BTCUSD, BTCGBP, and BTCEUR are essentially the most traded Bitcoin pairs, every reflecting the interplay between Bitcoin and the precise financial setting of their underlying currencies. Analyzing their respective performances permits us to realize perception into the worldwide Bitcoin market and the way native financial situations affect worth motion. Whereas this information is restricted to a single change, on this case, Bitstamp, it gives a consultant view of broader traits and permits for significant conclusions.

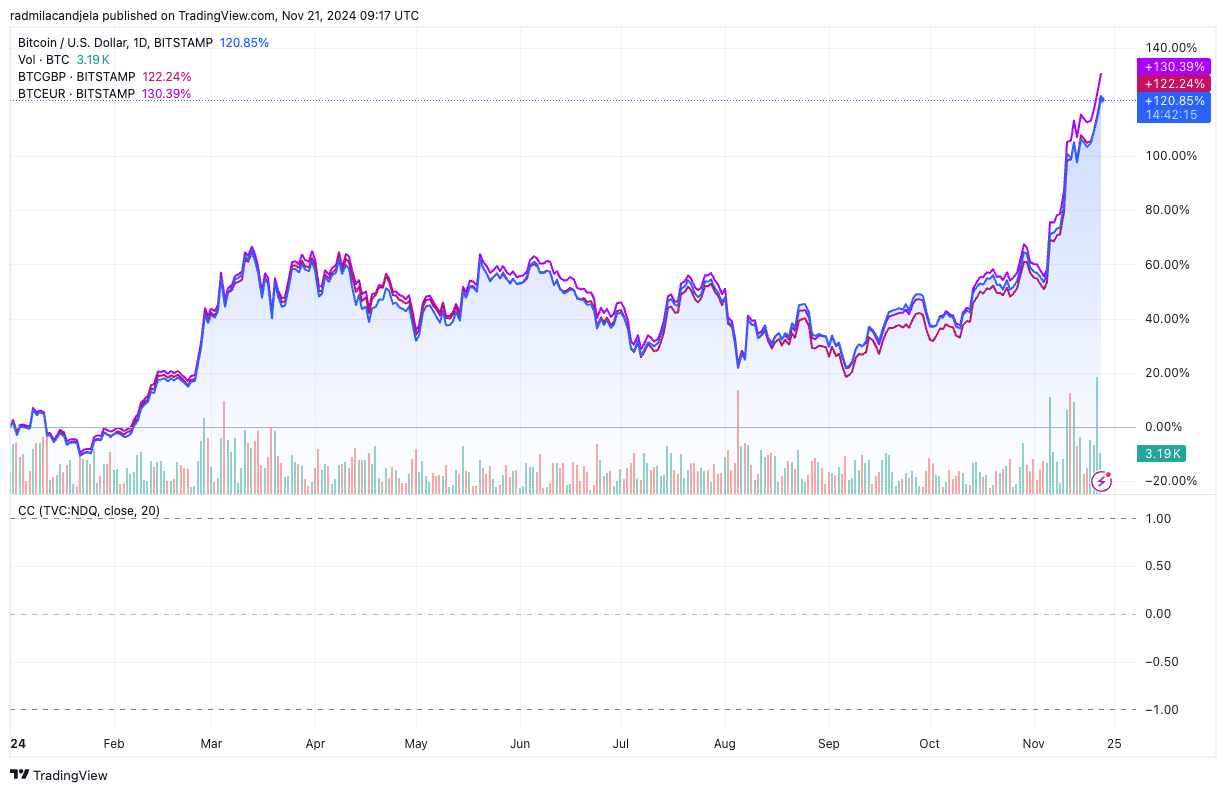

Yr-to-date, BTCEUR has delivered the best returns, with a acquire of 130.39%, in comparison with 122.24% for BTCGBP and 120.85% for BTCUSD. This outperformance can largely be attributed to the euro’s weak spot relative to the greenback and pound. With the Eurozone grappling with low progress and restricted financial coverage flexibility, the foreign money has suffered in opposition to a backdrop of greenback energy.

