Ethereum worth made a bullish breakout this week, reaching a excessive of $2,832, its highest stage since February 4.

Ethereum (ETH) has jumped 102 p.c from its lowest stage in April, giving it a market capitalization of $333 billion. At present buying and selling at round $2,800 there are 4 the reason why the coin can quickly rise to the $3,000 stage.

1. Ethereum ETF inflows proceed

Wall Road buyers are aggressively shopping for Ethereum funds, an indication that they anticipate additional upside. SoSoValue knowledge exhibits that inflows rose by $124.9 million on June 10, bringing cumulative inflows since inception to $3.5 billion.

These fund inflows have now elevated for 17 consecutive days, the longest streak on document. BlackRock’s ETHA fund has seen greater than $4.97 billion in cumulative inflows and now holds $4.3 billion in belongings.

You may also like: HYPE hits new ATH in 12% climb as whales wager massive

2. ETH provide on exchanges is falling

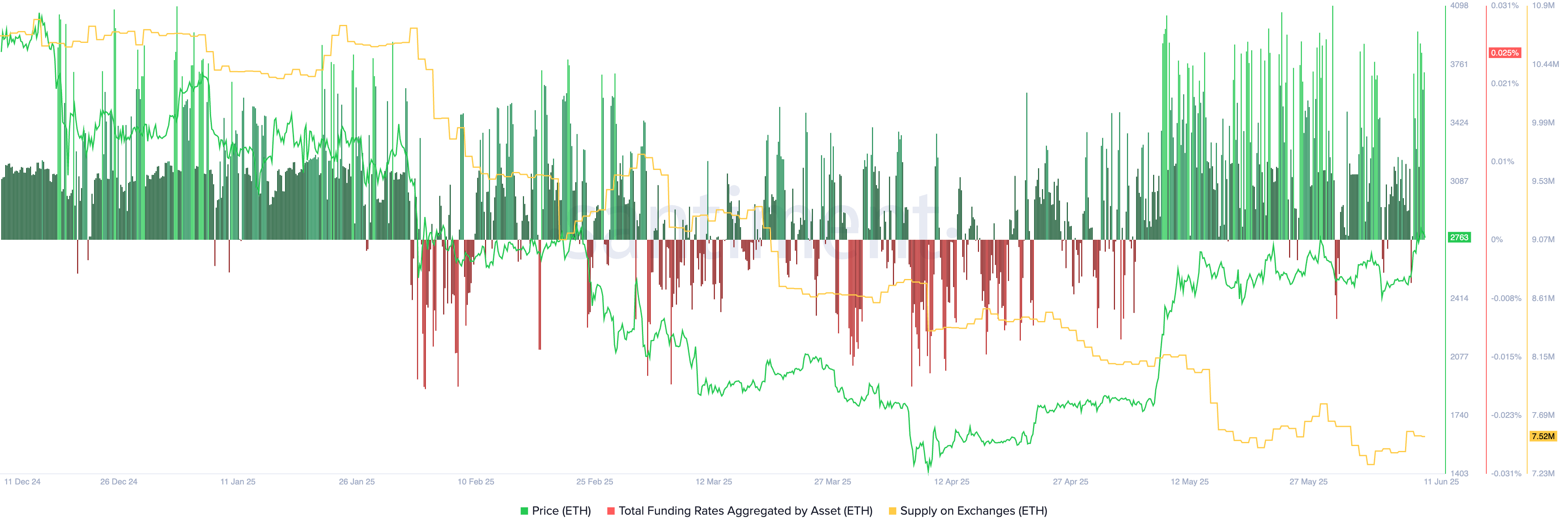

Ongoing inflows into Ethereum funds, mixed with whale accumulation, have pushed a pointy decline in alternate provide. There are actually 7.52 million ETH on centralized exchanges, down from the year-to-date excessive of 10.3 million. The decline has accelerated since April, when alternate balances peaked at 8.75 million.

ETH provide on exchanges | Supply: Santiment

On-chain knowledge exhibits that one account, suspected to belong to Consensys, just lately purchased 17,864 ETH value $49.57 million. The account now holds over $213 million in Ethereum.

Inside 24 hours, a pockets (might belong to #Consensys) purchased completely 17,864 $ETH (~$49.57M) from #Galxy_Digital OTC.

Simply now, his portfolio has 71,671 $lsETH ($215.9M) and 6,786 $ETH (~$18.92M)

Handle:https://t.co/WQD6flp8n6https://t.co/mhAb21dax7 pic.twitter.com/RFfBm47ivZ

— The Knowledge Nerd (@OnchainDataNerd) June 11, 2025

Further on-chain knowledge exhibits Ethereum’s funding charge has remained constructive in current weeks. A constructive funding charge alerts that merchants anticipate the long run worth to stay larger than the present spot worth.

3. Ethereum nonetheless leads in DeFi, RWA, and stablecoins

Ethereum continues to dominate throughout a number of core sectors of the crypto financial system.

In keeping with DeFi Llama, complete worth locked in Ethereum-based decentralized finance has elevated 9.5 p.c within the final 30 days to $143 billion. That offers Ethereum a 62 p.c market dominance, nicely forward of competing chains resembling Solana (SOL), Tron (TRX), and Sui (SUI).

Ethereum’s stablecoin provide has grown to $125 billion, giving it a number one share in a market now value over $250 billion.

Within the tokenized real-world asset sector, Ethereum’s lead stays intact. On-chain knowledge exhibits that tokenized real-world belongings on Ethereum rose to $7.4 billion, the very best of any blockchain.

4. Ethereum worth technical evaluation

ETH worth chart | Supply: crypto.information

The every day chart exhibits that ETH bottomed at $1,368 on April 8 earlier than surging to a excessive of $2,800. The coin has shaped a golden cross sample, with the 50-day shifting common crossing above the 200-day common.

ETH has additionally shaped a bullish flag sample, comprising a vertical rally adopted by a consolidation rectangle. The worth has damaged above the 50 p.c Fibonacci retracement stage at $2,738, suggesting {that a} transfer towards $3,000 stays doubtless.

You may also like: Ondo Finance launches tokenized U.S. Treasuries on XRP Ledger