Ethereum worth is rising once more, up over 2% up to now 24 hours, and continues to be constructive for the month. The rebound seems encouraging, however the construction beneath stays fragile.

A bearish sample continues to be lively, and until key ranges are defended, this bounce dangers turning right into a deeper pullback.

Ethereum Worth Rises Inside a Fragile Bearish Construction

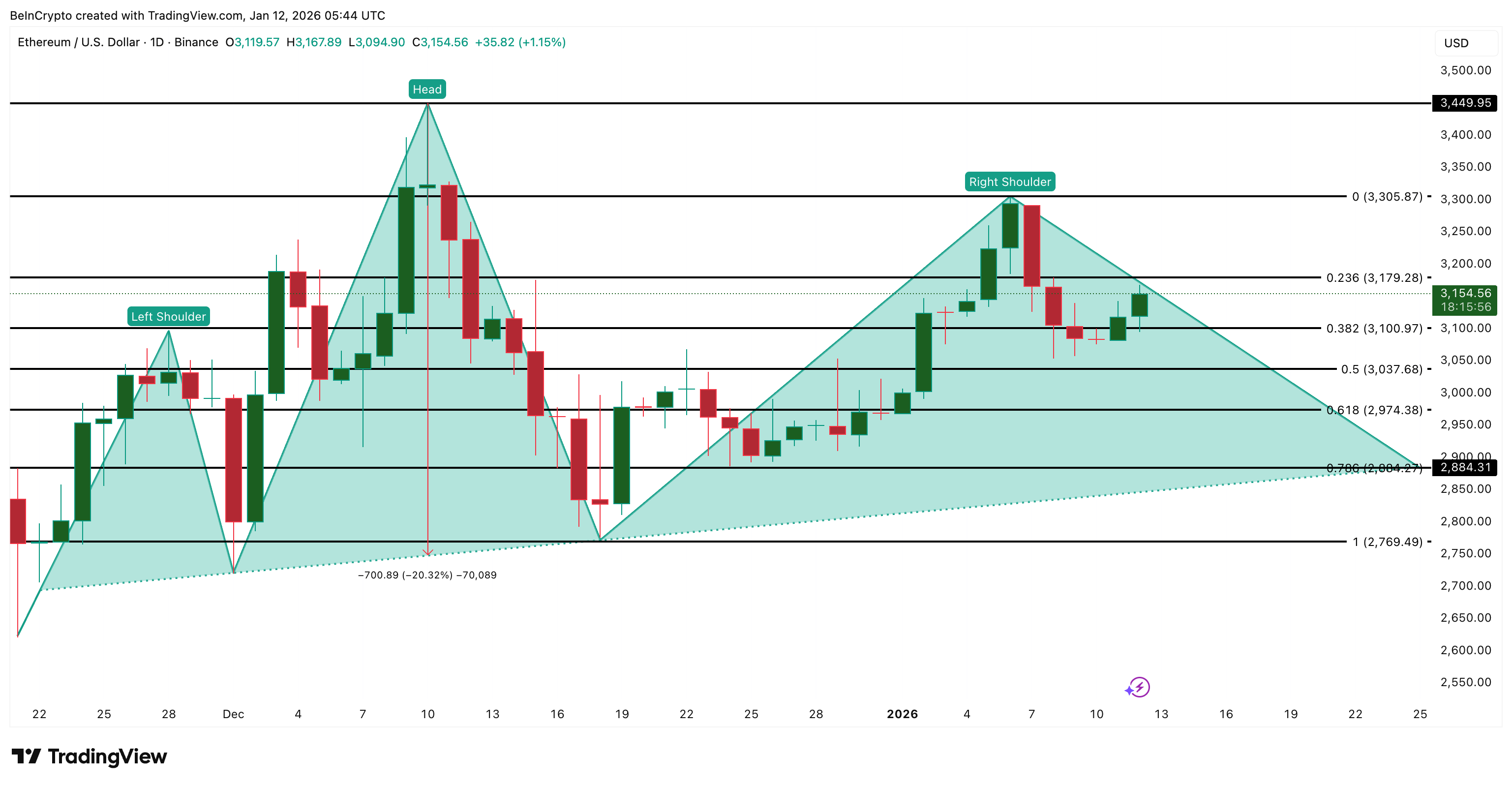

Regardless of the bounce, Ethereum continues to be buying and selling inside a head and shoulders sample on the day by day chart. The January 6 peak shaped the proper shoulder, and the worth is now making an attempt to stabilize with out invalidating the construction.

That is vital as a result of head-and-shoulders patterns usually fail regularly relatively than instantly. Rallies can occur inside them, however they solely change into secure as soon as the worth decisively strikes away from the neckline threat zone, round $2,880 in ETH’s case.

