Arthur Hayes, co-founder and former CEO of crypto alternate BitMEX, argued in a Substack essay revealed Friday that the Federal Reserve’s new “reserve administration purchases” (RMP) program is successfully a rebranded type of quantitative easing.

Hayes argues that by shopping for short-term Treasury payments and recycling liquidity by means of cash markets, the Fed is successfully financing authorities spending whereas avoiding the political stigma of quantitative easing, at the same time as officers body this system as a technical liquidity operation.

“The RMP is a thinly disguised approach for the Fed to money the federal government’s checks. That is extremely inflationary from each a monetary and actual items/providers perspective,” he wrote.

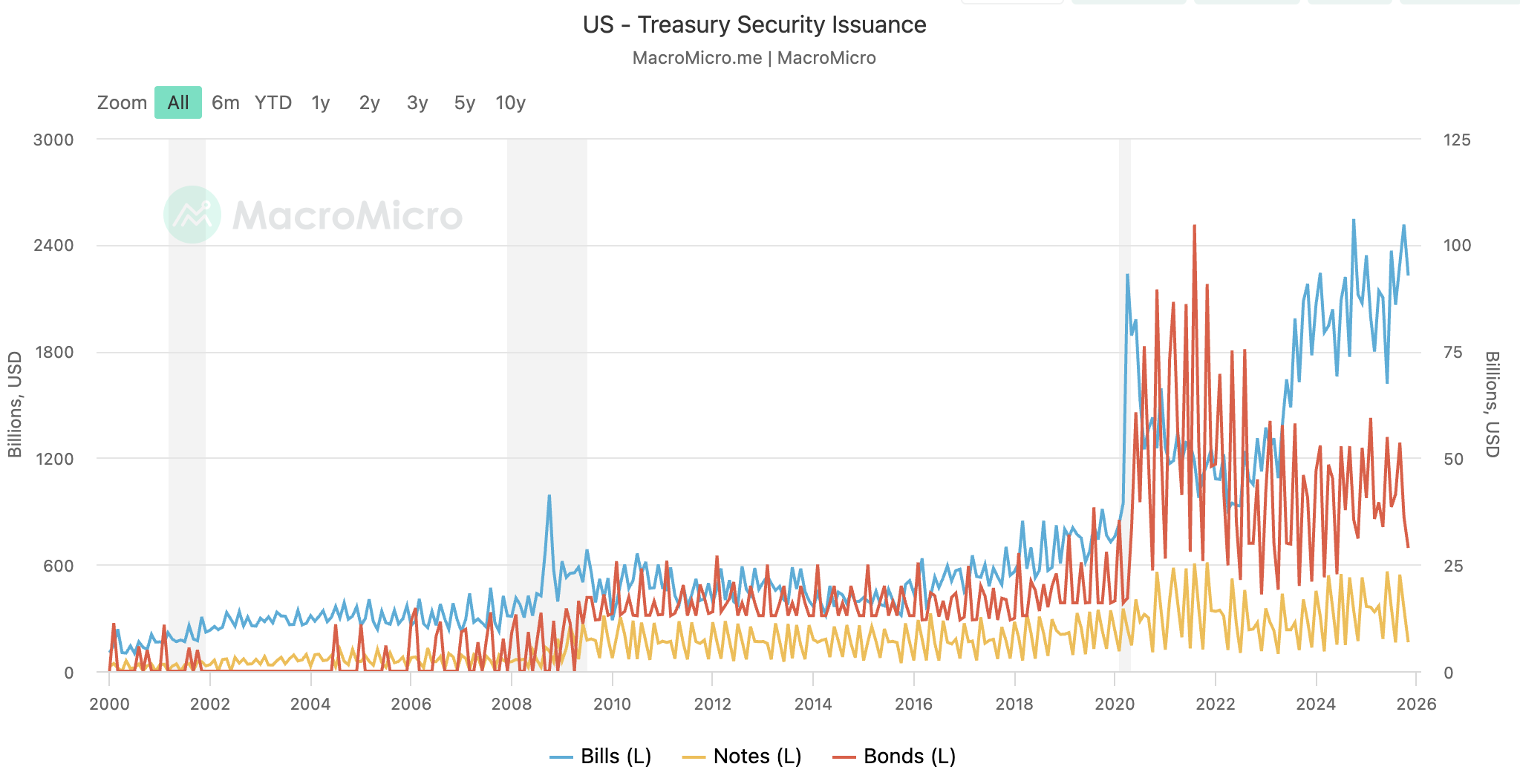

US Treasury issuance by maturity. Supply: MacroMicro

Hayes stated insurance policies like RMP broaden fiat liquidity and, in his view, favor scarce belongings similar to Bitcoin, gold and silver.

I like QE as a result of it means cash printing, and fortunately I personal monetary belongings like gold, gold/silver mining shares, and Bitcoin that rise quicker than the tempo of fiat cash creation.

On the identical time, he warned that individuals with out belongings are harmed, as cash creation erodes buying energy, weakens wages relative to costs and shifts wealth towards asset holders.

“Sadly, within the right here and now for many of humanity, cash printing destroys their dignity as productive people,” he wrote. “When the federal government deliberately debases the foreign money, it destroys the hyperlink between power inputs and financial outputs.”

