Circle has launched a privacy-focused model of its USDC stablecoin on Aleo, highlighting a broader push by privacy-oriented blockchains to achieve entry to regulated, dollar-backed property as demand for onchain privateness instruments grows.

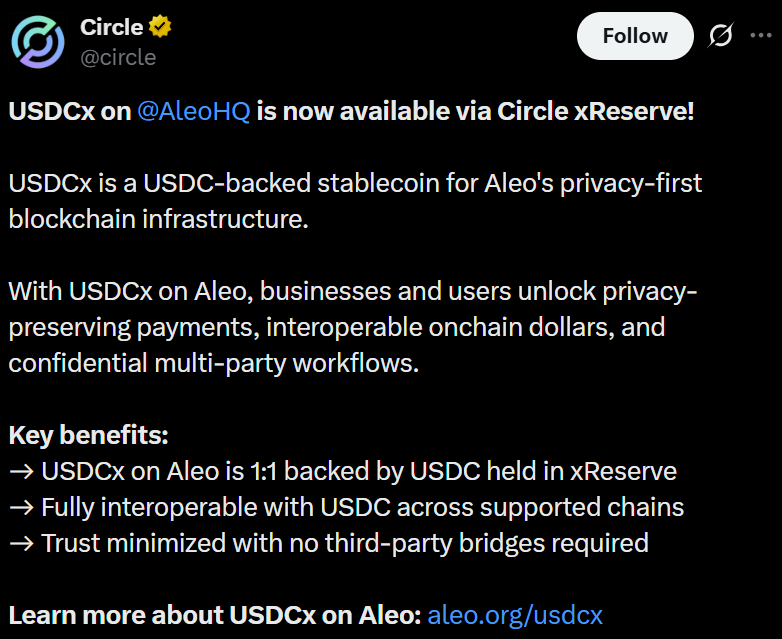

Circle and Aleo introduced Tuesday that USDCx on Aleo is now accessible through Circle’s xReserve, a reserve-backed issuance mannequin that permits USDC (USDC) to be represented on further blockchains with out counting on third-party bridges.

USDCx on Aleo is totally backed by USDC held in xReserve and is interoperable with USDC throughout different supported networks, together with Ethereum and a number of other main layer-1 and layer-2 blockchains the place USDC is natively issued.

Supply: Circle

USDC is Circle’s dollar-backed stablecoin issued immediately on supported blockchains, whereas USDCx is minted on Aleo by xReserve and operates inside Aleo’s privacy-focused structure.

Aleo makes use of zero-knowledge know-how to allow functions the place transaction particulars, such because the sender, receiver and quantity can stay confidential whereas nonetheless being verifiable onchain.

As Cointelegraph reported, the Circle-Aleo privateness venture was unveiled in December, focusing on banking and enterprise clients.

Associated: Financial institution foyer is ‘panicking’ about yield-bearing stablecoins

Privateness features traction as crypto markets battle

Whereas privacy-focused digital asset tasks have existed for years, the sector has regained traction since 2025 as market situations have shifted. Cryptocurrencies akin to Zcash (ZEC) and Monero (XMR) have outperformed components of the broader market in periods of heightened volatility.

Zcash, specifically, noticed renewed curiosity within the fourth quarter, with its value rising several-fold over a two-month interval. The rally coincided with a notable improve in using shielded addresses, which obscure transaction particulars akin to sender, receiver and transferred quantity.

Community information confirmed an increase in shielded transaction exercise throughout the identical interval, suggesting rising demand for enhanced onchain privateness.

Zcash value skilled a dramatic run-up in October and November. Supply: CoinMarketCap

Analysis from Grayscale recommended that the renewed curiosity in privateness cash was partly pushed by extra defensive positioning inside crypto markets, as traders sought property perceived to supply insulation from surveillance, compliance-related dangers and rising transparency throughout public blockchains.

Different analysts pointed to a tightening regulatory backdrop, significantly round international anti-money laundering requirements set by the Monetary Motion Activity Power (FATF). As enforcement of journey guidelines and transaction monitoring intensifies, privacy-focused tokens have drawn consideration as alternate options for customers in search of better confidentiality.

Associated: What’s behind the surge in privateness tokens as the remainder of the market weakens?