As blockchain know-how continues to evolve, understanding person engagement is essential to assessing the success of any community. One notably insightful metric is each day lively addresses. This refers back to the variety of distinctive blockchain addresses that take part in transactions on a given day, whether or not by sending or receiving property. Basically, it offers a snapshot of what number of customers are actively interacting with a blockchain at any given time, making it a dependable measure of real-world utilization and recognition.

On Dec. 27, 2024, CryptoRank revealed a chart rating the highest 10 blockchains of the 12 months primarily based on their common each day lively addresses. This knowledge, sourced from CryptoRank and Artemis.xyz, highlights some fascinating traits in blockchain adoption and presents insights into the platforms that led the best way in driving person engagement. Let’s delve into the highest three blockchains dominating this metric, adopted by a fast overview of the remaining networks within the high 10.

https://twitter.com/crypto_rand/standing/1873617510425309267

1. NEAR Protocol: 2.7 Million Day by day Lively Addresses (+766% YoY)

NEAR Protocol emerged because the chief in 2024, boasting 2.7 million each day lively addresses. This marks an astounding 766% year-on-year progress, largely pushed by its deal with scalability and user-friendly instruments for builders. NEAR employs an revolutionary sharding know-how known as Nightshade, which splits the blockchain into smaller, extra manageable items, enabling excessive transaction throughput at low prices. This effectivity has made NEAR a best choice for builders creating decentralized purposes (dApps).

NEAR’s success was additional bolstered by the speedy adoption of blockchain-based gaming and social dApps on its platform. These purposes attracted new customers unfamiliar with blockchain know-how, serving to NEAR construct a sturdy and rising ecosystem. Mixed with vital investments from the NEAR Basis in developer grants, the protocol’s rise to the highest underscores its attraction to each customers and builders alike.

2. Solana: 2.6 Million Day by day Lively Addresses (+702% YoY)

Solana ranked second, with 2.6 million each day lively addresses and a formidable 702% year-on-year progress. The community’s recognition in 2024 was fueled largely by its vibrant memecoin ecosystem, which noticed huge buying and selling exercise on platforms like Pump.enjoyable. These memecoins attracted retail and institutional traders alike, considerably boosting Solana’s utilization metrics.

Along with memecoins, Solana’s high-speed, low-cost infrastructure made it a go-to blockchain for decentralized finance (DeFi) and non-fungible token (NFT) initiatives. Builders and customers flocked to the community to make the most of its effectivity, whereas institutional curiosity grew as Solana proved its scalability and reliability. This mixture of things cemented Solana as one of many high blockchains of the 12 months.

3. TRON: 1.9 Million Day by day Lively Addresses (+20.3% YoY)

TRON secured the third spot with 1.9 million each day lively addresses, representing a gentle 20.3% progress in comparison with the earlier 12 months. TRON’s dominance in stablecoin transactions, particularly these involving Tether (USDT), has been a key driver of its person base. With low transaction charges and high-speed transfers, TRON grew to become a most popular platform for customers looking for seamless, cost-effective stablecoin operations.

The blockchain additionally maintained a robust presence within the decentralized finance (DeFi) sector, partnering with numerous world fee programs and monetary establishments. Whereas its progress was not as dramatic as NEAR or Solana, TRON’s constant efficiency and utility ensured its place among the many high blockchains of 2024.

A Fast Take a look at the Remainder of the High 10

Past the highest three, the remaining blockchains on the listing showcased numerous strengths and challenges.

BNB Chain noticed 1 million each day lively addresses, a slight decline of 4.8% from the earlier 12 months. Regardless of the drop, BNB Chain stays a hub for DeFi and token buying and selling, retaining its significance within the blockchain ecosystem.

Polygon (MATIC) recorded 855,000 each day lively addresses, reaching a sturdy 139% year-on-year progress. As a Layer 2 scaling answer for Ethereum, Polygon continues to draw gaming, NFT, and DeFi initiatives, solidifying its function as a significant a part of Ethereum’s ecosystem.

Base, Coinbase’s Layer 2 answer, achieved 655,000 each day lively addresses, experiencing an distinctive 2,098% year-on-year progress. Its shut integration with Ethereum and Coinbase’s user-friendly platform have considerably boosted its adoption.

Sui emerged as a standout performer with 519,000 each day lively addresses, experiencing a rare 908% year-on-year improve. This progress is attributed to its revolutionary programming language and quickly increasing ecosystem of decentralized purposes (dApps).

