Capital motion throughout blockchain networks is all the time a key signal for judging investor confidence and community exercise. Wanting on the final week, Base blockchain got here out on prime for optimistic web move, doing higher than all different chains.

Solana was proper behind, taking second place even with ongoing worries about its community stability.

Base and Solana Dominate Blockchain Web Inflows

Bitcoin, Ethereum, and Arbitrum additionally noticed optimistic web flows, although not as a lot. However, Polygon PoS, Sui, and StarkNet had minor inflows, whereas Avalanche C-Chain and OP Mainnet skilled important outflows.

Notably, OP Mainnet had the largest capital outflow, displaying weaker investor sentiment in the direction of that chain.

BASE is the one chain doing higher than $SOL.

Wonderful contemplating the sentiment round $SOL. pic.twitter.com/fuC1mthfug

— Altcoin Buzz (@Altcoinbuzzio) February 18, 2025

Base Overtakes Solana in Capital Inflows

Even with market uncertainty, Base turned the chief in web capital inflows. That is fairly notable, particularly given Solana’s lead place in latest occasions

Market sentiment towards Solana has been combined, largely due to previous outages and centralization discuss. Nevertheless, its capability to maintain attracting sturdy inflows suggests confidence in its long-term potential. The latest move of cash highlights investor optimism even when costs are shifting up and down within the quick time period.

Solana Worth Evaluation: Key Ranges to Watch

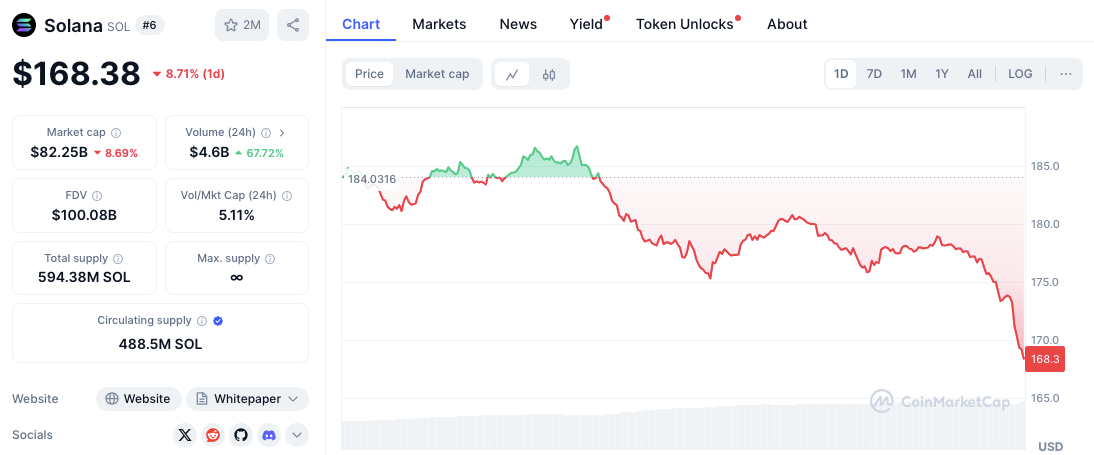

Solana’s worth has gone down of late, presently buying and selling at $172.16 after a 6.45% drop over the previous 24 hours.

The value initially went as much as an intraday excessive of $184.03 earlier than hitting resistance, inflicting a downward development. A robust resistance stage appeared round $184-$186, the place promoting stress elevated, resulting in a pullback.

Key assist ranges are forming at $172, $170, and the $165-$168 vary. If the value doesn’t keep above $172, additional declines might push it towards $170. A stronger breakdown could result in a retest of the $165-$168 assist zone, the place consumers might come again into the market.

Supply: CoinMarketCap

Market sentiment stays cautious, with buying and selling quantity growing by 61.85%, displaying extra exercise primarily from sellers.

Solana’s market capitalization additionally declined by 6.45%, indicating decreased investor confidence. Nevertheless, a restoration above $176 might change momentum, probably pushing the value again towards the $180 vary.

Associated: Solana Meme Cash Plummet By 91%, However Analysts See Indicators of Huge Rebound

Technical Indicators Level to Warning

SOL/USD each day worth chart. Supply: TradingView

The Relative Energy Index (RSI) presently stands at 31.27, nearing oversold territory. This means {that a} potential bounce might happen if shopping for stress strengthens. Nevertheless, the RSI’s downward trajectory signifies that bearish sentiment stays dominant.

Moreover, the Transferring Common Convergence Divergence (MACD) reveals a bearish crossover. The MACD line sits at -2.69, beneath the sign line at -10.11, confirming draw back stress. Destructive histogram bars additional reinforce the prevailing bearish momentum.

February 2025 Worth Outlook for Solana

Coincodex Market projections for February 2025 counsel a possible worth enhance of as much as 10.51%, bringing Solana’s common worth to about $189.50.

Associated: Regardless of Powerful 12 months, Solana Exhibits Development In Some Key Areas

Predicted worth fluctuations level to a variety between $177.26 and $195.47. If these predictions are right, Solana might present a short-term return of round 13.99% from present ranges.

Disclaimer: The knowledge introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any sort. Coin Version shouldn’t be answerable for any losses incurred on account of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.