Cash market merchants are pricing in an ECB charge hike within the coming months, ending the interval of comparatively low charges. Alternatively, Polymarket predictions level to unchanged charges for many of 2026.

The credit score panorama in 2026 might embody ECB charge hikes and an elevated financial outlook for the Euro space, after a interval of unchanged rates of interest and low inflation.

On the one hand, cash market merchants are pointing to a possible hike in 2026, because the Euro space financial system is displaying indicators of a quicker restoration. Alternatively, merchants are pointing to greater than a 50% likelihood that the European Central Financial institution will enhance rates of interest after every week of hawkish remarks.

The Euro space inflation stays comparatively low, however the interval of extraordinarily low charges in Europe could also be ending.

Regardless of the rate of interest cuts in 2025 and a dovish Fed, the expectations are that in 2026, quantitative easing might cease, and a few central banks might return to charge hikes.

Based mostly on money-market swaps, merchants anticipate 13 foundation factors of ECB charge hikes by the top of 2026. The market shifted from an expectation for a charge lower final week. On the finish of November, ECB Chief Christine Lagarde said that the present charge stage of two% is right and displays the specified impact on Euro Space inflation.

The expectation for charge hikes affected Euro space bond markets, with German 5-year bond yields nonetheless rising to 2.49%. The shift displays ongoing preparation for the top of the speed lower cycles for many main central banks.

Prediction markets see stability for ECB charge

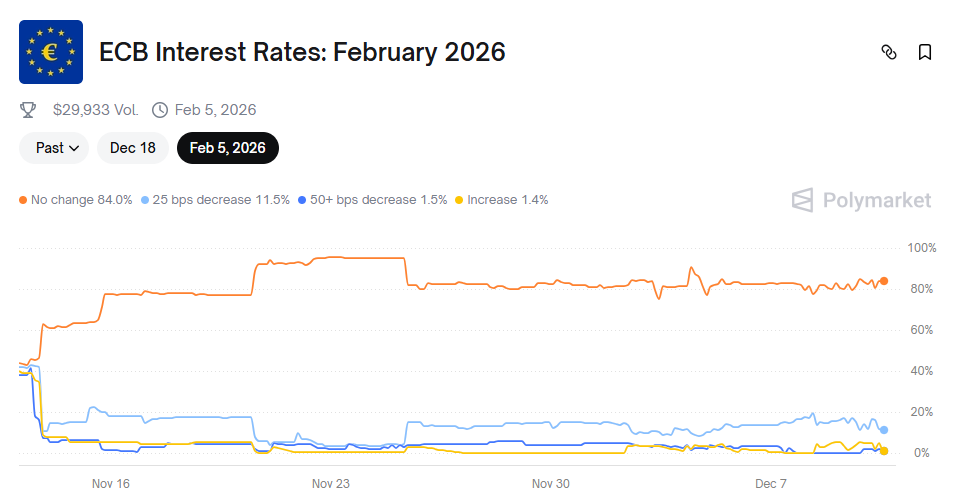

Polymarket merchants see no surprises from the ECB, with 99% of the bets on no charge hikes in December, awaiting decision because the market’s time runs out.

For 2026, Polymarket merchants present a distinct opinion, anticipating the ECB to retain its present charges.

Polymarket predictions on ECB charges are intently watched for the potential to shortly reverse their stability with new info as charge choice dates method. | Supply: Polymarket

Round 84% of market individuals anticipate no hike from the ECB. The market has a restricted quantity beneath $20K, however might turn out to be extra lively because the date of selections approaches.

The ECB charge market is taken into account undervalued, however is intently watched for whales positioning and the potential for quick beneficial properties within the case of early charge hikes from the ECB. Polymarket isn’t pricing in charge cuts, and a few merchants consider this can be a seemingly situation, although it clashes with the sign from cash markets.

ECB charge choice hinges on constructive outlook

The European Central Financial institution might problem a extra optimistic outlook for financial development within the subsequent few days. ECB Chief Lagarde pointed at upgraded predictions from the lately accomplished projections, and should announce an improved outlook by the top of the yr.

The Euro Space has confirmed extra resilient to the US tariffs, mentioned Lagarde in the course of the Monetary Instances International Boardroom occasion. The euro has not depreciated from these measures, leaving little stress for altering the charges to spice up the financial system.

A constructive outlook might also add one other argument for a charge hike earlier than the top of 2026.