Community revenues throughout the blockchain ecosystem declined by 16% month-over-month in September, primarily attributable to decreased volatility within the crypto markets, in keeping with asset supervisor VanEck.

Ethereum community income fell by 6%, Solana’s fell by 11%, and the Tron community recorded a 37% discount in charges, attributable to a governance proposal that decreased gasoline charges by over 50% in August, in keeping with VanEck’s report.

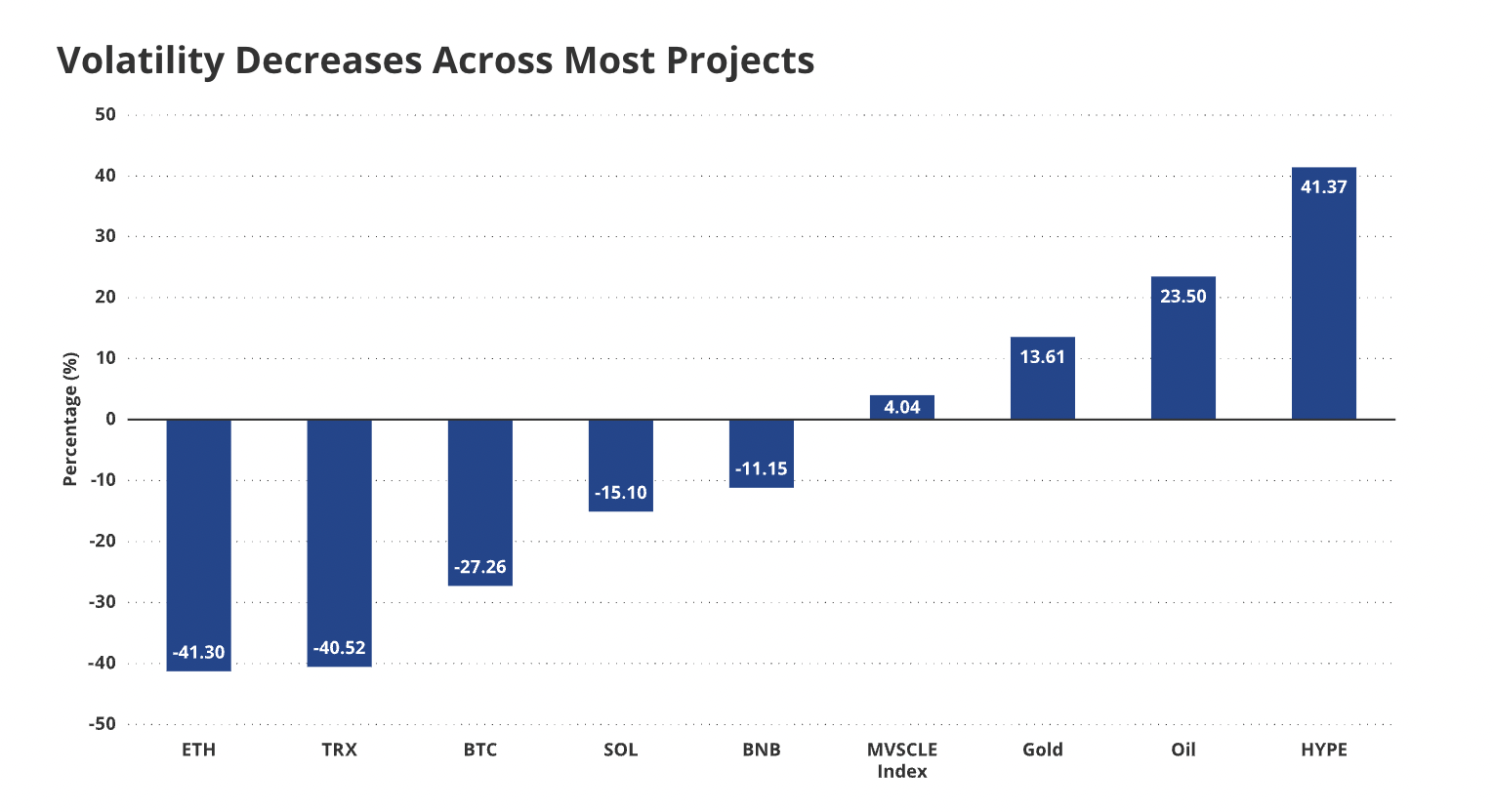

The income drop within the different networks was attributed to decreased volatility within the crypto markets and the underlying tokens powering these networks. Ether (ETH) volatility dropped by 40%, SOL (SOL) volatility fell by 16%, and Bitcoin (BTC) fell by 26% in September.

Most cryptocurrencies skilled decreased volatility in September. Supply: VanEck

“With decreased volatility for digital property, there are fewer arbitrage alternatives to compel merchants to pay excessive precedence charges,” the writers of the report defined.

