Ethereum is making an attempt to carry the essential $3,600 assist degree after a modest pullback from current highs. Regardless of the short-term correction, ETH stays one of many strongest performers within the crypto market, having surged over 85% since late June. Bulls proceed to point out energy, supported by weeks of sustained shopping for strain and rising investor confidence.

Amid the present market uncertainty, Ethereum’s fundamentals stay stable. The community has gained a significant increase from authorized readability in the US, giving institutional gamers extra confidence to interact with ETH. On the identical time, adoption continues to increase globally, with Ethereum main the Actual-World Asset (RWA) tokenization house—capturing over 80% of whole market share throughout chains.

On-chain information additionally factors to sturdy accumulation from giant holders, signaling that good cash continues to guess on Ethereum’s long-term potential. Whale exercise and wholesome on-chain metrics counsel that the current correction might merely be a consolidation part earlier than one other leg increased.

Ethereum Dominance within the RWA Market Strengthens Lengthy-Time period Progress

In line with prime analyst Ted Pillows, Ethereum at present holds a formidable 83.69% share of the entire Actual-World Asset (RWA) market capitalization by chain, highlighting its dominant place in one among crypto’s fastest-growing sectors. This commanding share has additional solidified Ethereum’s position because the foundational layer for tokenized real-world property, together with stablecoins, authorities bonds, and personal securities.

This development started to speed up notably in April 2025, coinciding with Ethereum’s sharp value surge and renewed investor confidence. The alignment of sturdy value motion with on-chain enlargement into tokenized finance displays each speculative curiosity and long-term utility development.

RWAs have turn into a focus for institutional curiosity, with stablecoins main the cost. Analysts view the stablecoin sector because the most definitely on-ramp for real-world worth into blockchain ecosystems over the following decade. Ethereum, which has lengthy supported the most important stablecoin provide—together with USDT and USDC—continues to guide the sector, alongside Tron.

Nonetheless, Ethereum’s benefit lies in its composability and DeFi integration, enabling extra advanced and scalable RWA infrastructures. As regulatory readability improves and monetary establishments transfer towards on-chain issuance, Ethereum is positioned to seize much more market share.

If RWA tokenization turns into a multi-trillion-dollar trade as projected, Ethereum’s first-mover benefit and community results could show essential. The information not solely helps bullish long-term narratives—it means that Ethereum’s dominance in RWAs may very well be one of many key catalysts within the subsequent main cycle.

Weekly Chart Reveals Sturdy Breakout and Help Reclaim Amid Pullback

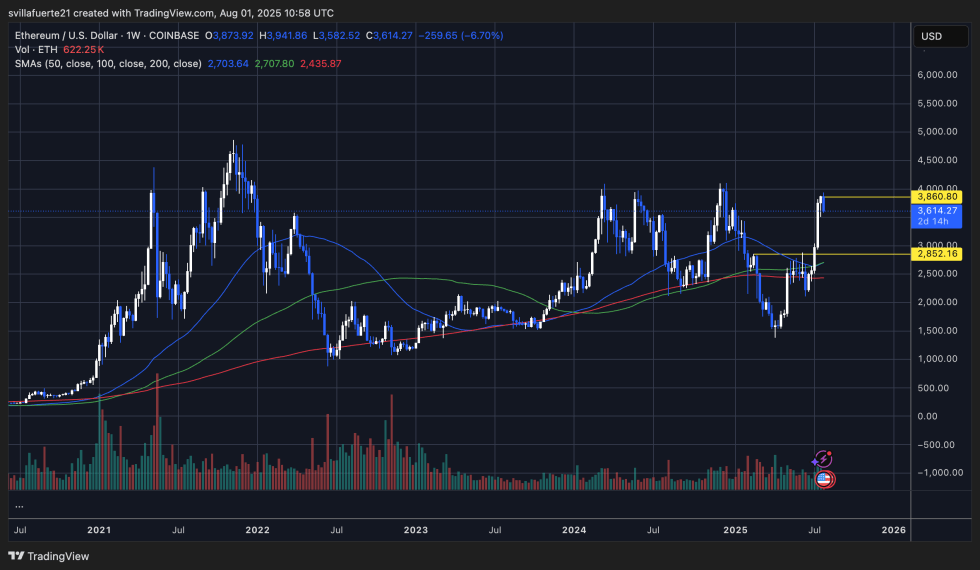

Ethereum’s weekly chart reveals a robust transfer above the $3,000 degree, adopted by a breakout towards $3,860 earlier than going through resistance and a 6.7% correction all the way down to $3,614. Regardless of the current decline, the larger image stays structurally bullish. ETH reclaimed each the 100-week and 200-week shifting averages ($2,707 and $2,435, respectively), which traditionally act as key trend-defining ranges. Holding above these ranges indicators a possible long-term development reversal from final 12 months’s lows.

Quantity surged through the breakout, suggesting sturdy demand relatively than weak speculative shopping for. The $2,852 degree now serves as the first weekly assist to observe—beforehand a multi-month resistance zone—which strengthens its significance. If ETH holds this assist on the following retest, bulls might goal one other transfer towards $4,000.

A weekly shut above $3,860 would mark a brand new excessive for the 12 months and open the trail towards retesting the $4,500–$5,000 zone final seen in late 2021. Nonetheless, failure to reclaim the $3,850 vary shortly might result in a bigger pullback or sideways consolidation.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our crew of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.