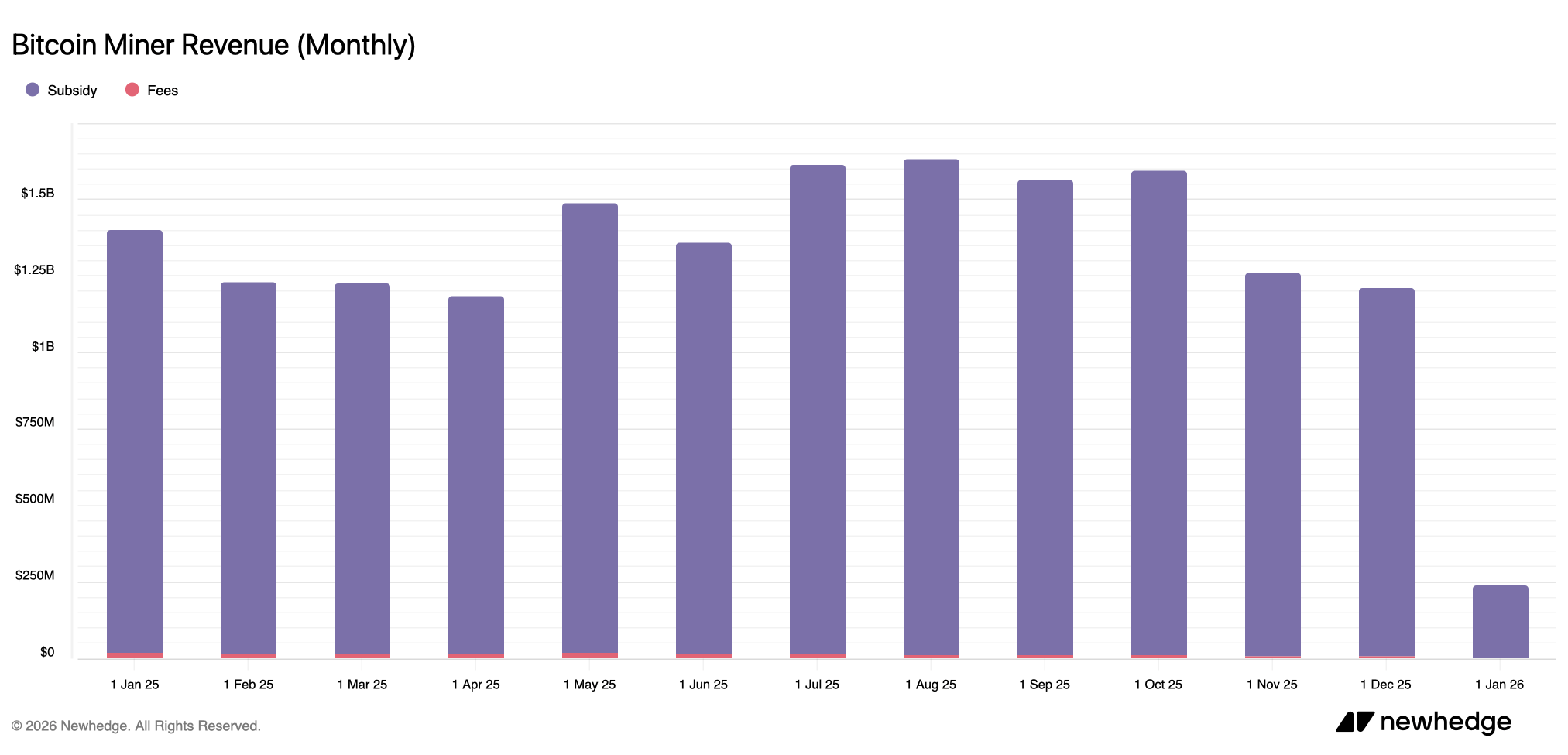

After a lackluster November, bitcoin miners collected even slimmer proceeds within the last month of 2025, with income tallying roughly $1.21 billion—marking the yr’s second-softest month-to-month exhibiting.

December Delivers Ache for Bitcoin Miners, however the Worst Might Be Passing

Though situations are enhancing for bitcoin miners in 2026, December’s income nonetheless ranked because the second weakest month of 2025, trailing solely April’s cumulative whole of $1.18 billion in response to newhedge.io stats. In November, miners pulled in $1.26 million, and December’s $1.21 billion determine got here in 4.13% decrease.

Dec. 18, 2025, marked the weakest day of the month for hashprice, the estimated spot worth assigned to a single petahash per second (PH/s) of uncooked hashpower.At that time, the going price for 1 PH/s stood at $36.25, inserting it among the many lowest hashprice ranges recorded lately.

Even with income beneath strain, the community’s hashrate stayed north of the 1,000 exahash per second (EH/s), or 1 zettahash per second (ZH/s), threshold by the ultimate days of December. As the primary week of January 2026 wraps up, the hashrate sits at 1,046 EH/s, with a brand new issue epoch set to reach in two days.

Additionally learn: Wall Road Heavyweight Morgan Stanley Recordsdata for Bitcoin and Solana ETFs

Block instances have drifted barely longer, averaging 10 minutes and eight seconds, and present projections counsel the problem may ease by 1.4%, although that outlook might shift over the subsequent two days.

The slight extension in block instances and a possible downward issue adjustment trace at modest mechanical reduction, however not a elementary reset. Each reasonably average-timed blocks and robust hashrate are largely on account of enhancing income, with present hashprice ranges sitting at $40.26 per PH/s.

Spot hashprice has climbed 11% from the Dec. 18 low. However onchain charges nonetheless account for lower than 1% of the entire block reward, leaving bitcoin miners largely reliant on BTC’s value positive factors to elevate the worth of the subsidy.

If BTC costs proceed to agency and hashprice sustains its current positive factors, early 2026 may provide steadier footing. Till then, mining economics stays a check of effectivity, balance-sheet endurance, and endurance.

FAQ ⛏️

- Why did bitcoin miners wrestle in December 2025?Income fell to $1.21 billion as hashprice dipped to multi-year lows and transaction charges remained minimal.

- What modified for bitcoin miners heading into 2026?Hashprice rebounded 11% from the Dec. 18 low whereas community hashrate and income indicators started to enhance.

- How robust is the bitcoin community regardless of decrease miner income? Hashrate held above 1 zettahash per second by late December, signaling sustained mining participation.

- What are miners counting on to enhance profitability in early 2026?Miners stay largely depending on BTC value positive factors, with onchain charges nonetheless contributing lower than 1% of block rewards.