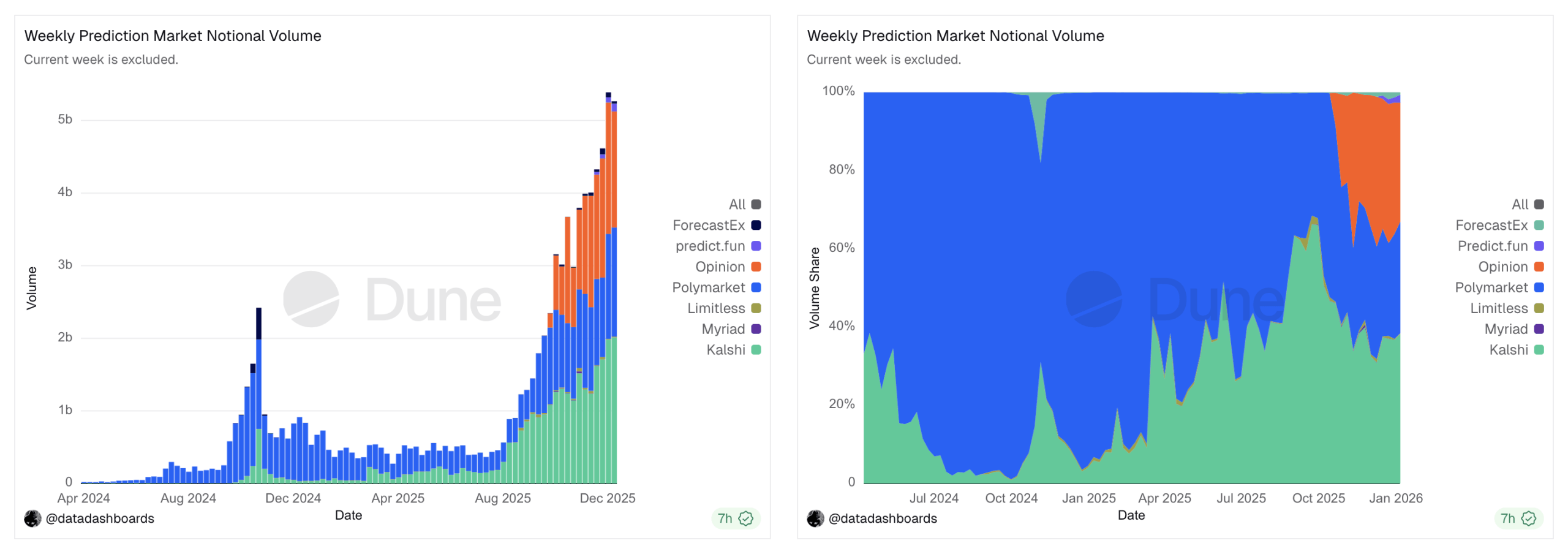

Within the last week of 2025, weekly prediction market notional quantity cleared $5.3 billion, and the opening week of 2026 pulled the identical trick—as soon as once more topping $5 billion and etching recent data into the sector’s ledger.

Prediction Markets Acquire Critical Consideration

Prediction markets have been stealing the highlight currently, and knowledge compiled by Dune Analytics makes it clear that three platforms are working a lot of the desk. Figures from the primary week of 2026 present the 12 months kicked off with $5.26 billion in quantity—only a whisker shy of the Dec. 29 high-water mark of $5.38 billion.

Dune.com knowledge compiled by @datadashboards exhibits Kalshi dominated the primary week of 2026, claiming 38.2% of whole market notional quantity throughout seven distinct prediction markets. Trailing Kalshi is Opinion, the BNB-based prediction market that has been flexing severe quantity muscle since late October. A lot of that exercise seems tied to Opinion’s points-based rewards system (PTS), with fast uptake fueled by the PTS program and the ever-tempting prospect of airdrops.

Two views of the notional quantity of seven distinct prediction markets. Dune.com knowledge compiled by @datadashboards.

Opinion now holds 30.3% of weekly notional quantity, whereas the long-standing Polymarket lags with 28.6% of the pie. Predict.enjoyable clocks in at roughly 2.1%, Forecastex, Limitless, and Myriad barely register at beneath 1% every, and on the transaction entrance Polymarket tops the chart with 11.4 million through the 12 months’s first week, Kalshi follows with simply over 11 million, and Opinion checks in with greater than 683,000.