Bearish Danger Looms For ETH: TradingView

Need extra token insights like this? Join Editor Harsh Notariya’s Each day Crypto E-newsletter right here.

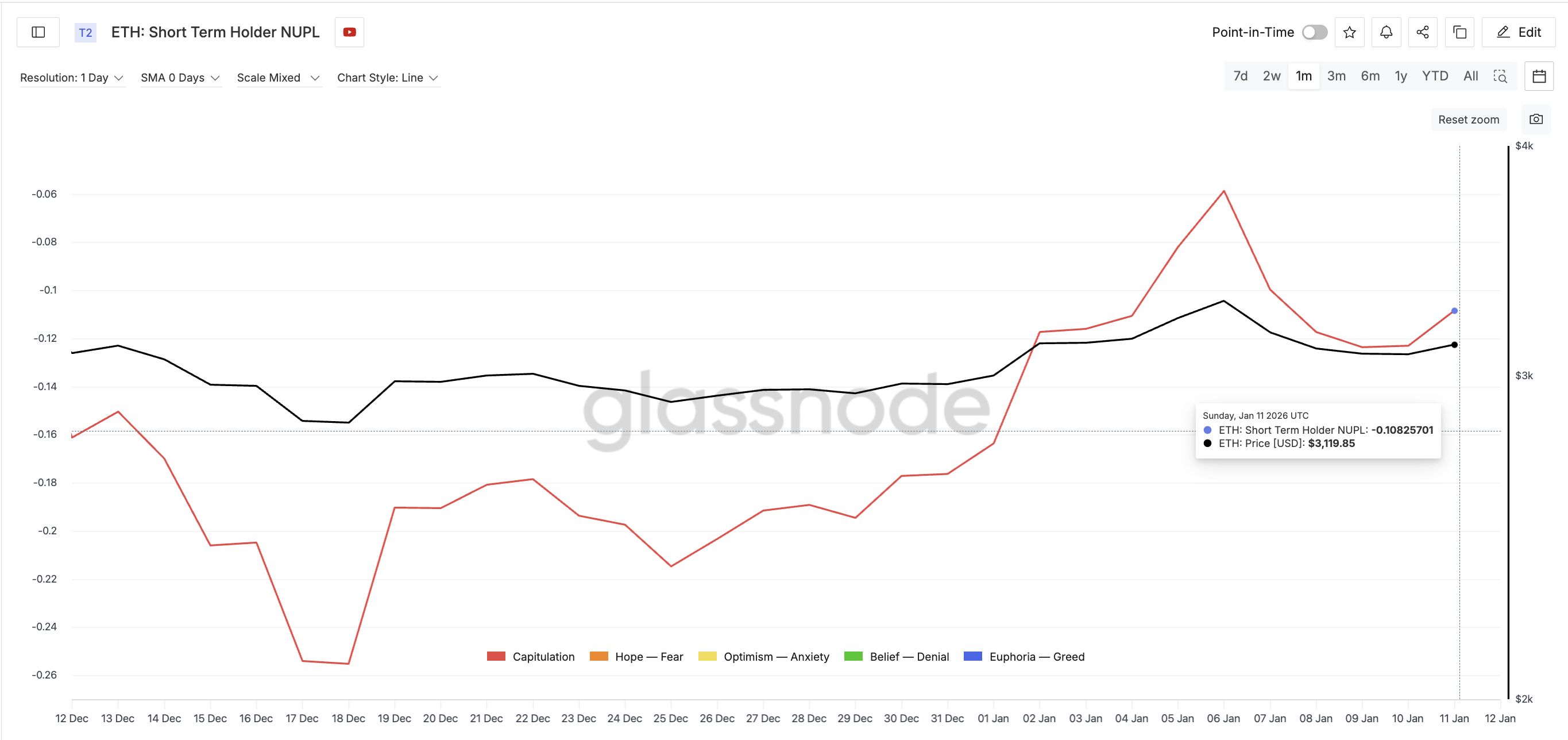

Brief-term holder habits provides warning. Brief-term holder NUPL, which tracks paper earnings/losses, stays within the capitulation zone however is rising towards month-to-month highs. It will increase the possibility of profit-taking if the worth pushes larger.

