Monetary establishments are shifting away from Ethereum (ETH) and choosing purpose-built blockchains tailor-made to fulfill their institutional wants.

Latest developments, akin to Klarna’s launch of its stablecoin on another community and the rise of privacy-focused chains like Canton, increase questions in regards to the community’s dominance.

Company Blockchain Adoption Alerts New Menace to Ethereum: Right here’s Why

On November 25, Klarna introduced KlarnaUSD, turning into the primary financial institution to situation a stablecoin on Tempo, a funds blockchain from Stripe and Paradigm. This choice has sparked debate within the crypto group. Some view it as a bearish sign for Ethereum.

“Somebody inform me why this isn’t bearish for Ethereum? A significant fintech with a giant transfer into stablecoins isn’t launching it on Ethereum. If Tempo didn’t exist then this could have seemingly launched on Ethereum or an ETH L2…Tempo taking marketshare in what’s the foremost thesis for Ethereum: stablecoins,” an analyst said.

Ethereum hosts main stablecoins, together with Tether (USDT) and USDC (USDC), which collectively command over $100 billion in market capitalization. They drive important community exercise and costs. By choosing Tempo, Klarna bypasses Ethereum’s ecosystem, doubtlessly diverting liquidity and innovation.

One other analyst, Zach Rynes, emphasised that Klarna’s choice demonstrates that company blockchains are gaining adoption, whereas public chains proceed to be overshadowed by giant fintech corporations.

“One other affirmation that corpo L1 chains are right here to remain and that your favourite commoditized ‘impartial’ public chain #375936 is getting steamrolled by Fintech but once more,” he mentioned.

The rise of the Canton Community additional exemplifies this. It’s a Layer 1 community constructed with privateness controls at its core. Establishments can select how seen or restricted their exercise is, enabling setups that vary from totally permissionless to fully non-public programs.

Regardless of these variations, purposes on Canton can nonetheless join and work together throughout the community. Goldman Sachs’ Digital Asset Platform (GS DAP) makes use of the Canton community natively.

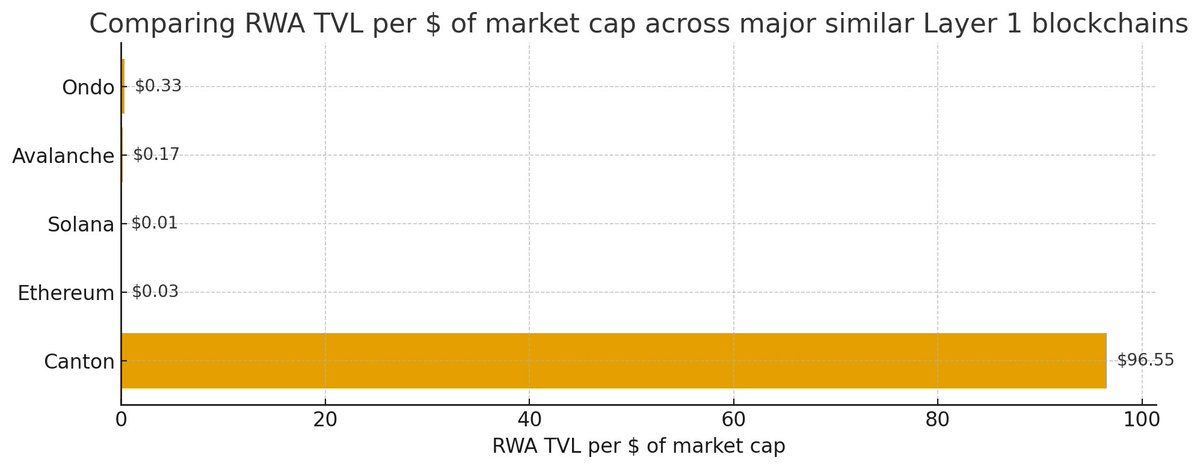

Notably, Canton reveals a big stage of capital effectivity, producing round $96 of RWA Complete Worth Locked (TVL) for each $1 of market capitalization. In distinction, Ethereum generates roughly $0.03 of RWA TVL for each $1 of market cap.

A Comparability of RWA TVL Per Greenback of Market Cap. Supply: X/MattMena__

However why are establishments transferring away from Ethereum? Privateness may very well be the first driver of this exodus. Public blockchains like Ethereum make all transactions completely seen, a core problem for establishments.

When banks or companies switch giant sums, this transparency poses a big danger. Rivals can analyze patterns, front-run trades, and uncover strategic enterprise ties.

In accordance with COTI Community’s evaluation, enterprises adopting Web3 usually overlook blockchain transparency as a legal responsibility. The article notes that public blockchains expose all transactions and metadata, which might reveal delicate information or undermine negotiation leverage. This creates regulatory issues with legal guidelines akin to GDPR and exposes commerce secrets and techniques.

This disconnect explains why establishments are constructing non-public blockchains or in search of public networks with enhanced privateness. Transparency, a celebrated advantage in crypto, creates vulnerabilities when dealing with billion-dollar trades and confidential relationships.

This pattern indicators a cut up: public networks like Ethereum for decentralized or retail use, whereas establishments transfer to non-public or specialised chains with confidentiality. Whether or not Ethereum can win again institutional belief or specialised networks take over stays unsure as finance undergoes a digital transformation.

The submit Establishments Flip to Objective-Constructed Blockchains as Privateness Issues Drive Shift Away from Ethereum appeared first on BeInCrypto.