The blockchain business continues to grapple with elementary scalability and interoperability challenges which have persevered since Ethereum’s early days. Excessive transaction charges, gradual affirmation instances, and remoted ecosystems create boundaries stopping mainstream adoption of decentralized purposes. Mango Community, a brand new Layer 1 blockchain constructed by MangoNet Labs, claims to resolve these issues by way of an formidable technical structure that mixes a number of digital machines, cross-chain performance, and throughput capabilities that dwarf present options.

With $13.5 million in funding, Mango Community guarantees to course of 297,450 transactions per second with 380-millisecond finality whereas supporting each Ethereum Digital Machine (EVM) and Transfer Digital Machine (MoveVM) in a unified ecosystem. These daring claims arrive alongside the mission’s Token Era Occasion on June 24, 2025, when $MGO tokens start buying and selling on Bitget, MEXC, and KuCoin at 09:00 AM UTC.

However technical specs alone do not assure success within the aggressive Layer 1 panorama. This evaluation examines Mango Community’s structure, tokenomics, and real-world potential to find out whether or not it represents real innovation or one other case of blockchain hype exceeding actuality.

Technical Structure: Multi-VM Innovation

The Transfer Programming Language Benefit

Mango Community implements “Mango Transfer,” an enhanced model of the Transfer programming language initially developed by Fb for the Diem mission. Transfer was designed particularly for digital belongings, treating tokens and NFTs as “first-class residents” within the programming mannequin.

This resource-oriented method supplies a number of crucial benefits:

- Possession Security: Digital belongings are represented as sources that can’t be copied or implicitly discarded, stopping double-spending assaults

- Static Typing: Each variable’s kind is thought at compile time, eliminating whole classes of runtime bugs which have plagued different sensible contract platforms

- Formal Verification: The Transfer Prover instrument mathematically verifies sensible contract habits earlier than deployment, permitting builders to specify contract logic in formal phrases

- Modular Design: Good contracts might be safely upgraded and composed with out breaking present performance

Twin Digital Machine Implementation

Whereas Transfer supplies superior safety for monetary purposes, Mango Community acknowledges that almost all present DeFi protocols and instruments are constructed for the Ethereum Digital Machine. Quite than forcing builders to decide on between safety and compatibility, Mango implements each EVM and MoveVM throughout the similar blockchain.

This dual-VM method works by way of parallel execution, permitting EVM-based purposes to function alongside Transfer-based contracts with out interference. Every VM maintains its personal state area whereas sharing the underlying blockchain infrastructure. Mango’s OP-Mango Layer 2 resolution facilitates communication between EVM and MoveVM environments by way of standardized occasion seize and knowledge serialization protocols.

The platform implements subtle useful resource allocation to forestall one VM from monopolizing community capability. Transaction charges and execution limits are balanced throughout each environments to keep up honest entry, whereas each digital machines entry a shared knowledge availability layer to make sure state adjustments in a single surroundings are seen to the opposite when wanted.

Modular Structure

Conventional blockchains bundle a number of features into single techniques that change into tough to optimize. Mango separates 4 core features: execution handles sensible contract computation, consensus manages validator coordination by way of DPoS, settlement supplies closing transaction affirmation, and knowledge availability shops transaction info throughout the community.

This separation permits every element to optimize independently whereas sustaining system integrity. The claimed 297,450 TPS throughput is dependent upon this modular design, although real-world efficiency usually differs from theoretical maximums.