Brief-Time period Revenue Rising: Glassnode

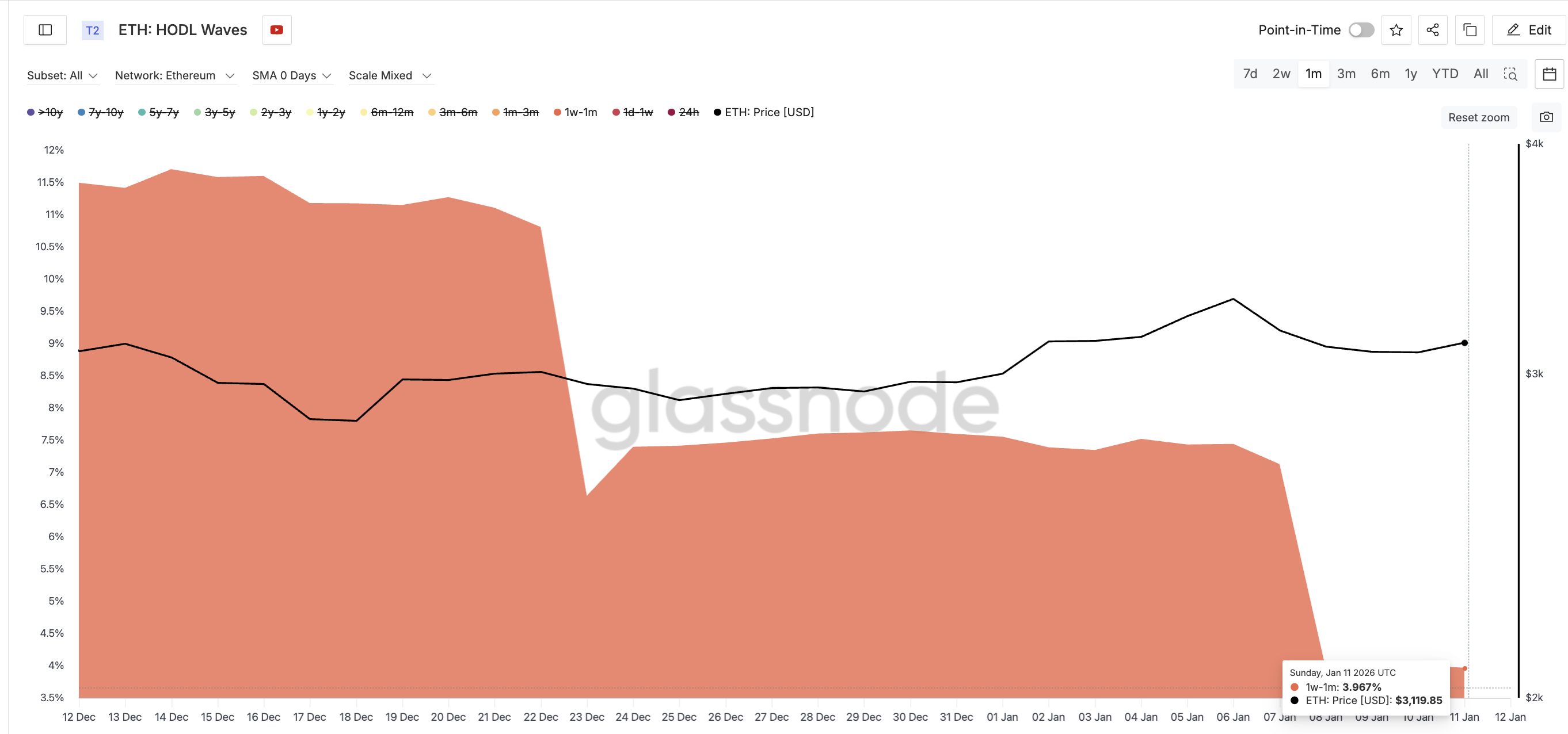

HODL Waves metric, which tracks cohorts based mostly on time, confirms that many short-term holders have already exited. This implies the NUPL threat might need already performed out.

The 1-week to 1-month cohort dropped sharply from round 11.5% of provide in mid-December to about 3.9% now.

Brief-Time period Holders Exit: Glassnode

That reduces instant promoting stress and in addition means this bounce shouldn’t be being pushed by aggressive and speculative new demand but. Whereas this may appear to be disinterest, the shortage of short-term consumers can finally assist the ETH worth transfer larger if different assist stays.

Dip Shopping for and Longer-Time period Holders Are Quietly Supporting Worth

The explanation Ethereum has not damaged down comes from the underlying assist.

The Cash Move Index (MFI), which tracks doable dip shopping for, exhibits a bullish divergence. Between mid-December and early January, the Ethereum worth shaped decrease highs, whereas MFI shaped larger highs. This indicators dip shopping for. Patrons constantly stepped in throughout pullbacks as an alternative of abandoning positions.

