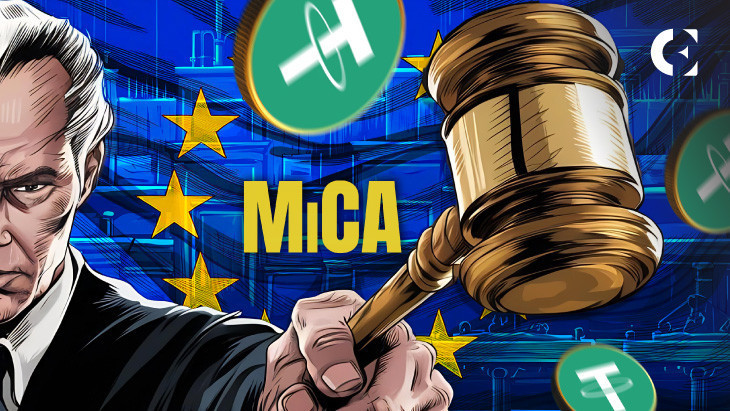

The European Union’s Markets in Crypto-Property Regulation (MiCA) is altering the area’s crypto market. Due to the brand new guidelines, some crypto exchanges within the EU eliminated Tether’s USDT stablecoin from their platforms.

MiCA has strict necessities for stablecoin issuers, which prompted issues for stablecoins and affected liquidity in European crypto markets. With Tether’s elimination, merchants are utilizing options just like the euro for buying and selling, and new stablecoin issuers need to fill the hole.

MiCA Regulation and Its Affect on Tether

Bloomberg stories that MiCA requires stablecoin issuers to have an e-money license and observe the necessities.

Circle, the issuer of USDC, bought its license in July, however Tether hasn’t but. If Tether doesn’t get the license, exchanges should delist USDT by December 30. Regardless of Tether attempting to scale back the illicit use of its stablecoin, similar to its involvement in legal actions that blockchain consultants reported; nevertheless, the EU’s push to extend transparency has prompted considerations.

Learn additionally : Tether’s USDT Faces Potential Delisting from Coinbase

Trade consultants warn that MiCA might cut back liquidity in crypto markets with out fixing the primary points, similar to unlawful actions and the shortage of regulatory readability.

The Liquidity Disaster and Market Disruptions

Tether is necessary in crypto buying and selling and is used throughout buying and selling pairs. USDT helps with crypto transactions.

However the delisting of USDT from a number of EU exchanges is forcing merchants to search out different commerce strategies. The liquidity pool is shrinking, so merchants are utilizing fiat buying and selling pairs or different stablecoins with decrease liquidity.

Crypto trade OKX, which eliminated USDT from its EU platform in April, noticed a shift towards fiat buying and selling pairs. Erald Ghoos, CEO of OKX Europe, stated the change was a shock. Many merchants now face challenges in swapping between fiat currencies and digital property as a substitute of utilizing stablecoin pairs.

Disclaimer: The data offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any variety. Coin Version just isn’t liable for any losses incurred on account of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.