Financial institution of Japan charge hike to 1% might set off main Bitcoin worth volatility globally.

Japan holds $1.2 trillion US Treasuries, making coverage modifications globally impactful for Bitcoin costs.

Bitcoin dropped 3% beforehand after Financial institution of Japan raised charges to 0.75% in January.

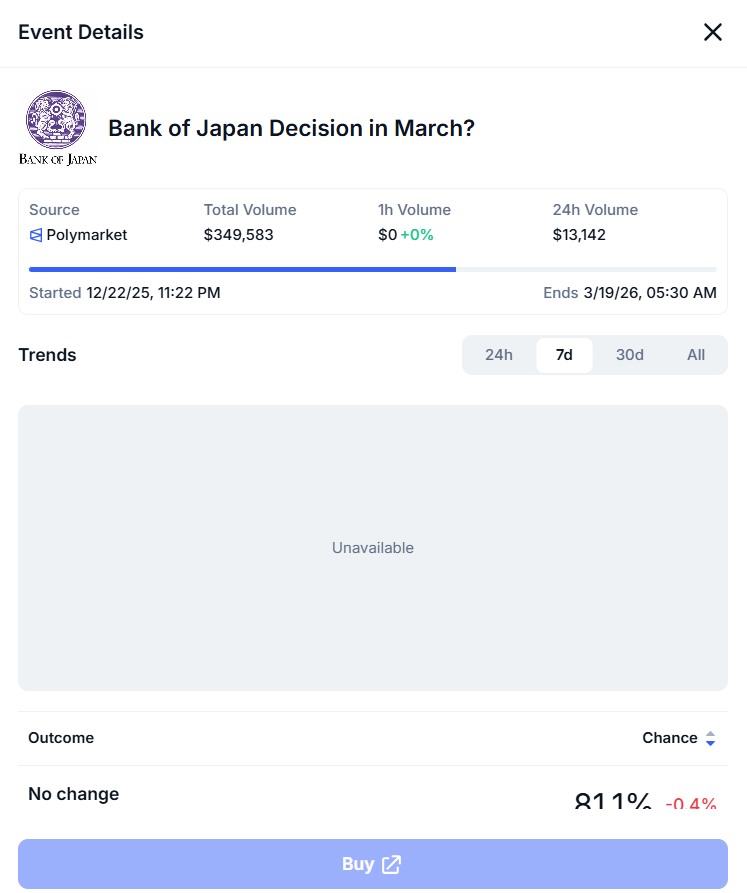

The worldwide crypto market is again below stress as expectations develop that the Financial institution of Japan might elevate rates of interest to 1% in April 2026. Financial institution of America warns that tighter coverage in Japan might cut back world liquidity and set off one other sharp Bitcoin sell-off, much like the three% drop seen after January’s hike.

Financial institution of Japan Charge Hike to 1% in April 2026

In keeping with Financial institution of America World Analysis, the Financial institution of Japan (BOJ) is predicted to extend rates of interest by 25 foundation factors, which might push the rate of interest to 1% in April 2026.

The Financial institution of Japan is predicted to implement a 25 foundation level rate of interest improve, which can convey rates of interest to 1% in April 2026, in accordance with Financial institution of America World Analysis

This might imply that rates of interest in Japan would attain their highest rate of interest degree for the reason that Nineteen Nineties as a result of Japan maintained its rates of interest near zero for an prolonged interval.

Bitcoin Worth After BOJ Charge Hike

Trying on the earlier BOJ charge hike information reveals robust sensitivity to Japan’s rate of interest modifications. The Bitcoin worth after BOJ charge hike in January 2026 mirrored this clearly, as Bitcoin fell practically 3% shortly after the Financial institution of Japan raised charges to 0.75%. This confirmed how shortly crypto markets react when world liquidity circumstances change.

When rates of interest improve, borrowing turns into dearer, which reduces the movement of capital into danger belongings like Bitcoin.

If the Financial institution of Japan raises charges once more towards 1%, analysts warn Bitcoin might face extra draw back stress. Some estimates recommend a doable 4% to five% decline, which can push the Bitcoin worth nearer to the $60,000 degree.