As blockchain know-how and synthetic intelligence proceed to converge, x402—a typical that permits AI brokers to execute automated on-chain funds—was anticipated to function a gateway to the rising Agent Financial system.

Nonetheless, current knowledge exhibits a pointy decline in x402 transaction quantity. This pattern has raised doubts about whether or not the preliminary hype light solely months after its speedy rise.

x402 Transactions Down Extra Than 92%

In keeping with a report from Artemis, the idea of x402 “agent funds” could presently be extra phantasm than actuality. Whereas instruments equivalent to OpenClaw, Moltbook, and specialised agent wallets are spreading quickly throughout social media and developer communities, on-chain knowledge tells a really completely different story.

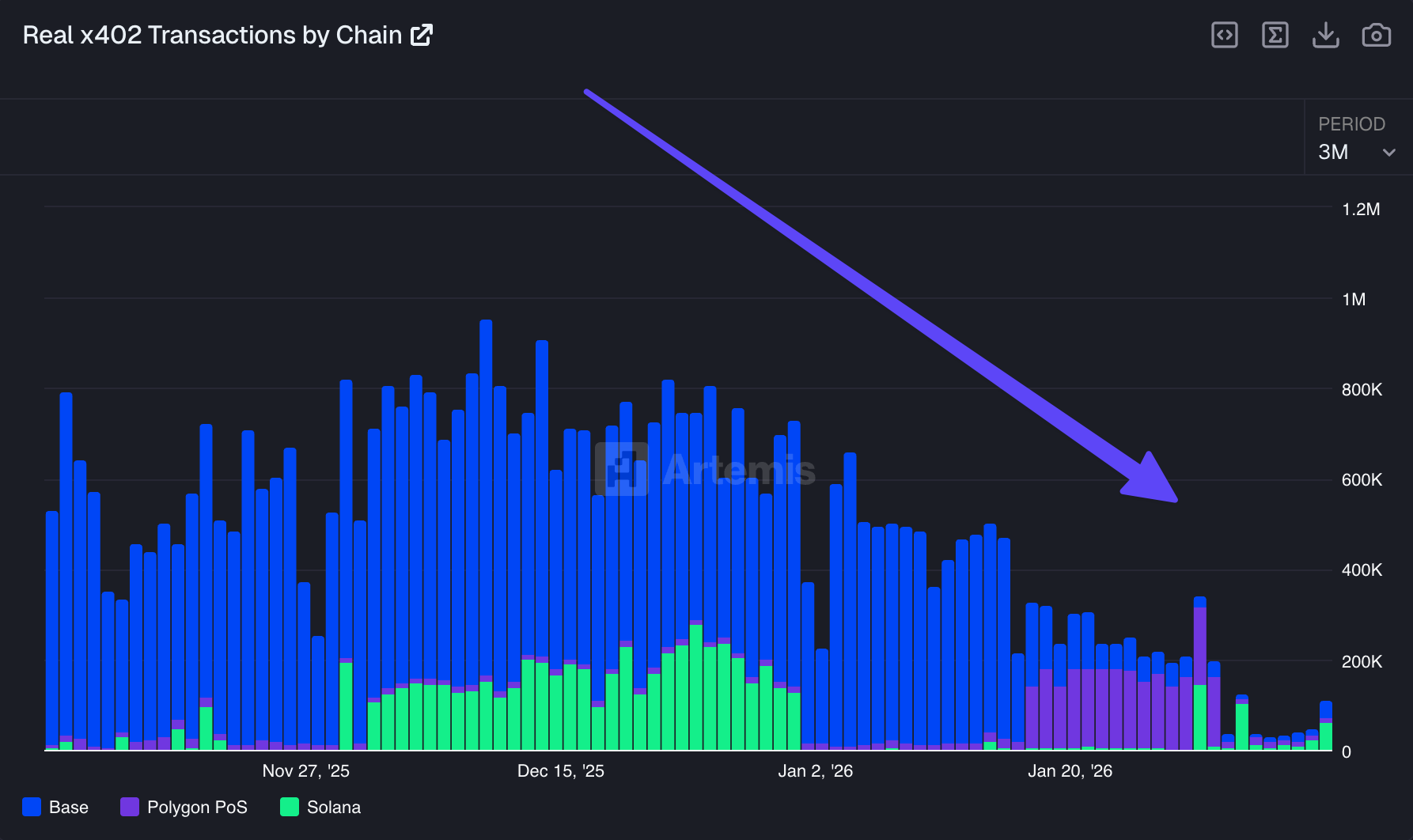

x402 Transactions by Chain. Supply: Artemis.

In December 2025, x402 averaged roughly 731,000 transactions per day. By February 2026, every day transactions fell to round 57,000. This represents a decline of greater than 92% from the height.

Charts from Artemis clearly illustrate this drop throughout networks equivalent to Base, Polygon PoS, and Solana.