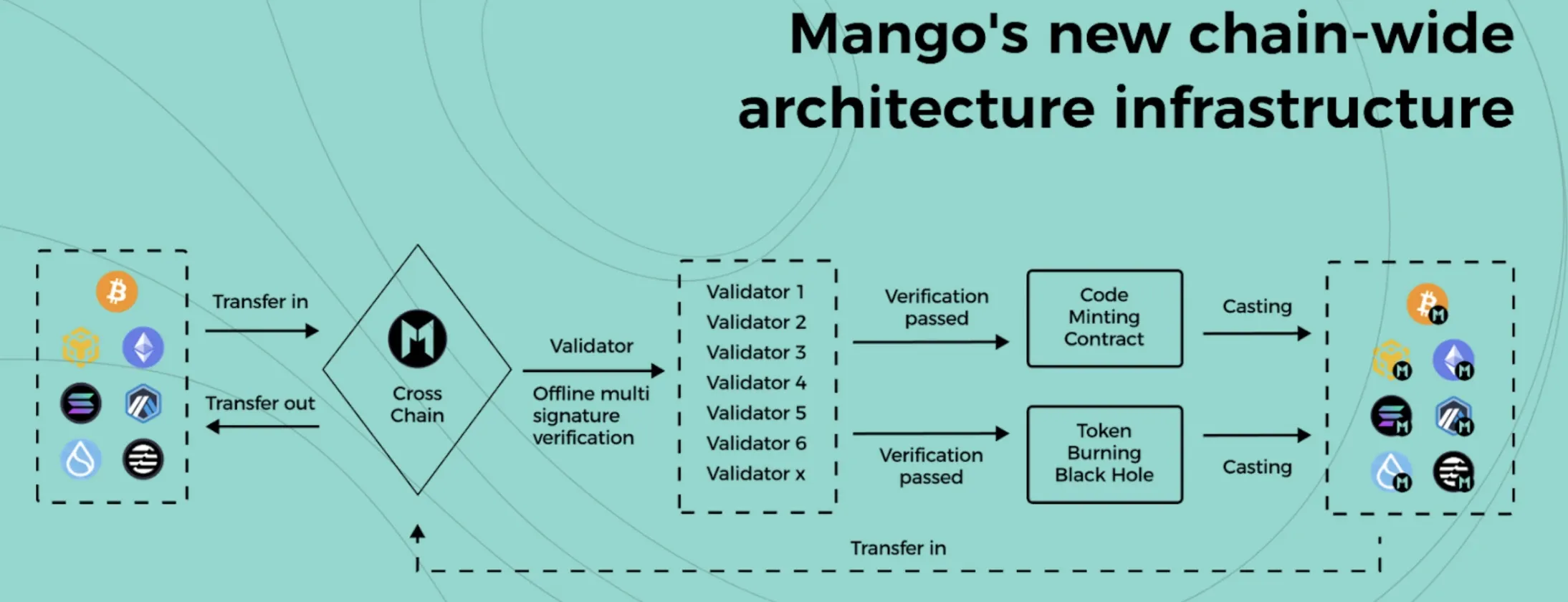

Mango’s chain infrastructure (official web site)

Cross-Chain Infrastructure and Zero-Data Integration

Cross-Chain Infrastructure and Privateness Options

OP-Mango powers cross-chain performance by processing transactions off-chain in batches earlier than submitting outcomes to networks like Ethereum. The system makes use of $MGO tokens as gasoline for cross-chain operations, consists of fraud proof mechanisms, and permits asset transfers between totally different blockchains whereas sustaining safety by way of cryptographic verification.

Privateness and Storage Options

The platform incorporates ZK-SNARK and ZK-STARK applied sciences for privacy-preserving transactions and cross-chain transfers. Customers can commerce anonymously or transfer belongings between chains with out revealing transaction particulars. The platform additionally makes use of decentralized storage with knowledge backups and financial incentives for storage suppliers who earn $MGO tokens for sustaining knowledge availability.

MgoDNS represents the platform’s decentralized area identify system that bridges conventional web and blockchain environments. The system can resolve normal web domains whereas including blockchain-specific options. For instance, a single area identify like “alice.mgo” may resolve to pockets addresses on a number of totally different blockchains. Good contracts can even routinely replace these area resolutions primarily based on programmed situations.

Tokenomics Deep Dive

Distribution Technique and Financial Mannequin

The $MGO token’s 10 billion whole provide with quick full unlock represents a big departure from typical token launch schedules. This technique displays particular theories about token velocity and community adoption however creates substantial financial dangers.

The excellent distribution allocates tokens throughout eight classes. The Basis receives 20% (2 billion tokens) for long-term improvement and operations, whereas the POS Stake Pool will get an equal 20% for community safety and validator rewards. The Ecosystem Innovation Fund holds 17% (1.7 billion tokens) for dApp improvement and partnerships, indicating critical dedication to ecosystem development.

Non-public traders obtain 15% (1.5 billion tokens) from the $13.5 million funding spherical, which suggests these tokens face quick unlock and potential promoting stress. The group and early contributors additionally get 15%, which raises questions on long-term alignment incentives given the shortage of vesting schedules.

Neighborhood airdrops symbolize 10% of the full provide, cut up equally between testnet (500 million tokens) and mainnet (500 million tokens) individuals. Claims open at 17:50 UTC on June 24, 2025, on a first-come, first-served foundation.

