of Zora and Farcaster, which robotically mints social posts as ERC-20 tokens.

- Whereas Solana nonetheless leads in memecoin buying and selling quantity, Base’s fast progress alerts a shifting dynamic, notably in experimentation and social-driven token creation.

Derivatives Positioning

- Futures open curiosity within the high 10 cash excluding BTC dropped 4% to 10% up to now 24 hours, indicating capital outflows from the market. BTC’s open curiosity held flat.

- Funding charges nonetheless stay above an annualized 5% for many main tokens indicating a dominance of bullish lengthy bets. It additionally means potential for lengthy liquidations ought to costs proceed to drop.

- Bitcoin’s CME futures additionally point out capital outflows, with open curiosity in normal contracts (sized at 5 BTC) at lowest since late April. The idea in BTC and ETH futures stays locked between 5% and 10%, exhibiting no indicators of enchancment.

- On Deribit, BTC and ETH choices danger reversals now present bearish (put) bias out to October expiry. Block flows on OTC desk Paradigm featured rollover of BTC places.

Market Actions

- BTC is up 0.237% from 4 p.m. ET Tuesday at $114,105.72 (24hrs: -0.55%)

- ETH is up 1.39% at $3,626.69 (24hrs: -1.34%)

- CoinDesk 20 is up 0.78% at 3,768.88 (24hrs: -2.33%)

- Ether CESR Composite Staking Charge is up 7 bps at 2.93%

- BTC funding price is at 0.0086% (9.3699% annualized) on Binance

- DXY is unchanged at 98.73

- Gold futures are down 0.56% at $3,415.60

- Silver futures are unchanged at $37.80

- Nikkei 225 closed up 0.6% at 40,794.86

- Hold Seng closed unchanged at 24,910.63

- FTSE is up 0.22% at 9,162.81

- Euro Stoxx 50 is up 0.28% at 5,264.22

- DJIA closed on Tuesday down 0.14% at 44,111.74

- S&P 500 closed down 0.49% at 6,299.19

- Nasdaq Composite closed down 0.65% at 20,916.55

- S&P/TSX Composite closed up 2.03% at 27,570.08

- S&P 40 Latin America closed up 0.71% at 2,590.51

- U.S. 10-Yr Treasury price is up 4.3 bps at 4.239%

- E-mini S&P 500 futures are up 0.23% at 6,339.50

- E-mini Nasdaq-100 futures are unchanged at 23,141.75

- E-mini Dow Jones Industrial Common Index are up 0.31% at 44,374.00

Bitcoin Stats

- BTC Dominance: 61.82% (unchanged)

- Ether to bitcoin ratio: 0.03177 (+0.38%)