Dip Shopping for Continues: TradingView

Regardless that MFI has cooled barely, it stays properly above its prior lows. So long as this holds, promoting stress continues to get absorbed relatively than accelerating.

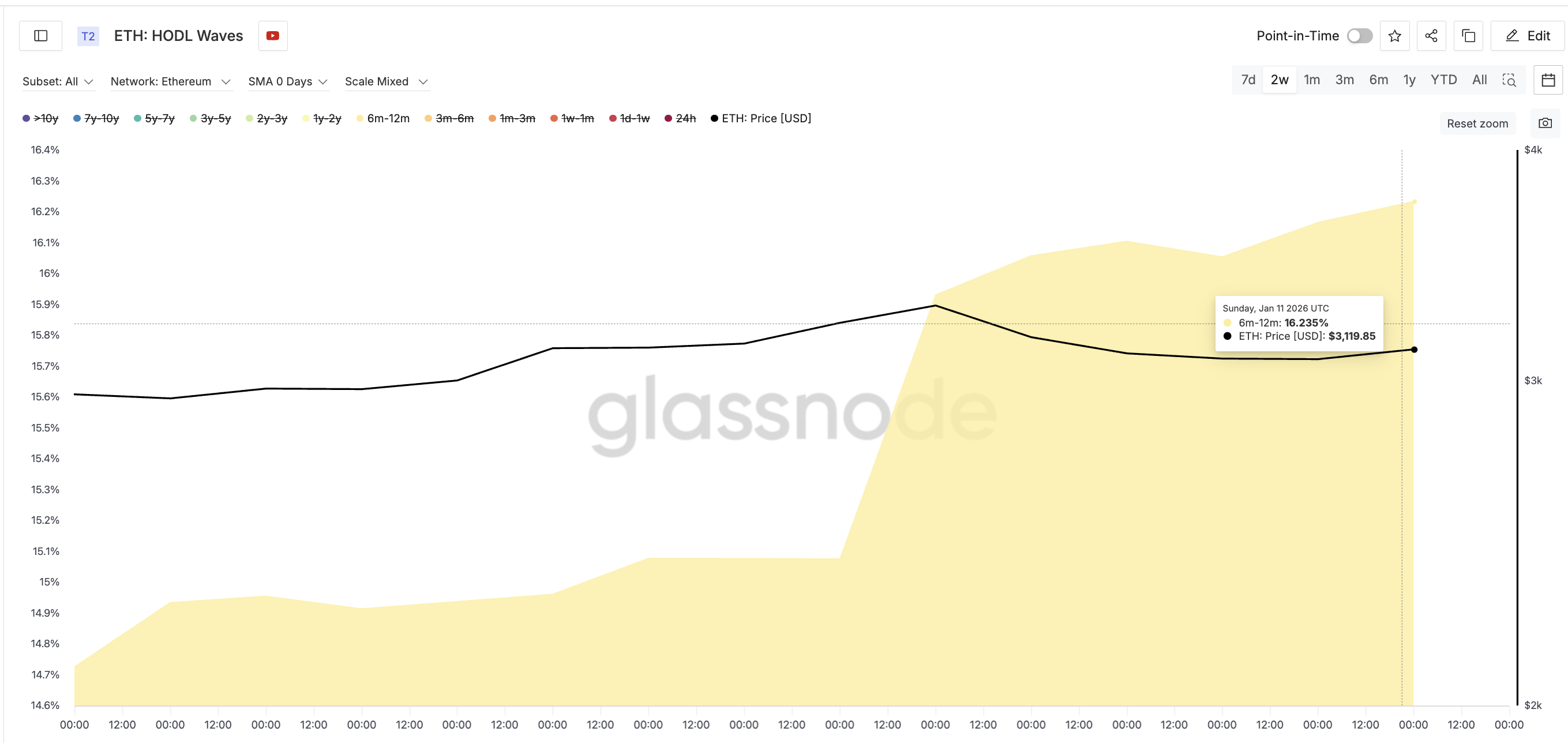

Longer-term holders reinforce this assist. The 6-month to 12-month holder group elevated its provide share from about 14.7% to roughly 16.2% since late December. That is regular accumulation, not speculative chasing.

Mid-Time period ETH Patrons: Glassnode

Collectively, diminished short-term provide, ongoing dip shopping for, and mid-to-long-term holder accumulation clarify why Ethereum is bouncing as an alternative of collapsing.

However assist alone doesn’t take away threat. It solely slows it.

Ethereum Worth Ranges That Resolve Whether or not the Bounce Holds

Ethereum is now at a transparent determination level.

A very powerful draw back degree is $2,880. This marks the neckline zone of the pinnacle and shoulders construction. A day by day shut under this degree would activate the total sample, opening the door to a roughly 20% dip threat based mostly on the measured transfer from the pinnacle to the neckline.

