After reclaiming $2,600 earlier this week, Ethereum worth immediately has pulled again towards the $2,550–$2,560 zone, breaching key intraday assist. The rejection from the $2,610 provide zone triggered renewed draw back as bears compelled a breakdown beneath a rising short-term trendline.

ETH worth dynamics (Supply: TradingView)

On the time of writing, Ethereum trades close to $2,560 with a gentle intraday loss, as short-term indicators level to waning momentum and rising volatility.

What’s Taking place With Ethereum’s Worth?

ETH worth dynamics (Supply: TradingView)

The 4-hour chart exhibits that Ethereum worth motion broke out above a multi-week consolidation vary close to $2,520, solely to get rejected close to the $2,610–$2,620 resistance band. This zone has capped ETH’s upside thrice since mid-June, reinforcing it as a key provide space. The rising trendline assist from the late June lows has now been breached, shifting short-term construction to bearish.

ETH worth dynamics (Supply: TradingView)

In the meantime, on the each day timeframe, ETH stays trapped inside a big symmetrical triangle sample, with the apex drawing nearer. The decrease assist of this triangle presently aligns with the $2,420–$2,440 zone, making it the subsequent potential bounce space if present weak point persists.

Why Is the Ethereum Worth Going Down Right now?

ETH worth dynamics (Supply: TradingView)

Why Ethereum worth taking place immediately could be attributed to a number of bearish technical and sentiment cues. On the 30-minute chart, a transparent breakdown beneath the blue assist channel round $2,570 has opened area for additional losses. MACD is in unfavourable territory, displaying fading bullish momentum, whereas RSI on the identical chart is at 35.6 with a number of bearish divergence alerts confirmed on July 3.

ETH worth dynamics (Supply: TradingView)

VWAP evaluation reveals ETH has slipped beneath the session common of $2,576, indicating short-term worth weak point. On the DMI, the -DI line is dominant, whereas ADX is rising — confirming a strengthening bearish development.

