The Federal Reserve has lowered rates of interest by 25 foundation factors to a goal vary of three.50%–3.75%, delivering the minimize markets overwhelmingly anticipated — however with out providing clear momentum towards additional easing.

At the moment’s choice was non-unanimous, reinforcing the uncertainty that has dominated investor sentiment over the previous week.

Steerage Is the Market Focus, Not the Minimize

The FOMC acknowledged slowing job features, the next unemployment development by means of Q3, and inflation that has ticked larger since early 2025.

Whereas policymakers famous that draw back dangers to employment have risen, they stopped in need of committing to a sustained slicing cycle. As an alternative, at this time’s assertion locations future coverage firmly on a data-dependent observe.

The committee reiterated that it’ll consider “incoming knowledge, evolving outlook, and steadiness of dangers” earlier than deciding on additional modifications.

Crypto merchants will interpret this stance as impartial to barely cautious. With out express ahead dedication, January and March now turn out to be the important thing pivot factors for rate-path expectations.

The Minimize Everybody Expects.. However Perhaps They Shouldn’t??

Markets see an 87% likelihood of a 25 bp minimize Wed (prediction markets: 97%).

However CreditSights says the choice is “hotly contested.”

The common policymaker path is extra hawkish than the median soo shock danger is actual. 🧵👇

— Schaeffer’s Funding Analysis (@schaeffers) December 9, 2025

This aligns with pre-meeting discussions the place analysts warned {that a} hawkish minimize was doable: easing at this time, however with no dovish roadmap.

The omission of forward-leaning language suggests the Fed desires flexibility, notably with inflation described as “considerably elevated” and uncertainty round development nonetheless excessive.

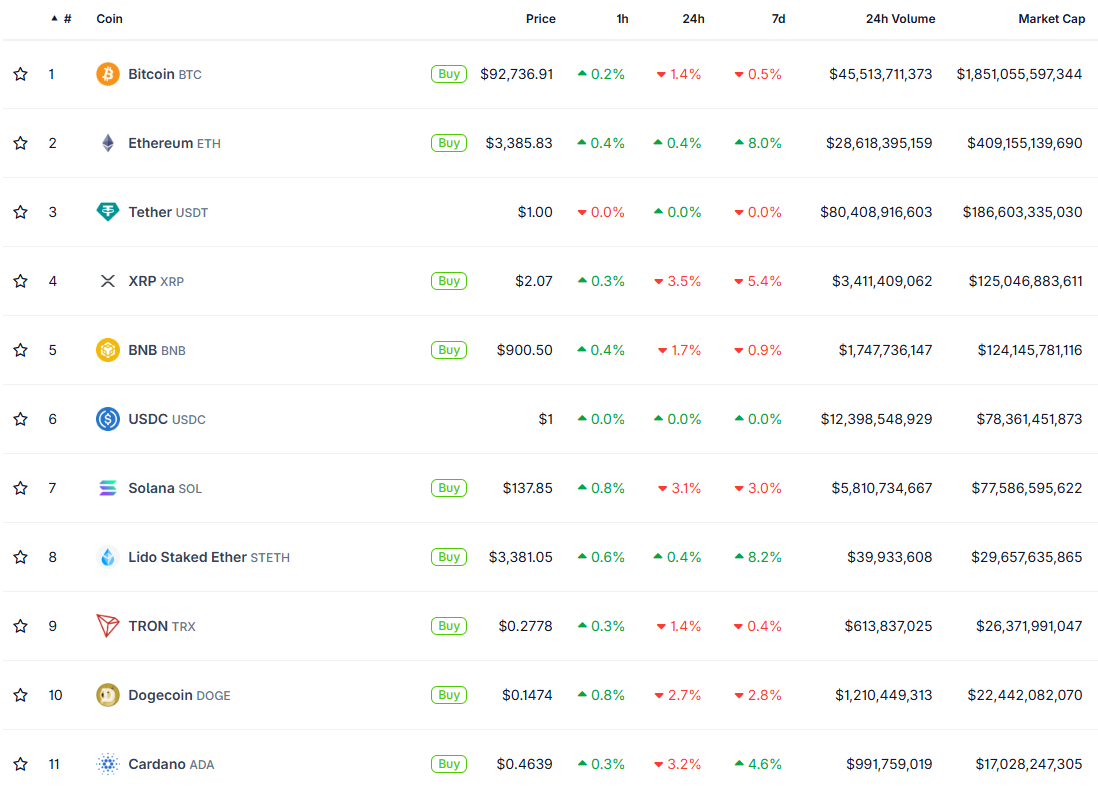

Crypto Market Stays Irresponsive to the Fed Price Minimize. Supply: CoinGecko

Uncommon Cut up Vote Highlights Inner Pressure

The vote breakdown underscores a divided committee. Stephen Miran most well-liked a bigger 50-basis-point minimize, whereas Austan Goolsbee and Jeffrey Schmid needed coverage left unchanged.

A 3-way break up like this displays the uncertainty forward. Labour softness is rising, inflation is now not drifting steadily downward, and views on how a lot easing the economic system wants seem more and more divided.

This three-way break up is notable. It indicators disagreement over how a lot slack is rising within the economic system — and whether or not easing ought to transfer quicker or pause altogether. Markets will learn this as affirmation that the cycle is now not cleanly dovish.

Steadiness Sheet Be aware Price Flagging

The Fed additionally introduced readiness to buy short-term Treasuries as wanted to keep up reserve adequacy — refined, however necessary for liquidity circumstances. This might act as a stabilizer if volatility rises into 2026.

At the moment’s transfer lands precisely the place markets anticipated, however with no roadmap. The tone is measured, cautious, and>Fed Cuts Charges 25bps, However the Actual Shock Is What Comes Subsequent appeared first on BeInCrypto.