Bitcoin (BTC), the world’s most acknowledged blockchain, recorded 496,000 each day lively addresses, a 19% decline year-on-year. Whereas Bitcoin stays the dominant asset when it comes to market capitalization, its lower in each day lively addresses displays shifting person priorities.

The Open Community (TON), the blockchain related to Telegram, skilled exponential progress in 2024, with each day lively addresses surging by 5,185% to achieve 414,000. This progress was fueled by TON’s integration with Telegram, leveraging the messaging platform’s huge person base to spice up adoption.

Lastly, Arbitrum, a number one Ethereum Layer 2 answer, achieved 413,000 each day lively addresses, a 180% improve year-on-year. Arbitrum’s means to scale Ethereum purposes whereas sustaining low charges and excessive throughput has made it a key participant within the Ethereum ecosystem.

Evaluating Exercise with Complete Worth Locked: A Broader Perspective

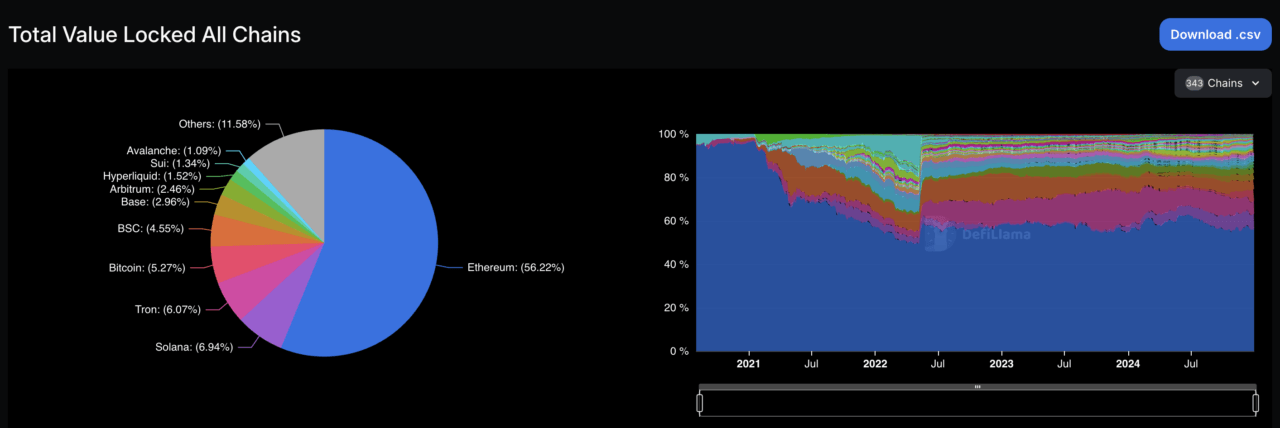

A further lens to judge blockchain ecosystems is Complete Worth Locked (TVL), a metric that displays the full greenback worth of property locked in decentralized finance (DeFi) protocols on a blockchain. TVL measures how a lot capital customers have dedicated to DeFi purposes, resembling lending, staking, and liquidity provision. In contrast to each day lively addresses, which emphasize person exercise, TVL offers insights into the monetary depth and maturity of a blockchain’s DeFi ecosystem.

By this measure, Ethereum stands unequalled, commanding 56.22% of the full TVL throughout all chains as of Dec. 30, 2024, in line with knowledge from DeFiLlama.

Supply: DefiLlama

Ethereum’s dominance stems from its well-established DeFi ecosystem, which homes probably the most numerous and superior set of decentralized purposes, supported by its early adoption and a robust developer group. Nevertheless, Ethereum’s supremacy in TVL contrasts with its place in each day lively addresses, the place it doesn’t lead. This divergence highlights the differing nature of those metrics: TVL captures capital locked in protocols, which requires fewer however bigger transactions, whereas each day lively addresses spotlight the frequency of person interactions, usually linked to smaller, retail-driven actions.

Solana and TRON, ranked second and third in each day lively addresses, maintain considerably decrease TVL rankings. Solana accounts for six.94% of complete TVL, and TRON makes up 6.07%, inserting them behind Ethereum.

The distinction between TVL and each day lively addresses highlights the varied strengths of blockchain networks. Whereas Ethereum excels in monetary liquidity and high-value purposes, chains like Solana and TRON thrive on person engagement and transaction exercise. Collectively, these metrics present a extra nuanced understanding of the blockchain panorama, showcasing that no single measure can seize the complete image of a community’s adoption and utility.

Featured Picture through Pixabay