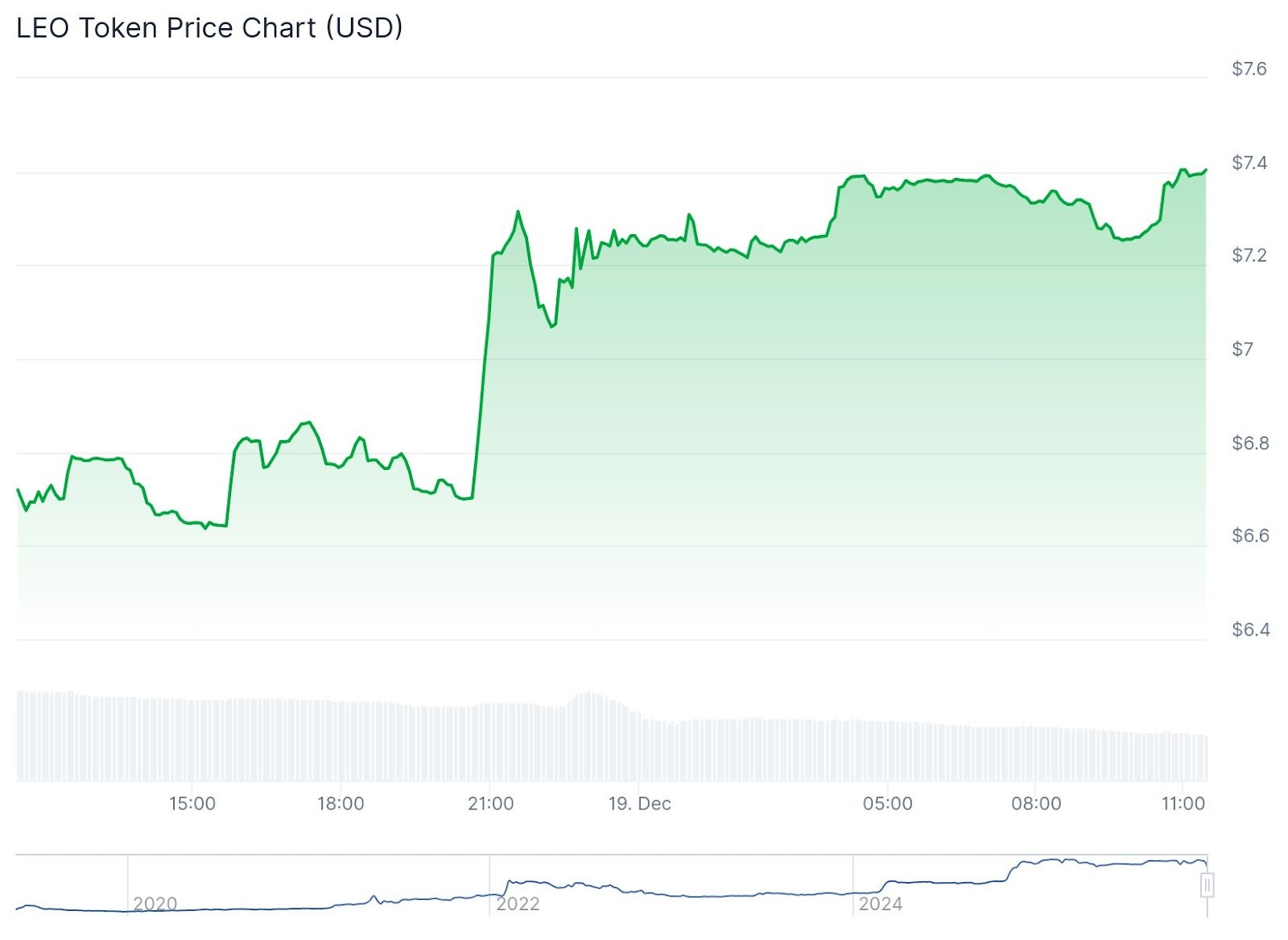

LEO, the native token of the iFinex — the father or mother firm of Bitfinex and Tether — outperformed the broader cryptocurrency market on Friday, Dec. 19 following Bitfinex’s determination earlier this week to scrap all buying and selling charges.

The token is at the moment altering arms at $7.40, up 11% on the day, in line with information from CoinGecko, pushing it into the highest gainers in the present day. The surge follows a couple of days of losses for the token, which was buying and selling as excessive as $9.51 only a week in the past.

LEO 24-hour worth chart. Supply: CoinGecko

The centralized alternate (CEX) determined to remove maker and taker buying and selling charges throughout its platform, together with all buying and selling pairs for spot, margin, derivatives, OTC trades and tokenized securities, in line with an official weblog submit.

The CEX Problem

The transfer has reignited debate over how smaller crypto exchanges can entice and retain customers in an area dominated by a handful of enormous gamers like Binance and Bybit. Bitfinex, which launched in 2012 and as soon as held over 15% of month-to-month international crypto spot quantity, now ranks thirty third amongst CEXs by 24-hour buying and selling quantity, in line with CoinGecko.

The choice to chop charges additionally comes as exercise rises on decentralized exchanges (DEXs) like Hyperliquid, Uniswap and PancakeSwap. In October, DEX exercise reached file highs with whole DEX spot quantity reaching $613.3 billion, up from round $500 billion in September.

That progress was primarily led by Uniswap’s large month, which recorded $170.8 billion, whereas PancakeSwap posted $101.9 billion in buying and selling quantity, The Defiant beforehand reported. Furthermore, in comparison with final October, DEX quantity was up about 200% yr over yr, although weekly volumes have tapered off for the reason that Oct. 10 liquidations.

Simply earlier in the present day, Hyperliquid’s HIP-3 improve, which launched in October and permits permissionless perpetual markets, surpassed $10 billion in whole buying and selling quantity.

“The hole is obvious: DEXs function with near-wholesale margins, whereas CEXs depend on broker-style charges,” a Hyperliquid group account below the deal with @Hyperliquid_Hub stated on X after Bitfinex’s information went dwell.

“This structural distinction makes price competitors an uphill battle for centralized platforms.”

Earlier in the present day, Bitfinex additionally had its working restrict for its tokenized securities platform raised to $310 million from $210 million, following an enlargement accepted by regulators in Kazakhstan. This improve permits Bitfinex Securities to record and commerce a bigger quantity of tokenized securities. At the moment, the tokenized real-world asset (RWA) sector is valued at over $37 billion, per RWAxyz.