MicroStrategy Inc (NASDAQ: MSTR) introduced one other Bitcoin (BTC) buy on December 23 at a mean worth of $106,662. This marks an announcement made at a worth beneath the dollar-cost common, signaling a purchase at Bitcoin’s native prime.

However, the corporate remains to be worthwhile with its Bitcoin portfolio, and MSTR’s inventory steadily sustains a premium in opposition to its holdings. In accordance with Michael Saylor’s announcement, MicroStrategy has acquired 444,262 BTC at a mean value of $62,257.

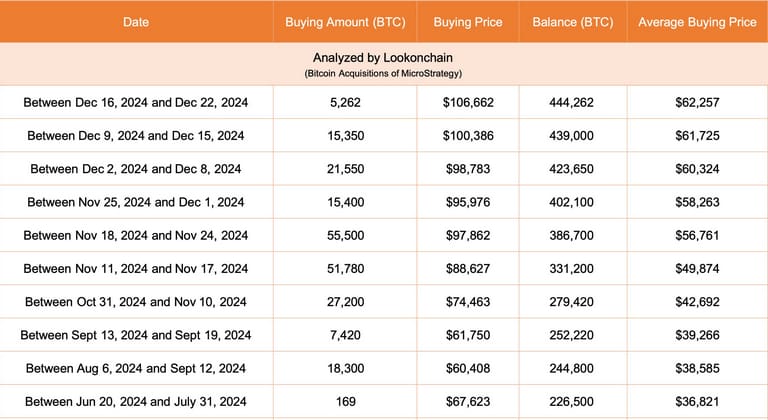

This most up-to-date buy was of 5,262 BTC for $561 million and MicroStrategy’s lowest disclosed purchase since July 2024. On that notice, the economist and identified Bitcoin critic Peter Schiff has commented on X, highlighting a “firepower” loss. Schiff has been commenting in opposition to Saylor’s Bitcoin technique for some time, as Finbold reported in a single event.

“It looks like you might be working out of firepower to maintain propping up Bitcoin. Plus, not solely is that this your smallest purchase, however the first time your common buy worth has been above the market worth on the Monday you disclosed the purchase.”

– Peter Schiff

MicroStrategy’s lowest Bitcoin purchase on the prime

Curiously, this latest buy is roughly 3 times decrease than the earlier buy at $100,000, introduced on December 16. Furthermore, it’s practically 4 occasions decrease than the one earlier than that, introduced on December 9, as Lookonchain analyzed.

The purchases have been of 5,262, 15,350, and 21,550 BTC, respectively. In November, MicroStrategy made two buys superior to 50,000 BTC, or practically ten occasions increased than final week’s acquisition.

Novacula Occami, former Wall Avenue analyst, additionally commented on Michael Saylor’s technique, explaining it depends on two pillars. First, Saylor buys when “numbers go up,” the analyst stated, after which on “thrilling the much less refined herd,” he concluded.

Primarily, Occami believes the purchases are at all times made when Bitcoin reveals robust momentum, normally amid a rally. That is supposedly accomplished to draw retail merchants with constructive sentiment concerning BTC and MSTR.

MSTR inventory and Bitcoin (BTC) worth evaluation

Certainly, MSTR inventory is buying and selling at $344.27, with a market capitalization that’s two occasions increased than its Bitcoin holdings, making it a 100% premium in opposition to regular BTC investments for buyers who need Bitcoin publicity by way of MicroStrategy.

In the meantime, BTC is buying and selling at $93,113, at a 12% low cost from Saylor’s most up-to-date common Bitcoin acquisition worth.

Taking a look at Bitcoin’s chart, we are able to see that, after each MicroStrategy buy, BTC skilled an aggressive drop beneath the typical. This validates the 2 analysts’ criticisms concerning Michael Saylor’s Bitcoin technique, which now experiences one of many longest latest drawbacks.

Nevertheless, it’s notable that the corporate’s excessive time-frame outcomes are nonetheless massively constructive, accumulating an unrealized revenue of practically $15 billion.

Featured picture from Shutterstock.