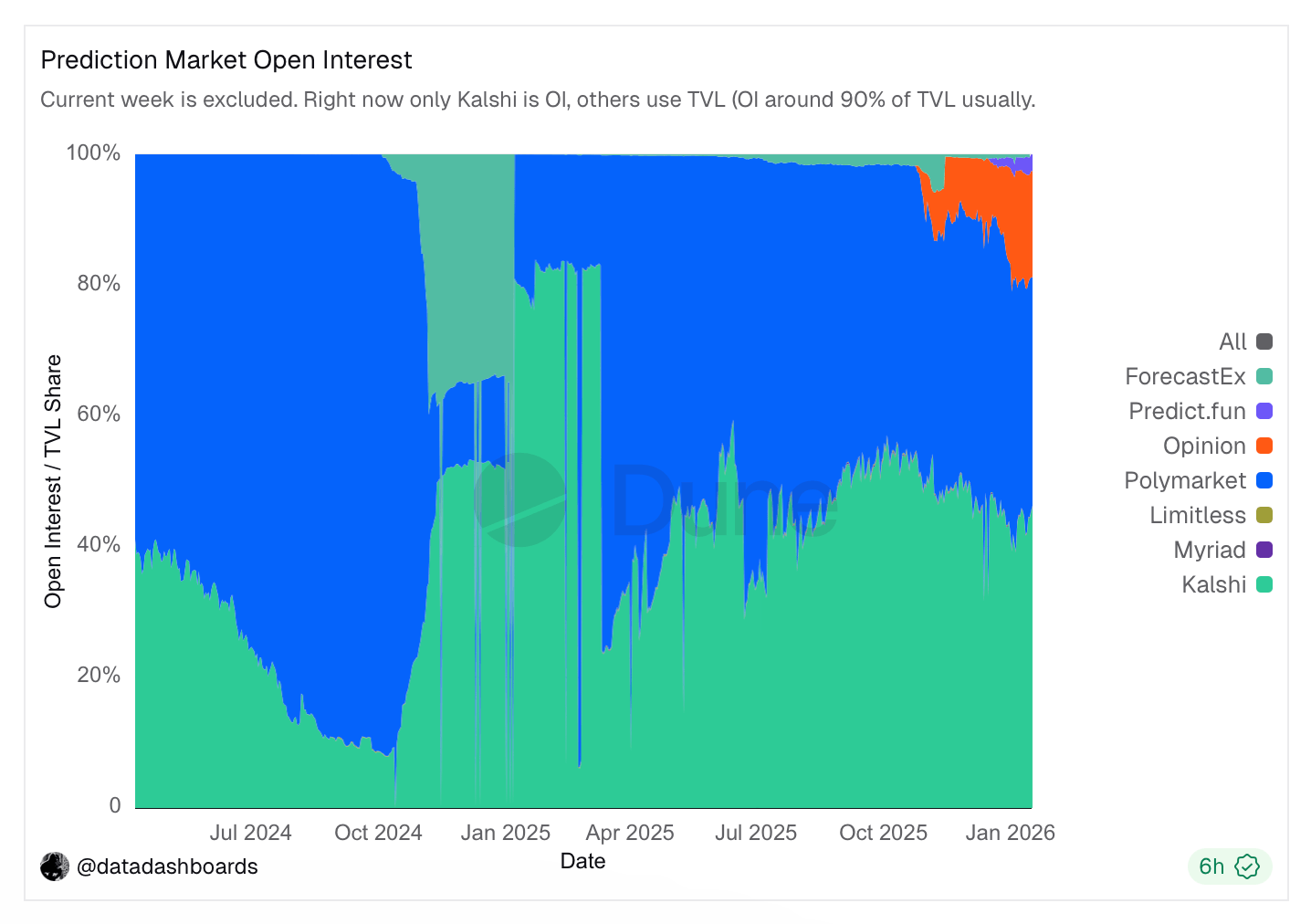

Open curiosity throughout all markets sat at $892 million as of Jan. 16, 2025, the newest day recorded on the Dune.com dashboard. That blend of curiosity, demand, and quantity has turned loads of heads, with many betting the area will get a lot greater—stoking an more and more aggressive race.

On high of that, Kalshi and Polymarket have pulled in hefty capital infusions and carved out actual mainstream traction, with Kalshi touchdown partnerships with CNBC, CNN, and MSNBC. Past cable information, Kalshi has additionally teamed up with the NHL and tapped golfer Bryson DeChambeau as its first athlete endorser, rolling him out for promotions and new market launches.

Additionally learn: Is Bitcoin About to Go Parabolic? Bitwise Sees ETF Demand Draining Provide

Polymarket has inked partnerships with the Golden Globes, Dow Jones—the writer of The Wall Avenue Journal—the New York Rangers, and Yahoo Finance, and Parcl, amongst others. Furthermore, Polymarket pulled in a $2 billion capital injection from Intercontinental Alternate (ICE), giving the platform a deep-pocketed ally and loads of monetary muscle.

Dune.com knowledge compiled by @datadashboards.

The YZi Labs-backed Opinion wasted no time snagging a significant slice of weekly sector quantity after launch, and it didn’t precisely slip in quietly—others sniffing across the predictions market embody Crypto.com, Draftkings, Robinhood, Fanduel, and Coinbase.

The sector enlargement, quantity, competitiveness, and progress make one factor clear: prediction markets aren’t fading into the background, and the class has grown effectively past a passing novelty. Today in age, it’s shortly turning into gold-rush territory, with platforms large and small dashing in to stake a declare as prediction market progress attracts an ever-crowded area.

FAQ 🔮

- What’s driving the rise in weekly prediction market quantity?

Elevated buying and selling exercise and intensifying competitors amongst main platforms are pushing weekly prediction market quantity increased throughout international markets. - Which platforms are competing for prediction market quantity?

A number of main prediction market platforms are vying for liquidity and market share because the sector attracts extra customers and capital. - Why does buying and selling quantity matter in prediction markets?

Greater quantity improves liquidity, pricing accuracy, and person confidence, making platforms extra aggressive at scale. - How does Polymarket’s funding have an effect on the sector?

Polymarket’s $2 billion capital infusion from Intercontinental Alternate strengthens its place as competitors intensifies within the international prediction markets enviornment.