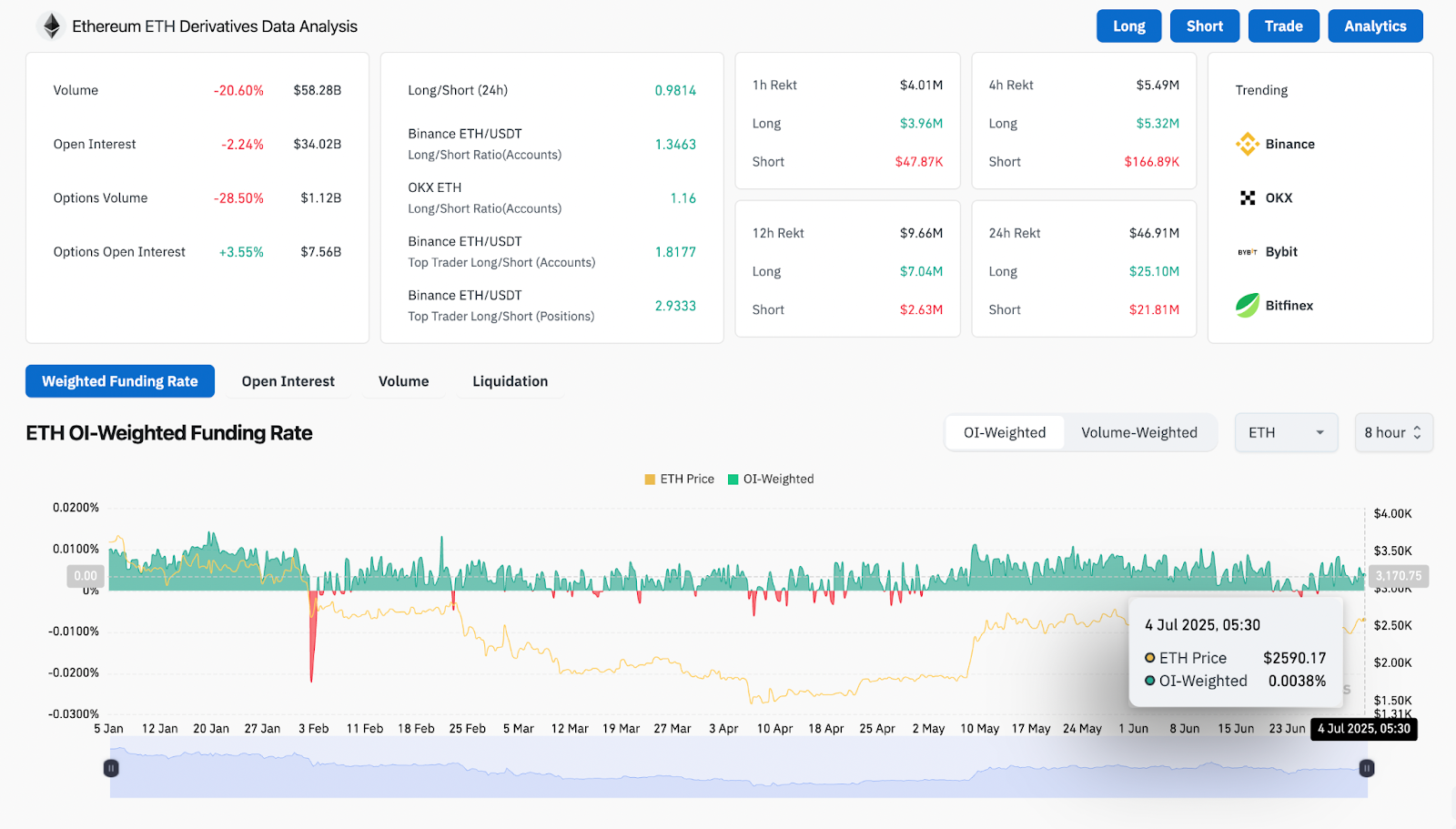

The derivatives dashboard exhibits a 20.60% drop in quantity and a 2.24% decline in open curiosity, reflecting decreased market conviction. Most notably, brief liquidations up to now 4 hours have been minimal in comparison with lengthy liquidations, implying sellers are nonetheless in management. Funding charges stay barely constructive, suggesting leverage skew stays barely lengthy, which can invite extra draw back if sentiment worsens.

Worth Indicators, Indicators, Graphs and Charts (24h)

ETH worth dynamics (Supply: TradingView)

Bollinger Bands on the 4-hour chart are beginning to widen after compression, a sign of accelerating Ethereum worth volatility. ETH has now closed a 4-hour candle beneath the mid-band ($2,560), suggesting downward stress may proceed towards the decrease band close to $2,515.

The EMA cluster provides combined alerts. ETH remains to be holding simply above the 20 and 50 EMA close to $2,534 and $2,491 respectively, however is beginning to drift beneath the 100 EMA ($2,482). If worth continues closing beneath the 100 EMA, momentum might shift decisively in favor of the bears.

On-chain information stays impartial. Regardless of a constructive funding fee of 0.0038% and an extended/brief ratio favoring longs (Binance accounts at 1.34), the shortage of bullish follow-through at $2,610 suggests merchants are cautious.

ETH Worth Prediction: Quick-Time period Outlook (24h)

If Ethereum worth fails to reclaim $2,570 shortly, the subsequent assist lies at $2,515 (decrease Bollinger Band and horizontal assist). Beneath that, the $2,440–$2,460 demand zone aligns with trendline and Fibonacci confluence, providing a possible bounce space.

On the upside, a reclaim of $2,580 may invalidate the breakdown, with resistance once more at $2,610 after which $2,645. For bulls to regain management, ETH must reclaim the VWAP mid-zone and break above the descending resistance from the June highs.

With RSI and MACD turning bearish and quantity thinning, merchants ought to look ahead to any spikes in promoting stress or sudden liquidation-driven wicks.

Ethereum Worth Forecast Desk: July 5, 2025

Disclaimer: The data introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any sort. Coin Version isn’t answerable for any losses incurred because of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.