Though 2026 will not be but a fortnight outdated at press time, sure Tesla (NASDAQ: TSLA) insiders have already executed huge TSLA inventory insider gross sales.

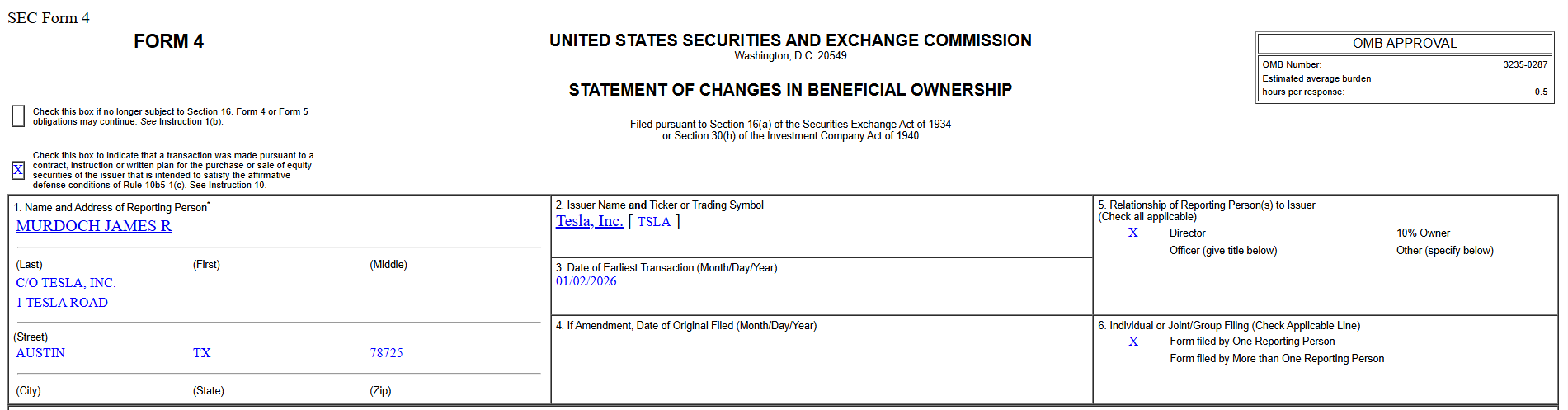

Certainly, Director James Murdoch – son of the previous Australian-American media mogul, Rupert Murdoch – bought 60,000 Tesla shares on January 2 at a mean value of $445.4 and for a complete of $26.7 million.

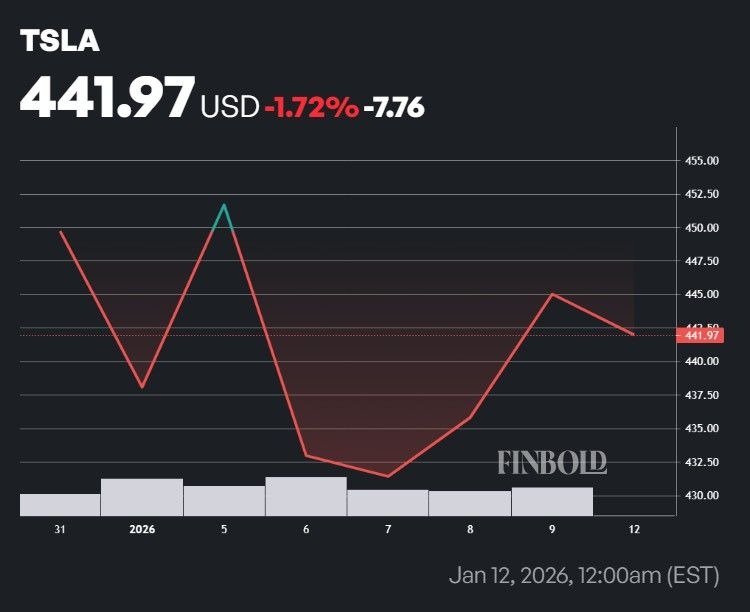

Had the commerce – reported to the Securities and Change Fee (SEC) on January 6 – been made at press time on January 12, it might have been value a complete of $26.5 million, as Tesla inventory is altering palms at $441.97 within the Monday pre-market.

Regardless of $26 million being a comparatively modest determine in comparison with a few of the different TSLA insider trades, it’s value stating that the overall bought in January 2025 amounted to $44 million, that means it’s doubtless senior personnel on the electrical automobile (EV) maker can have bought much more by the tip of the month than one 12 months prior.

Ought to Tesla inventory buyers fear about huge early 2026 insider sale

Elsewhere, it’s value stating that insider trades, regardless of their measurement, usually are not a dependable gauge of an organization’s well being. Certainly, many officers and administrators have often executed scheduled gross sales of their fairness, that means that almost all of such maneuvers aren’t aware moment-to-moment choices.

Nonetheless, holding an in depth eye on Tesla insiders may very well be a savvy transfer in 2026. Whereas the EV big carried out comparatively effectively for the whole-year 2025 regardless of the huge springtime plunge, latest developments give trigger for concern.

After years of dominating, Tesla’s deliveries within the fourth quarter (This fall) got here beneath the already-modest expectations, showcasing the corporate’s relative weak spot in the complete 12-month interval.

Nonetheless, the decline in gross sales doesn’t essentially exhibit that one thing goes incorrect with Elon Musk’s automobile firm, as most of it may be linked to exterior elements corresponding to broad shopper pressures and the tip of EV credit that got here final September.

The elements that may very well be of larger concern for TSLA inventory buyers are Musk’s alleged gutting of the EV maker’s high-tech division for the advantage of his new synthetic intelligence (AI) firm, xAI.

The transfer might be seen as alarming as a major think about Tesla shares’ restoration within the second half of 2025 has been the numerous self-driving and robotics guarantees Elon Musk has made – an endeavor that absolutely requires a workforce of AI-focused engineers.

Featured picture by way of Shutterstock