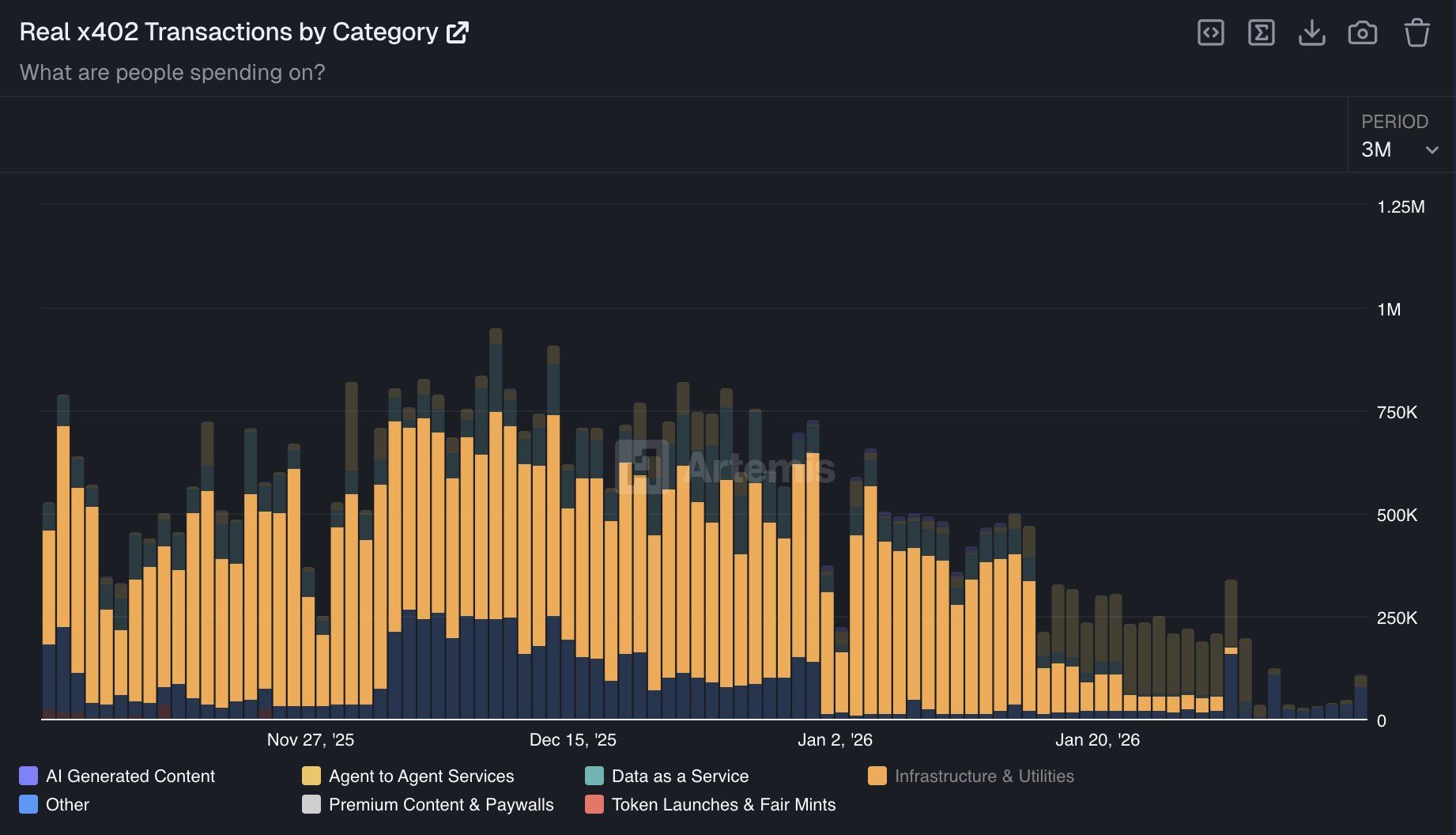

Lucas, an on-chain funds specialist at Artemis, offered additional perception. By inspecting transaction declines by class, he recognized a pointy contraction within the “Infrastructure & Utilities” phase as the first direct trigger.

x402 Transactions by Class. Supply: Artemis.

Exercise from companies equivalent to x402secure.com, agentlisa.ai, and pay.codenut.ai dropped by greater than 80% from earlier highs. These platforms function crucial infrastructure bridges, enabling easy, dependable x402 funds for brokers. In the meantime, demand has but to materialize.

“The larger takeaway is that these instruments, apps, and interfaces developed just lately present what’s doable and the place issues are heading. However the demand actually isn’t right here but,” Lucas stated.

Regardless of the adverse knowledge, many analysts proceed to precise optimism in regards to the long-term way forward for an agent-based economic system.

Alerts Pointing to a Future Agent Financial system Growth

Wanting additional forward, analysts envision a brand new financial system by which AI brokers grow to be impartial financial entities. These brokers could be able to performing autonomously, making choices, transacting, and producing worth with out fixed human oversight.

Analyst Stacy Muur highlighted three key indicators supporting this imaginative and prescient:

- The OpenClaw framework has surpassed 180,000 GitHub stars, indicating robust neighborhood curiosity. That is an open-source, autonomous AI assistant that may monitor wallets, automate airdrops, and take part in prediction markets.

- Moltbook, the primary social community designed solely for AI brokers, has already attracted almost 2.5 million brokers.

- ERC-8004, a brand new token customary designed for decentralized AI brokers, is prepared for deployment on the Ethereum mainnet, bringing this imaginative and prescient nearer to actuality.

From an funding perspective, nonetheless, initiatives inside the x402 ecosystem listed on CoinGecko have but to show notable worth efficiency. The sector’s complete market capitalization exceeds $6.7 billion, however Chainlink (LINK) alone accounts for greater than $6 billion. Most remaining initiatives have market capitalizations under $100 million.

Broad market promoting stress and prevailing worry have brought about traders to miss the constructive fundamentals of the x402 and AI Agent ecosystem. Beneath extra favorable market sentiment, these components might doubtlessly give rise to new billion-dollar crypto initiatives.

The put up AI Brokers Have been Presupposed to Energy a New Financial system on Blockchain —What Went Unsuitable appeared first on BeInCrypto.