This depreciation amplifies Bitcoin’s good points in EUR phrases, because it takes extra euros to buy the identical quantity of BTC. In contrast, the greenback’s energy—underpinned by robust US financial information, sturdy Treasury yields, and expectations of higher-for-longer Federal Reserve coverage—has dampened BTCUSD’s obvious good points, as a stronger greenback offsets the upward strain on Bitcoin’s worth.

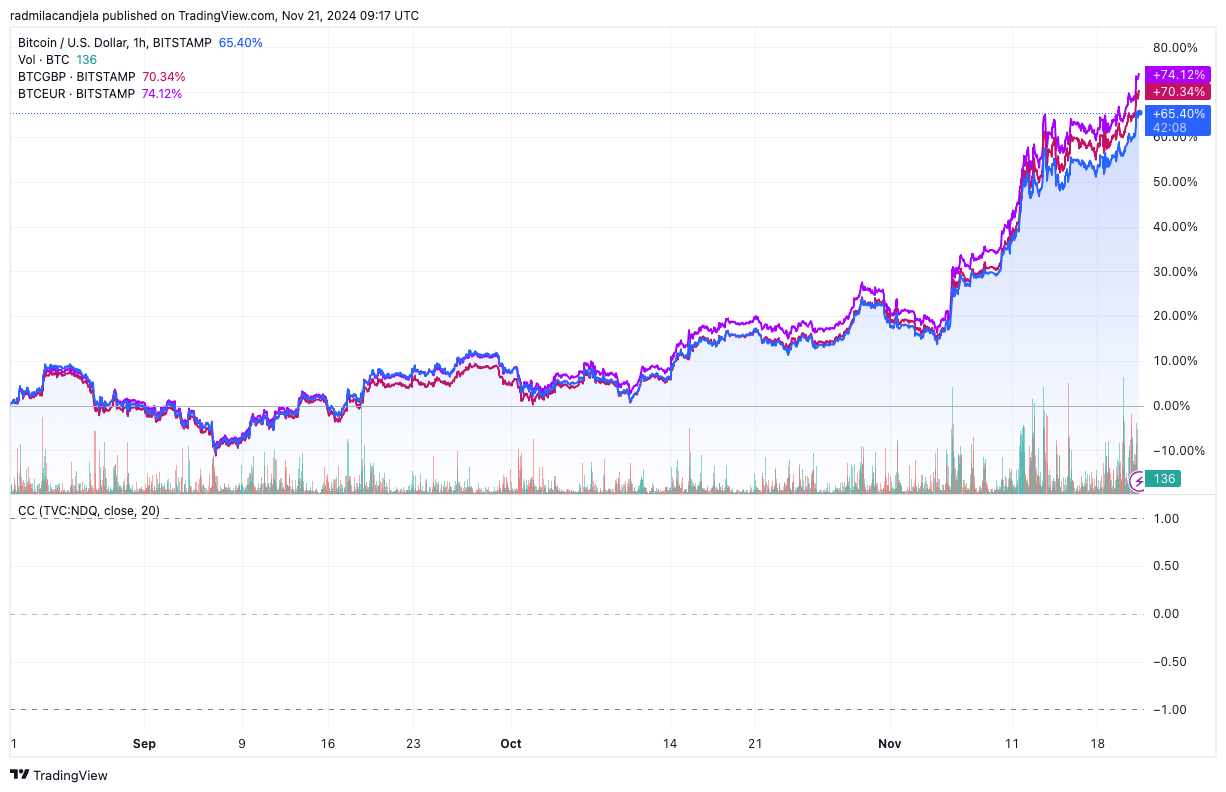

Within the three-month window, the traits stay constant, with BTCEUR persevering with to outperform BTCGBP and BTCUSD. Throughout this era, euro weak spot grew to become much more pronounced, falling to a one-year low in opposition to the greenback. This decline displays a mix of disappointing Eurozone progress metrics, dovish alerts from the European Central Financial institution, and geopolitical uncertainties.

In the meantime, BTCGBP has proven a barely extra sturdy efficiency than BTCUSD, highlighting the pound’s relative weak spot. The UK’s persistent financial stagnation and diminished hawkishness from the Financial institution of England have positioned strain on GBP, even because it maintains marginally extra resilience than the euro.

