Ethereum continues to commerce sideways, limiting upside momentum as broader market conviction stays fragile. ETH has struggled to determine a transparent pattern, holding worth motion compressed close to key technical ranges.

With inside indicators blended, the altcoin chief now seems more and more depending on exterior catalysts to set off a decisive breakout.

Bitmine’s Confidence In Ethereum’s Worth Reaches New Excessive

Bitmine not too long ago disclosed that it has begun staking Ethereum from its company treasury, reinforcing long-term confidence within the community. The agency at present holds 4.11 million ETH, representing roughly 3.41% of complete circulating provide. This strategic allocation positions Bitmine among the many largest institutional Ethereum holders globally.

Out of its complete holdings, roughly 40,627 ETH, valued at $1.2 billion, has already been staked. Bitmine plans to develop staking operations additional by means of its upcoming Made in America Validator Community, or MAVAN, scheduled for early 2026.

“At scale (when Bitmine’s ETH is totally staked by MAVAN and its staking companions), the ETH staking payment is $374 million annual (utilizing 2.81% CESR), or better than $1 million per day,” acknowledged Galaxy Digital and private investor, Tom Lee.

Ethereum Holders’ Actions Come Into Consideration

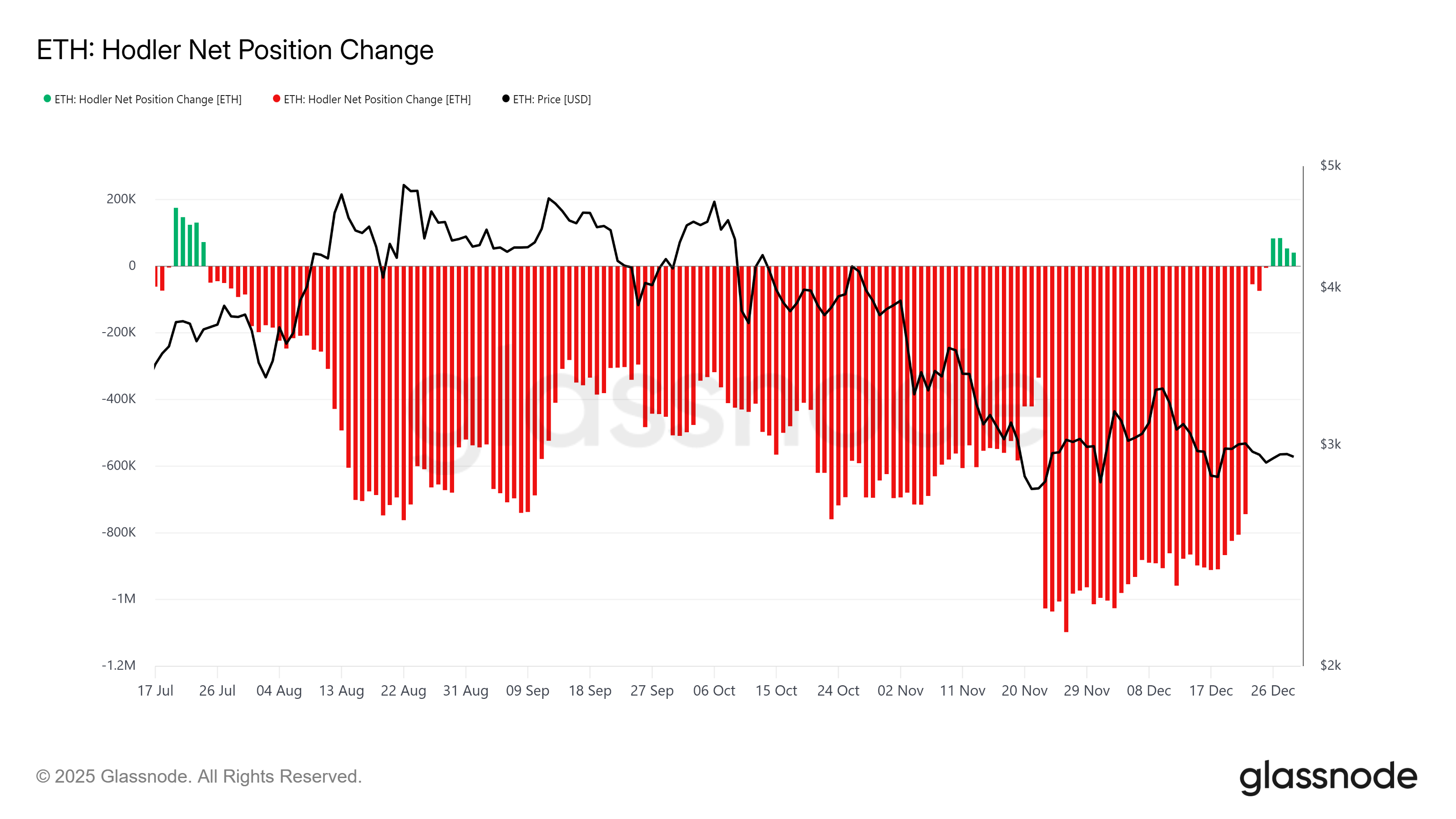

Investor conduct throughout the Ethereum market stays divided. Lengthy-term holders, typically considered because the asset’s structural spine, have resumed accumulation after months of persistent distribution. This shift follows almost 5 months of regular outflows that beforehand weakened long-term provide stability.

The renewed HODLing pattern is constructive for Ethereum’s restoration outlook. Lengthy-term holder resilience typically dampens volatility throughout unsure intervals. Their return to accumulation suggests bettering confidence.

Need extra token insights like this? Join Editor Harsh Notariya’s Day by day Crypto Publication right here.

Ethereum HODLer Place Change. Supply: Glassnode

Whale exercise, nonetheless, presents a contrasting sign. Throughout the final 5 days, addresses holding between 100,000 and 1 million ETH have offered roughly 270,000 ETH. At present costs, this distribution exceeds $793 million, including notable provide stress to the market.

This conduct signifies discomfort amongst giant holders relating to near-term draw back dangers. Whale promoting typically displays defensive positioning quite than outright bearish conviction. Nonetheless, decreased publicity suggests restricted confidence in a right away restoration.

Ethereum Whale Holding. Supply: Santiment

ETH Value Awaits A Clear Course

Ethereum worth is at $2,941 inside an asymmetrical triangle sample, signaling indecision. Value stays constrained between resistance close to $3,000 and assist round $2,902. This tightening vary displays balanced shopping for and promoting stress, with volatility steadily compressing because the sample matures.

Blended investor indicators cloud near-term course, but Bitmine’s aggressive staking technique introduces a bullish narrative. Sustained optimism may assist ETH reclaim $3,000 and goal $3,131 by early January 2026. Thus, a confirmed breakout would require a decisive shut above $3,131.

ETH Value Evaluation. Supply: TradingView

Failure to align broader sentiment with Bitmine’s outlook could set off a correction. Moreover, a drop under $2,902 would invalidate the sample, exposing Ethereum to a decline towards $2,796. Such a transfer may provoke a short-term downtrend, undermining restoration expectations.

The publish Tom Lee’s Bitmine Stakes Over $1.2 Billion in ETH as Ethereum Awaits a Breakout Set off appeared first on BeInCrypto.