A synthetic intelligence mannequin predicts that Ethereum (ETH) is prone to maintain above the $3,000 assist stage by December 1.

This outlook comes as ETH recovers alongside the broader market, reclaiming the $3,000 mark after days of prolonged losses that had raised the opportunity of sustained declines under $2,000.

ETH value prediction

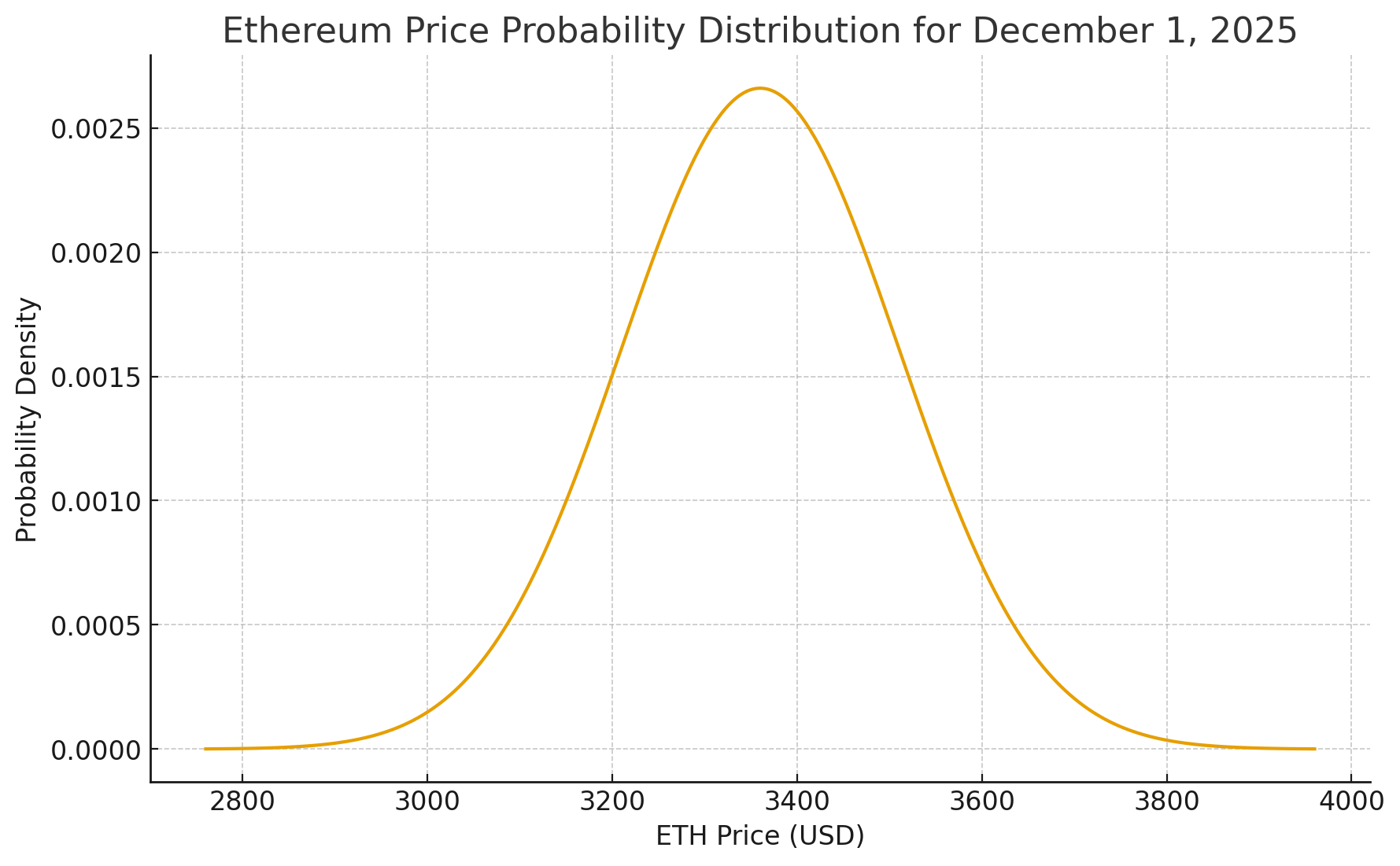

For the December 1 value prediction, Finbold consulted OpenAI’s ChatGPT, which anticipates that Ethereum will commerce close to $3,360, with a sensible vary of $3,300 to $3,420.

In response to ChatGPT, latest market habits reveals Ethereum constantly attracting consumers within the $3,300 to $3,350 zone, forming a agency assist base that limits draw back danger.

Alternate reserves have dropped to multi-year lows, suggesting speedy promoting strain is constrained as fewer cash are available on buying and selling platforms.

Mildly bullish catalysts are additionally supporting an upward bias in response to ChatGPT. Staking continues to scale back circulating provide, whereas DeFi and Layer-2 networks stay lively. Markets are additionally positioning forward of the December Fusaka improve, making a delicate pre-event carry, although momentum is inadequate for a fast breakout.

On the identical time, market sentiment has stabilized following latest volatility, with no indicators of panic, compelled liquidations, or disorderly sell-offs. Open curiosity is firming, suggesting merchants are cautiously re-entering positions, pointing towards a average rebound moderately than a renewed decline.

Based mostly on these fundamentals, ChatGPT famous that Ethereum’s ceiling stays well-defined, with repeated failures to interrupt above the $3,880 to $4,000 resistance zone. This barrier is stopping a bigger pattern shift and limits how far the value can climb within the close to time period.

Weighing the present spot stage close to $3,000, the robust underlying assist, and the cautiously enhancing sentiment backdrop, ChatGPT’s estimate locations Ethereum’s most possible touchdown zone on December 1 at roughly $3,360.

ETH value evaluation

By press time, ETH was buying and selling at $3,004, down 1.6% previously 24 hours, whereas on the weekly timeline, the second-ranked cryptocurrency by market capitalization has gained over 10%.

Ethereum’s present stage factors to short-term bearish pressures relative to its easy transferring averages (SMAs). The 50-day SMA sits at $3,509.66, with the present value 14% under it, highlighting latest downward momentum and potential resistance overhead if consumers try and reclaim this stage.

Conversely, the 200-day SMA at $3,400.05 gives stronger long-term assist, as ETH stays 12% above it, preserving a bullish structural bias and suggesting resilience towards deeper corrections.

Complementing this, the 14-day Relative Energy Index (RSI) of 42.8 signifies impartial territory, removed from overbought ranges above 70 or oversold ranges under 30, implying balanced circumstances appropriate for consolidation or a average upside.

Featured picture by way of Shutterstock