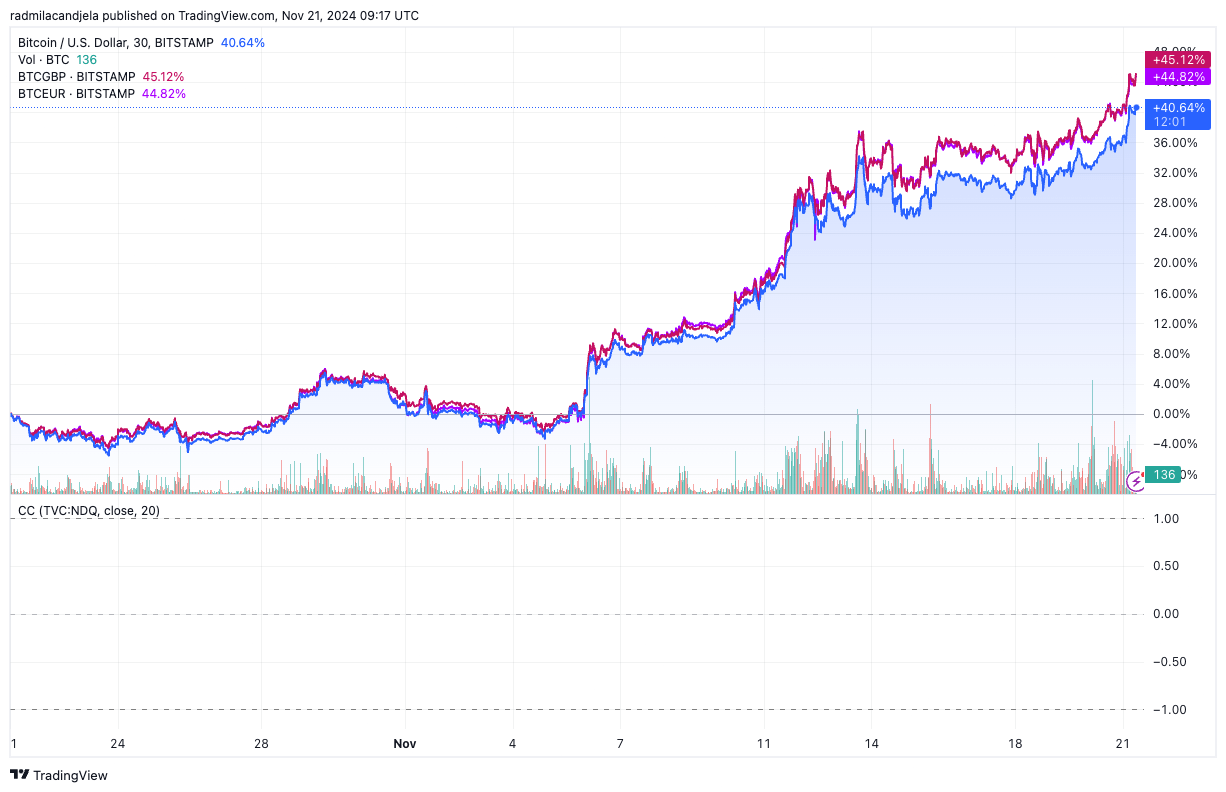

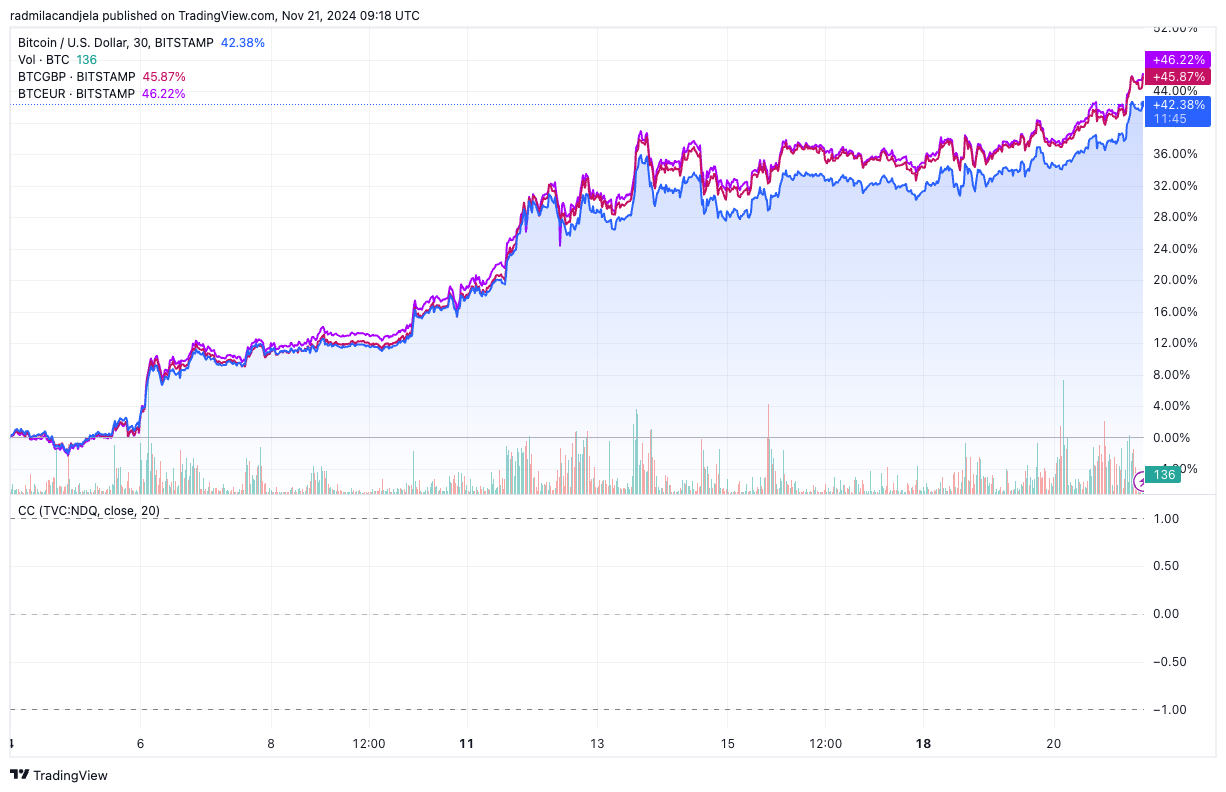

The value motion because the US election exhibits that Bitcoin’s efficiency in opposition to these three currencies displays the latest macroeconomic and geopolitical developments. BTCUSD gained 42.38%, trailing BTCEUR and BTCGBP, which grew 46.22% and 45.87%, respectively. The greenback’s persistent energy has been very important in tempering BTCUSD’s good points. The market’s response to the US election was aggressive.

Because the upcoming Trump administration’s insurance policies are anticipated to spice up US progress, the election strengthened the greenback and drove additional demand for US property, weighing on BTCUSD. In distinction, BTCEUR and BTCGBP had been comparatively unaffected by this political occasion, and their performances remained largely a perform of their respective fiat weaknesses.

The divergence in Bitcoin’s efficiency throughout these pairs additionally exhibits the affect fiat volatility has on perceived returns. The euro and the pound have been way more unstable than the greenback this yr, notably given the contrasting financial insurance policies and financial prospects of every space.

This volatility exaggerates Bitcoin’s worth actions in EUR and GBP phrases, creating the phantasm of larger returns in comparison with BTCUSD. Because the Eurozone continues to face structural progress challenges, Bitcoin’s outperformance in opposition to the euro is prone to persist. Whereas underneath related strain, the pound has proven barely extra resilience because of much less extreme structural considerations, which aligns with BTCGBP’s middle-ground efficiency relative to BTCUSD and BTCEUR.

The short-term traits noticed because the US election on Nov. 5 reveal a somewhat fascinating market state. Regardless of the USD’s energy, BTCUSD steadily elevated throughout this era. This implies that whereas the greenback’s energy muted Bitcoin’s good points in comparison with BTCEUR and BTCGBP, it didn’t solely stifle its worth momentum.

For BTCEUR and BTCGBP, continued EUR and GBP weak spot after the election allowed Bitcoin to maintain its relative outperformance. That is notably related on condition that Eurozone and UK markets more and more look to Bitcoin as a hedge in opposition to depreciating fiat currencies.

The submit Weak euro fuels Bitcoin’s standout efficiency in Eurozone appeared first on yourcryptonewstoday.