Advisors obtain the smallest allocation at 3% (300 million tokens), suggesting they supply primarily strategic quite than operational worth.

Token Utility and Worth Drivers

The $MGO token serves a number of features that ought to create varied sources of demand:

- Transaction Charges: All community operations require $MGO for gasoline, creating baseline demand that scales with community utilization

- Cross-Chain Operations: OP-Mango makes use of $MGO as common gasoline for cross-chain transactions, doubtlessly driving important demand as interoperability grows

- Community Safety: Validators should stake $MGO to take part in consensus, eradicating tokens from circulation whereas incomes staking rewards

- Governance Rights: Token holders vote on protocol adjustments and parameter updates, giving $MGO worth past pure utility

- Ecosystem Integration: Varied protocols inside Mango could incorporate $MGO into their very own tokenomics, creating further demand sources

Nonetheless, the quick unlock technique creates a number of financial dangers. Ten billion tokens coming into circulation concurrently may overwhelm demand, notably if early individuals rush to appreciate earnings. The big ecosystem fund allocation assumes fast adoption and improvement exercise, but when ecosystem development lags expectations, these tokens may change into a protracted supply of promoting stress.

Aggressive Evaluation and Market Positioning

Layer 1 Competitors Panorama

Mango Community enters a crowded Layer 1 market the place established gamers keep important benefits by way of developer adoption, whole worth locked, and ecosystem maturity. Ethereum retains the biggest developer ecosystem regardless of excessive charges and scaling challenges, whereas Solana affords excessive throughput with a confirmed monitor document, although it has confronted community stability points.

Transfer-based opponents Aptos and Sui each use variations of the Transfer programming language with totally different approaches. Mango’s dual-VM method differentiates it from these opponents but additionally provides complexity.

The platform’s claimed 297,450 TPS represents a big enchancment over most present networks, however these theoretical maximums require validation below real-world situations. Mango’s omni-chain imaginative and prescient competes with established interoperability options like Cosmos and Polkadot, which provide cross-chain performance by way of totally different technical approaches. Success will rely upon whether or not Mango’s built-in method supplies significant benefits over present options and whether or not builders discover the multi-VM structure compelling sufficient to beat the momentum of established platforms.

Safety Audit and Growth Staff

Skilled Safety Assessment

Mango Community underwent complete safety audits by MoveBit, a acknowledged blockchain safety agency. The mission accomplished two separate audits: a core community audit (April 7-19, 2024) and a devoted bridge audit (December 9, 2024 – January 6, 2025), demonstrating thorough safety protection throughout all crucial elements.

The core community audit employed a number of testing methodologies together with dependency checks, static code evaluation, fuzz testing, and handbook code assessment. Outcomes had been notably constructive, with solely two points recognized – zero crucial vulnerabilities, one main problem, and one informational discovering. Each points had been resolved earlier than mainnet launch.

The bridge audit was extra complete, figuring out seven points throughout totally different severity ranges, together with one crucial vulnerability associated to signature replay assaults. Nonetheless, all seven points had been efficiently fastened earlier than deployment. The bridge audit coated cross-chain performance between Sui, Ethereum, and Mango chains, guaranteeing safe asset transfers throughout the platform’s multi-chain structure.

MoveBit’s evaluations coated execution layers, consensus mechanisms, cross-chain infrastructure, and exterior dependencies, offering confidence within the platform’s safety basis throughout each core performance and important bridge operations.

Growth Staff and Management

The mission maintains transparency by way of seen management, together with CEO Benjamin Kittle and CTO David Brouwer. Brouwer brings related technical experience in Transfer programming and high-performance techniques improvement. The group’s dedication to open-source improvement is obvious by way of their lively GitHub repository with a number of branches and model tags, indicating ongoing improvement exercise.

The event course of emphasizes educational analysis and formal verification instruments, with Transfer Prover being actively maintained as an open-source element. This method aligns with the technical rigor required for the platform’s formidable multi-VM structure.

Ecosystem Purposes and Adoption Technique

DeFi and Cross-Chain Use Circumstances

Conventional DeFi operates in a multi-chain surroundings the place protocols deploy separate situations on totally different blockchains, creating liquidity silos and forcing customers to handle belongings throughout a number of environments. Mango Community’s omni-chain method guarantees unified liquidity swimming pools that may entry belongings from a number of blockchains concurrently.