Community revenues and costs are a essential metric for financial exercise in crypto ecosystems. Market analysts, merchants, and buyers monitor community fundamentals to gauge the general well being of a selected ecosystem, particular person tasks, and the broader crypto sector.

Associated: Ethereum income dropped 44% in August amid ETH all-time excessive

Tron community continues to dominate income metrics

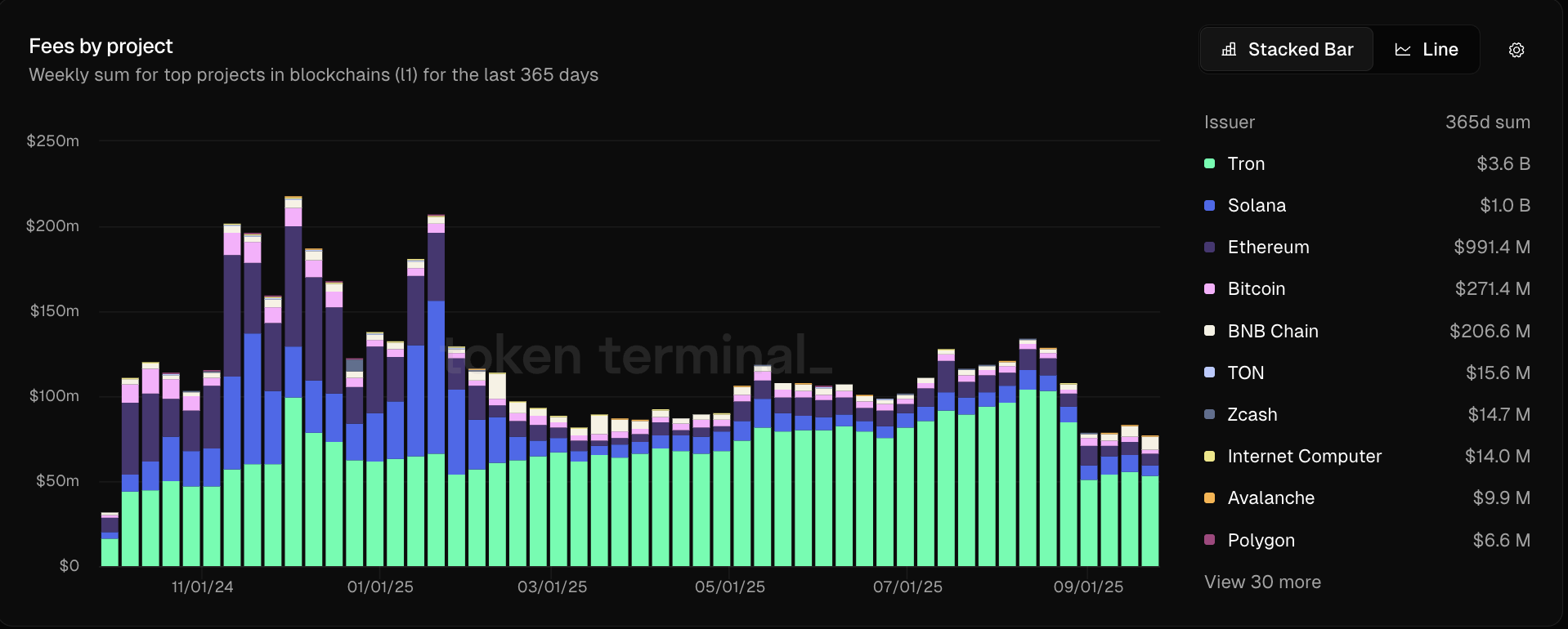

The Tron community is ranked because the primary crypto ecosystem for income, producing $3.6 billion within the final 12 months, in keeping with knowledge from Token Terminal.

Ethereum, by comparability, solely generated $1 billion in income over the past 12 months, regardless of ETH hitting all-time highs in August, and a market capitalization of about $539 billion — over 16x the TRX (TRX) market capitalization, which is simply north of $32 billion.

A comparability of crypto community charges over the past 12 months. Supply: Token Terminal

Tron’s income is attributed to its function in stablecoin settlements. 51% of all circulating Tether USDt (USDT) provide has been issued on the Tron community.

The stablecoin market cap crossed $292 billion in October 2025 and has been steadily rising since 2023, in keeping with knowledge from RWA.XYZ.

Stablecoins are a serious use case for blockchain expertise, as governments try to extend the salability of their fiat currencies by putting them on crypto rails.

Blockchain rails permit currencies to circulation between borders, with near-instant settlement instances, minimal charges, 24/7 buying and selling, and don’t require a checking account or conventional infrastructure to entry.

Journal: Ether might ‘rip like 2021’ as SOL merchants brace for 10% drop: Commerce Secrets and techniques