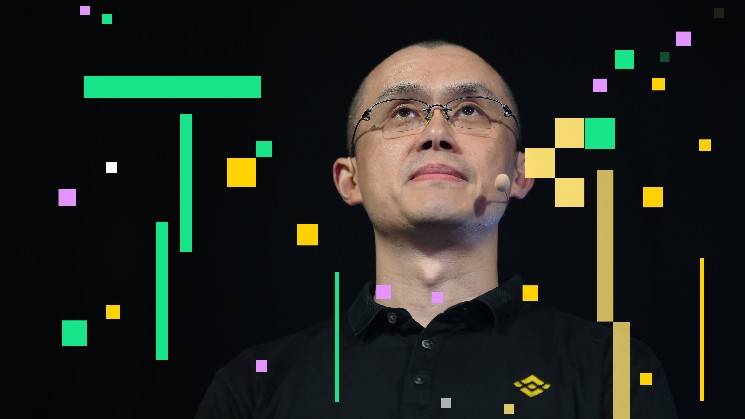

YZi Labs, the household workplace based by Binance co-founder Changpeng “CZ” Zhao and Yi He, which was rebranded from Binance Labs, has expanded its place in Ethena Labs, the protocol behind USDe, which has develop into the third-largest U.S. dollar-denominated crypto asset with greater than $13 billion in circulation.

The funding comes as Ethena enters a brand new stage of progress, which incorporates extending its footprint on BNB Chain. This consists of rolling out merchandise designed to bridge crypto and conventional finance, resembling USDtb, a fiat-backed stablecoin in growth, and Converge, an institutional settlement layer being constructed with Securitize and companions linked to BlackRock.

USDe, marketed as a “artificial greenback,” makes use of bitcoin BTC, ether (ETH) and Solana’s SOL (SOL)as backing belongings, pairing them with an equal worth of brief perpetual futures positions on exchanges to take care of a $1 peg.

Launched lower than two years in the past, the artificial greenback crossed the $10 billion provide milestone sooner than every other dollar-pegged crypto asset.

“Since our funding crew first met Man [Young] in late 2023, Ethena has develop into the class definer for yield-bearing artificial {dollars},” mentioned Dana Hou, funding accomplice at YZi Labs.

For customers, the developments imply extra choices for holding and utilizing digital {dollars} throughout centralized exchanges and decentralized finance protocols. For establishments, merchandise like Converge goal to create a well-recognized settlement layer for tokenized belongings, doubtlessly broadening adoption of on-chain monetary infrastructure.

Learn extra: Ethena’s USDe Outpaces BlackRock’s Bitcoin, Ether ETFs With $3.1B Influx Surge