For instance, a lending protocol on Mango may theoretically settle for Bitcoin collateral, Ethereum-based tokens, and Solana belongings throughout the similar pool, dramatically increasing accessible liquidity. Nonetheless, this imaginative and prescient requires fixing challenges round asset worth synchronization, bridge safety, and regulatory complexity throughout a number of jurisdictions.

The platform’s excessive throughput and low charges additionally make it appropriate for gaming purposes that require frequent microtransactions. Dynamic NFTs that change properties primarily based on participant actions or cross-game interactions change into possible, doubtlessly creating shared gaming economies the place belongings transfer between totally different video games.

Enterprise Integration Potential

MgoDNS represents the platform’s decentralized area identify system that bridges conventional web and blockchain environments. The system can resolve normal web domains whereas including blockchain-specific options. For instance, a single area identify like “alice.mgo” may resolve to pockets addresses on a number of totally different blockchains. Good contracts can even routinely replace these area resolutions primarily based on programmed situations.

Corporations may doubtlessly handle tokenized belongings by way of acquainted internet interfaces backed by blockchain safety, or combine blockchain monitoring into present provide chain techniques with out full infrastructure overhauls. Nonetheless, enterprise adoption sometimes requires confirmed safety monitor data and regulatory readability that new platforms lack.

The success of those purposes is dependent upon greater than technical functionality. Consumer expertise elements, regulatory compliance, and integration with present enterprise processes usually decide adoption charges greater than underlying technical efficiency.

Funding Evaluation and Threat Evaluation

Bull Case for Mango Community

The platform addresses actual issues in present blockchain infrastructure by way of technical innovation that, if executed efficiently, may present sustainable aggressive benefits. Rising demand for cross-chain performance creates market alternatives for platforms that ship seamless omni-chain experiences.

Optimistic Growth Indicators

The platform demonstrates a number of encouraging indicators for potential success. The MoveBit safety audits, with minimal findings, counsel strong code high quality and improvement practices. The $13.5 million funding supplies satisfactory sources for ecosystem improvement, whereas the substantial ecosystem fund allocation signifies a critical dedication to attracting builders and purposes.

Energetic GitHub improvement with a number of branches and common commits reveals ongoing technical progress. The group’s emphasis on formal verification by way of Transfer Prover and educational analysis references suggests a rigorous method to blockchain improvement that might enchantment to institutional customers and critical DeFi protocols.

The blockchain infrastructure market continues to develop quickly, with room for a number of profitable Layer 1 platforms serving totally different use circumstances and person segments. If Mango can show its technical claims and appeal to high quality builders, it may seize important market share within the cross-chain and high-performance blockchain segments.

Threat Elements and Considerations

The technical complexity of supporting a number of VMs and seamless cross-chain performance creates important execution threat. Many blockchain tasks fail to ship on formidable technical guarantees, and Mango’s scope will increase each potential impression and failure threat.

Established Layer 1 platforms have community results, developer mindshare, and institutional relationships that might be tough to beat no matter technical superiority. The quick unlock of all tokens creates important draw back threat and suggests both overconfidence in quick adoption or inexperience with token financial greatest practices.

Cross-chain performance and privateness options could face regulatory challenges that might restrict adoption or require expensive compliance modifications. The Layer 1 blockchain market can also be approaching saturation, with restricted room for brand new entrants to attain significant market share and developer adoption.

Conclusion

Mango Community presents a technically subtle method to Layer 1 blockchain infrastructure by way of its multi-VM structure, complete cross-chain performance, and robust safety basis. The platform’s clear audit outcomes from MoveBit, clear improvement practices, and substantial funding present a strong basis for ecosystem development.

Whereas the quick token unlock technique and aggressive market dynamics current challenges, the mission’s technical improvements deal with actual issues in present blockchain infrastructure. The mix of Transfer programming language safety, EVM compatibility, and omni-chain capabilities may present significant benefits if correctly executed and adopted.

The June 24, 2025 token launch will present essential market suggestions on investor and person curiosity. Early efficiency metrics, developer adoption charges, and the platform’s capability to ship on its high-throughput guarantees might be key indicators of long-term viability and success within the aggressive Layer 1 panorama.

For extra details about Mango Community and airdrop eligibility, go tomangonet.io, or for updates, comply with @MangoOS_Network on X.