- Hashrate (seven-day transferring common): 952 EH/s

- Hashprice (spot): $56.64

- Complete Charges: 3.67 BTC / $418,957

- CME Futures Open Curiosity: 137,790 BTC

- BTC priced in gold: 33.7 oz

- BTC vs gold market cap: 9.53%

Technical Evaluation

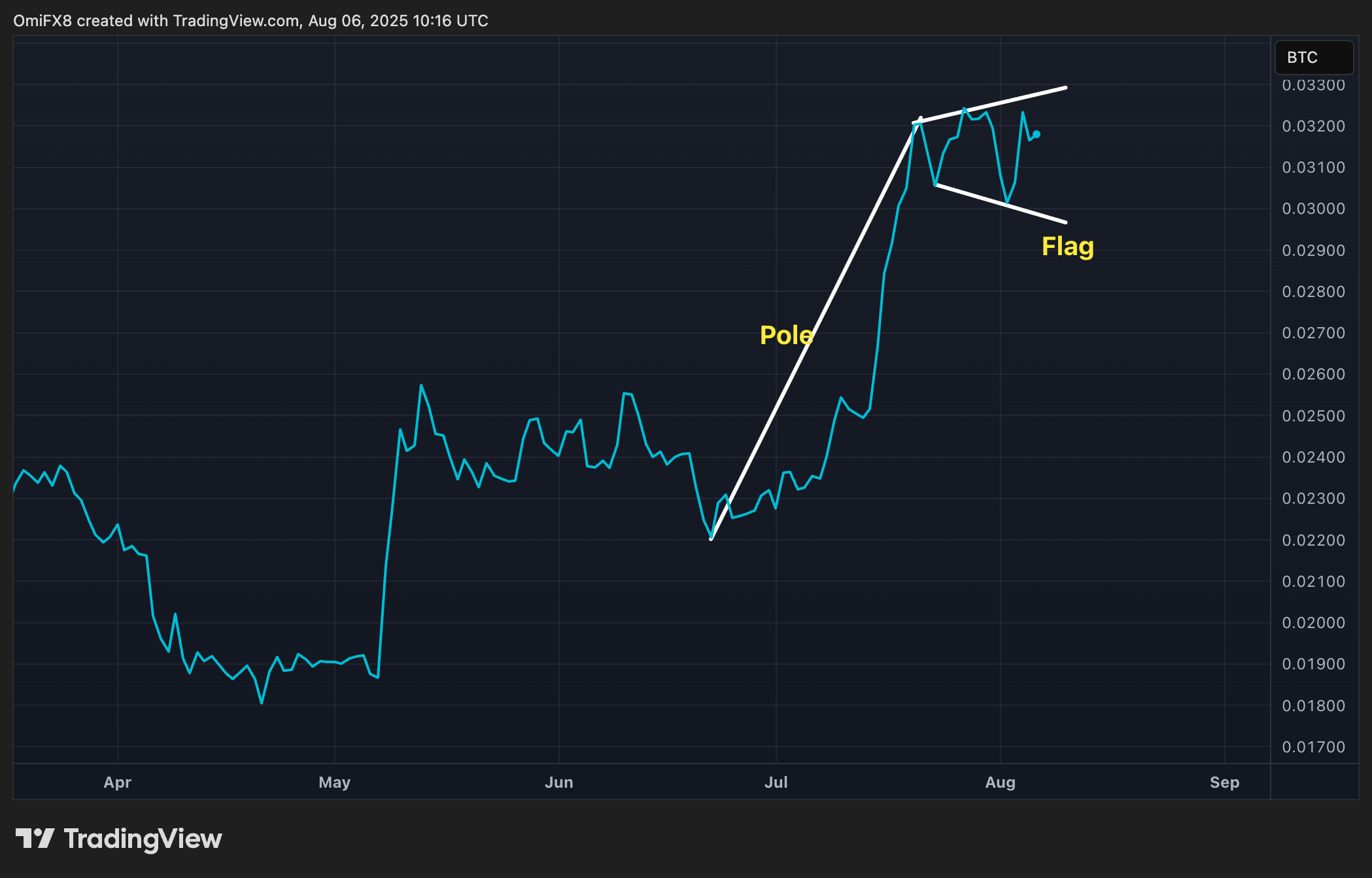

Binance-listed ETH/BTC pair. (TradingView)

- The ether-bitcoin (ETH/BTC) pair has shaped a bull flag sample on the day by day chart. The sample represents a short lived pause within the preliminary uptrend that often refreshes increased.

- A transfer via the higher finish of the flag would sign the resumption of the ether rally relative to bitcoin.

Crypto Equities

- Technique (MSTR): closed on Tuesday at $375.46 (-3.54%), +0.87% at $378.71 in pre-market

- Coinbase World (COIN): closed at $297.99 (-6.34%), +1.41% at $302.18

- Circle (CRCL): closed at $153.93 (-6.61%), -1.3% at $151.93

- Galaxy Digital (GLXY): closed at $27.68 (-4.19%), -0.58% at $27.52

- MARA Holdings (MARA): closed at $15.62 (-2.62%), unchanged in pre-market

- Riot Platforms (RIOT): closed at $11.13 (-2.54%), unchanged in pre-market

- Core Scientific (CORZ): closed at $14.08 (+3.15%), -0.43% at $14.02

- CleanSpark (CLSK): closed at $10.83 (+1.98%), +0.37% at $10.87

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $24.85 (+0.08%)

- Semler Scientific (SMLR): closed at $34.87 (-1.41%)