Associated: Bitcoin rebounds on Japan fee hike as Arthur Hayes sees greenback at 200 yen

Polymarket factors to pause after December fee reduce

On Dec. 10, the Federal Open Market Committee (FOMC) reduce rates of interest by 25 foundation factors and introduced purchases of short-term Treasury securities, a transfer Fed Chair Jerome Powell stated was “solely for the aim of sustaining an ample provide of reserves” and separate from the stance of financial coverage.

The Fed stated the purchases would initially complete about $40 billion within the first month and will stay elevated for a number of months to ease near-term pressures in cash markets, notably round seasonal fluctuations similar to tax funds.

Regardless of the rate of interest reduce and the announcement of short-term Treasury purchases, analysts stated combined indicators from Powell have been prone to dampen a sustained Bitcoin rally till the rate-cutting cycle resumes in 2026.

The value of Bitcoin was about $92,695 on Dec. 10, based on Yahoo Finance information. It’s was buying and selling round $87,300 at time of writing.

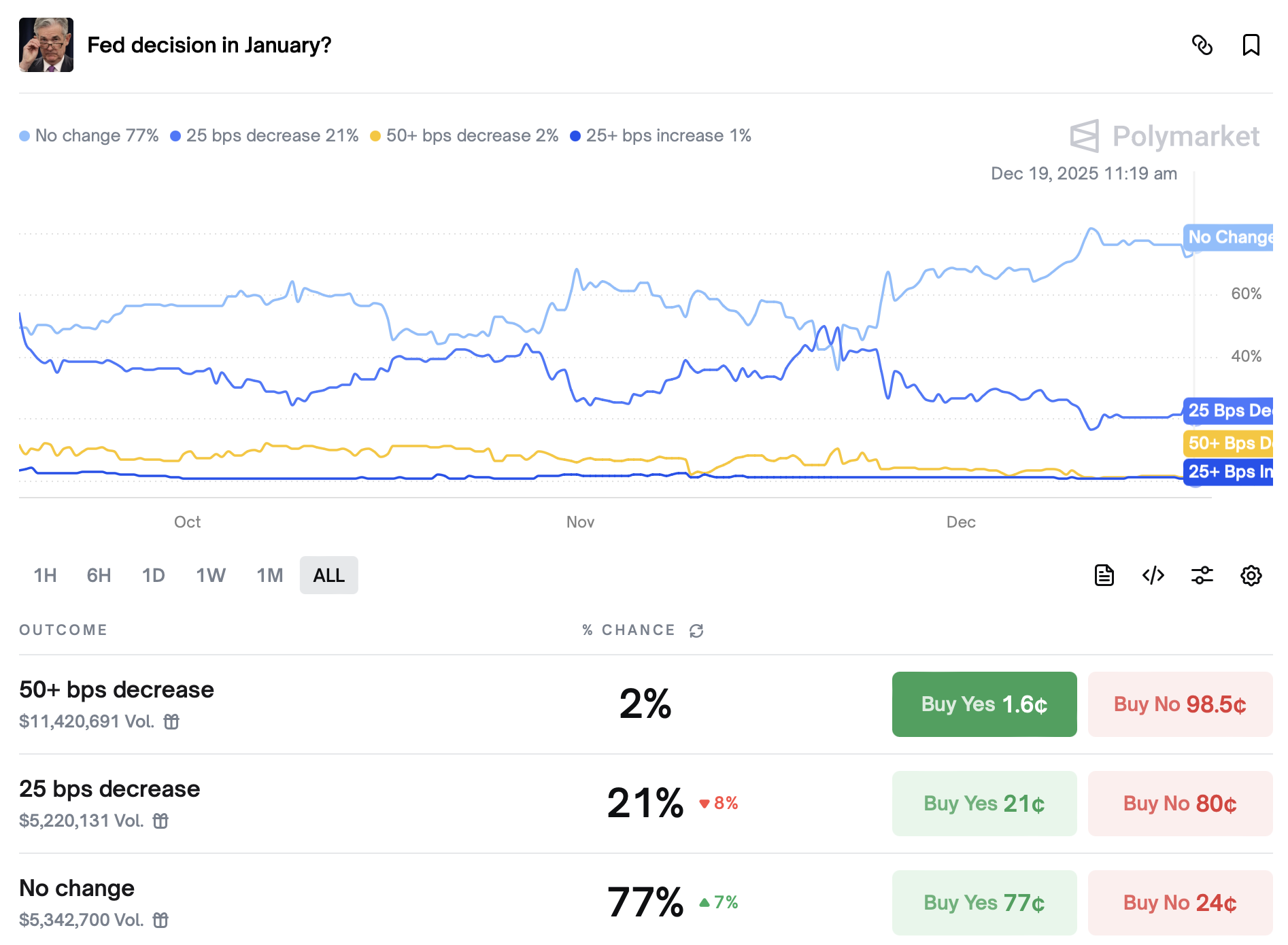

On the time of writing, Polymarket merchants have been overwhelmingly pricing in no change to Fed coverage in January, with the likelihood of charges staying unchanged at about 77%, whereas odds of one other 25 foundation level reduce sit close to 21% and bigger strikes are seen as extremely unlikely.

Odds of Fed fee reduce in Jan. Supply: Polymarket

Powell’s time period is ready to run out in Could 2026. US President Donald Trump, who has publicly pushed for the following Fed chair to pursue aggressive rate of interest cuts, is getting ready to interview finalists to succeed him, with Nationwide Financial Council Director Kevin Hassett extensively seen because the frontrunner.

Journal: Massive questions: Would Bitcoin survive a 10-year energy outage?