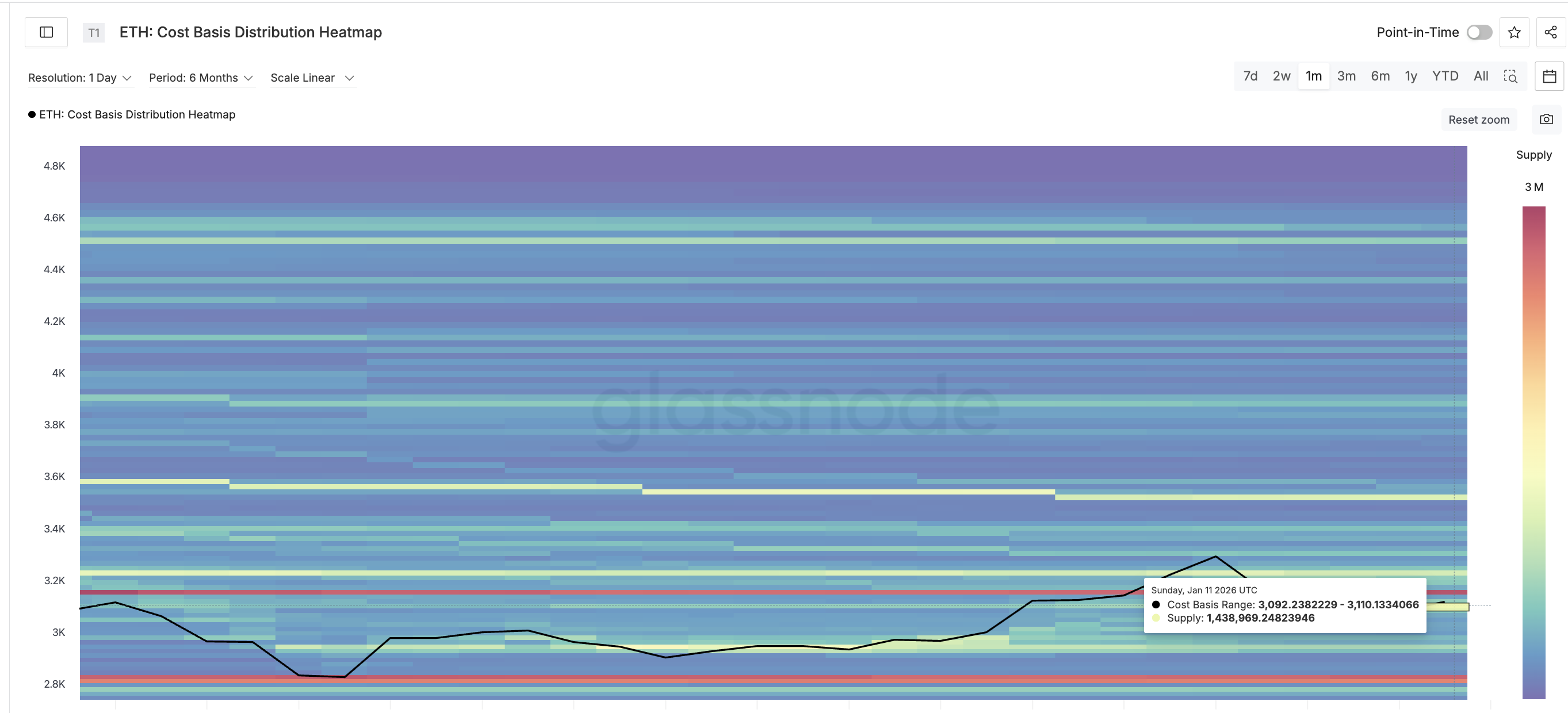

Above that worth, the primary key zone sits between $3,090 and $3,110, common of $3,100, a degree additionally seen on the worth chart. This vary is essential as a result of it accommodates a dense on-chain cost-basis cluster the place roughly 1.44 million ETH final modified arms. Markets usually react strongly round such zones.

Key Provide Cluster: Glassnode

If Ethereum holds above this space, it strengthens the case that consumers are defending value and absorbing provide. Failure to carry it could improve draw back stress towards $2,970, adopted by the essential $2,880 degree.

Ethereum Worth Evaluation: TradingView

To totally invalidate the bearish construction, Ethereum wants sustained power above $3,300. A transfer above $3,440 would erase the pinnacle and shoulders threat totally.

The publish Ethereum Bounces — However Is a 20% Entice Forming Beneath One Essential Stage? appeared first on BeInCrypto.