- Exodus Motion (EXOD): closed at $28.9 (-2.27%), +0.69% at $29.10

- SharpLink Gaming (SBET): closed at $20.23 (+5.69%), -1.33% at $19.96

ETF Flows

Spot BTC ETFs

- Day by day web flows: -$196.2 million

- Cumulative web flows: $53.63 billion

- Complete BTC holdings ~1.29 million

Spot ETH ETFs

- Day by day web flows: $73.3 million

- Cumulative web flows: $9.12 billion

- Complete ETH holdings ~5.57 million

Supply: Farside Traders

In a single day Flows

Chart of the Day

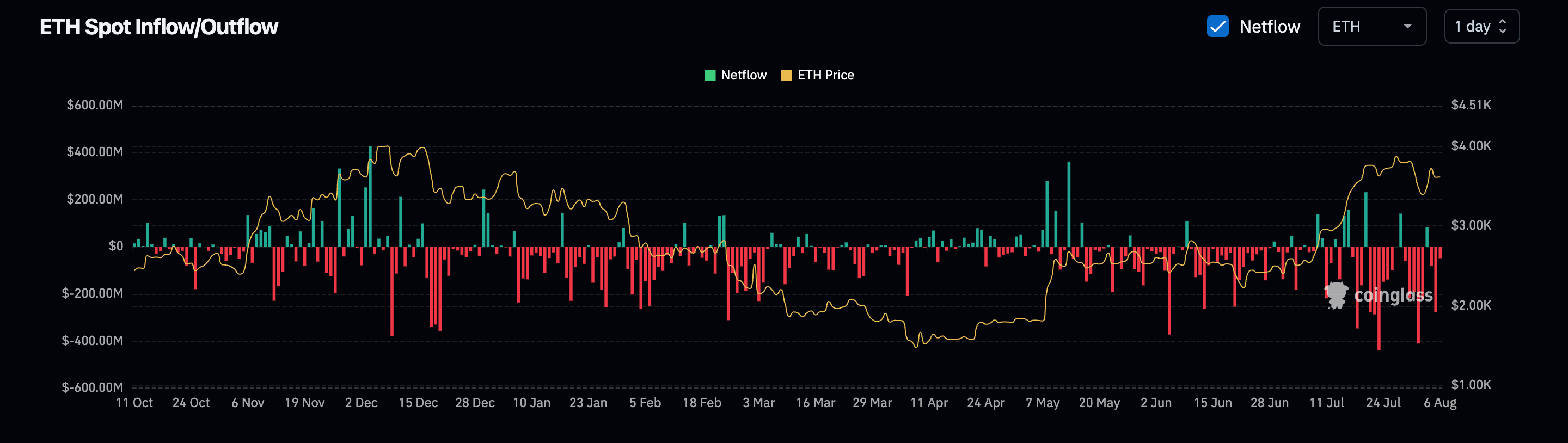

Ether: day by day trade flows. (Coinglass)

- The chart exhibits day by day web influx of ether into centralized exchanges.

- Not too long ago, there have been massive outflows, an indication of traders accumulating the cryptocurrency on the dip.

Whereas You Had been Sleeping

- Bitcoin ETFs Bleed Thousands and thousands for 4th Straight Day as U.S. Stagflation Fears Weigh on BTC and Shares (CoinDesk): Tuesday’s U.S. ISM companies PMI confirmed tariff-driven inflation, weak employment and commerce disruptions — indicators of stagflation, a worst-case state of affairs for danger property like tech shares and crypto.

- Swiss President Set to Meet Rubio on Wednesday to Avert Tariffs (Bloomberg): Talks are sophisticated by a $38 billion U.S. commerce deficit pushed by gold and prescribed drugs, with analysts warning the proposed 39% tariff might threaten as much as 1% of Swiss financial output.

- Leveraged Bearish Technique ETF Surges 19%, Indicators Dour Outlook for MSTR and Bitcoin (CoinDesk): The Defiance 2x Quick MSTR ETF, up 19% final week, has seen a web influx of $16.3 million up to now six months, whereas its bullish counterpart skilled vital outflows.

- China Warns Worldcoin-Model Iris Scanning a Nationwide Safety Menace (CoinDesk): China’s Ministry of State Safety warned that incentivized iris scans might enable international corporations to exfiltrate biometric knowledge, elevating issues about surveillance abuse and deepfake-enabled infiltration by intelligence companies.

- India’s Central Financial institution Holds Charges Amid Rising Tariff Tensions With Donald Trump (Monetary Instances): The RBI stored its repo price at 5.5%, citing tariff uncertainty and the still-unfolding influence of 100 foundation factors in cuts this 12 months because the U.S. threatens extra tariffs over India’s Russian oil imports.

- Trump Simply Bought a Recent Shot at Bending the Fed to His Will (The Wall Road Journal): Adriana Kugler’s early resignation lets the president appoint a rate-setter now, doubtlessly one who can stress Chair Jerome Powell, advocate price cuts and sign succession plans, relying on whether or not the decide is strategic or short-term.

Within the Ether