“The basis downside with typical forex is all of the belief that’s required to make it work. The central financial institution should be trusted to not debase the forex, however the historical past of fiat currencies is stuffed with breaches of that belief. Banks should be trusted to carry our cash and switch it electronically, however they lend it out in waves of credit score bubbles with barely a fraction in reserve.”

— Satoshi Nakamoto (2009)

Bitcoin was created to get rid of the necessity for trusted intermediaries. It changed opaque, permissioned methods with transparency, auditability, and decentralized verification. The ethos was clear from day one: don’t belief—confirm.

And but, lots of the establishments now holding Bitcoin—custodians, exchanges, ETFs, even public firms—proceed to depend on trust-based assumptions, the very downside Bitcoin was designed to resolve.

For Bitcoin treasury firms, this contradiction is very obtrusive. These are companies that declare to function on a Bitcoin normal—but with out verifiable Proof of Reserves (PoR), there’s no means for shareholders to know whether or not the Bitcoin is definitely there.

The Downside: Unproven Bitcoin Is Simply One other IOU

Bitcoin is designed to be verifiable—however most company disclosures aren’t. When firms report BTC holdings with out public pockets visibility or on-chain proof, buyers are left to belief stability sheets, auditors, and custodians.

That opens the door to systemic dangers:

- Rehypothecation: BTC pledged or lent behind the scenes

- Custodial failure: Centralized providers working with out 1:1 backing

- “Paper Bitcoin”: A number of claims on the identical BTC, echoing legacy monetary opacity

The mere presence of Bitcoin on a stability sheet is just not a assure. With out verification, it’s no totally different than a fiat-denominated declare—an IOU dressed up in BTC phrases.

What We Realized from Gold: The Paper Downside

Bitcoin is just not the primary arduous asset to face this problem. The gold market affords a cautionary story.

For many years, gold buyers have handled “paper gold” methods—unallocated accounts, artificial ETFs, and derivatives with little or no linkage to precise steel. These claims typically outnumber actual reserves many occasions over, resulting in widespread suspicion of value distortion and systemic misrepresentation.

Most gold buyers don’t personal gold—they personal a declare to gold. And so they haven’t any technique to show it.

Bitcoin provides us the instruments to interrupt this cycle. However provided that firms select to make use of them.

Bitcoin Is Constructed for Proof—and Firms Ought to Use It

In contrast to legacy property, Bitcoin is designed to make proof of possession and solvency a local operate of the asset itself. Via public key cryptography, on-chain auditability, and permissionless transparency, Bitcoin permits real-time, trust-minimized verification.

This isn’t only a technical functionality—it’s a governance characteristic. Bitcoin permits firms to display, cryptographically and with out intermediaries, that their reserves exist, are intact, and are unencumbered. No financial institution statements. No opaque custodial claims. Simply knowledge, on-chain.

That’s a radical shift—and it’s one which Bitcoin treasury firms are uniquely positioned to benefit from. In doing so, they will cut back audit complexity, strengthen shareholder communication, and align their inside capital practices with the trustless structure of the asset they’re holding.

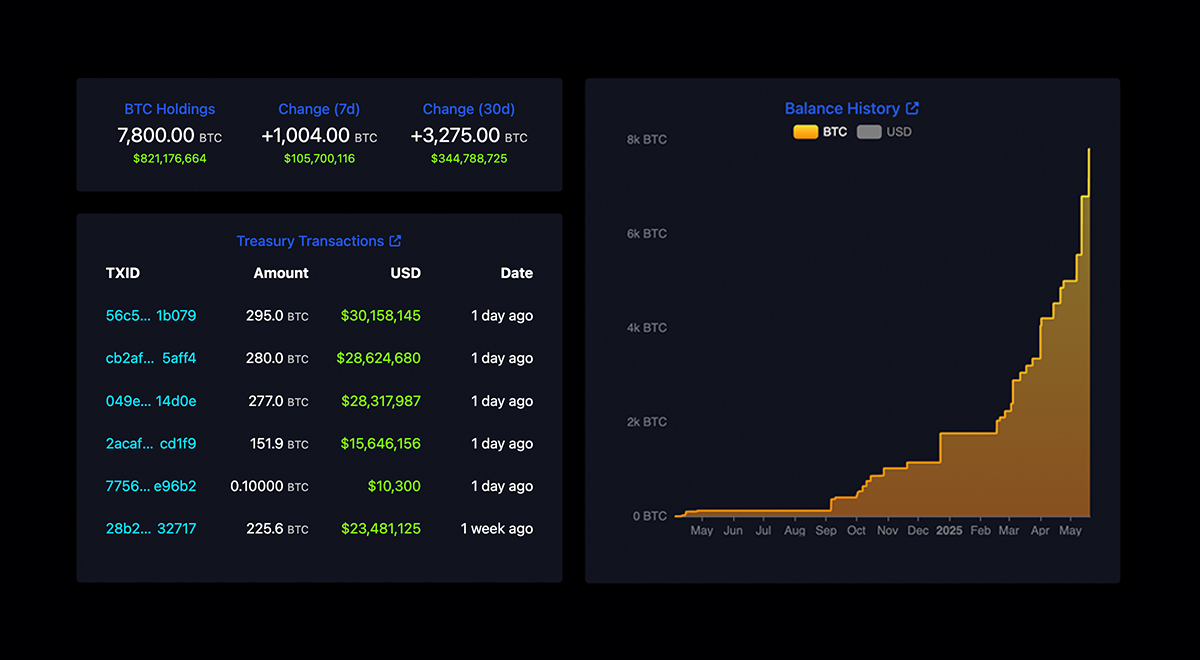

And it’s already taking place. Metaplanet, Premiere Member of Bitcoin For Companies, publicly discloses its BTC reserve addresses and transaction historical past. Anybody on the earth—together with shareholders, analysts, and regulators—can independently confirm the existence and motion of their treasury. That’s not simply compliance. That’s Bitcoin, utilized. View the snapshot of Metaplanet’s proof of reserves dashboard under.

Public Firms Face the Biggest Accountability

Public firms don’t function in a vacuum. Their disclosures form market notion, affect investor habits, and—particularly when Bitcoin is concerned—function a proxy for the maturity of the asset class itself.

When a publicly traded firm holds Bitcoin however affords no visibility into how that Bitcoin is held or verified, it exposes itself to a number of ranges of danger: authorized, reputational, operational, and strategic. It undermines belief on the very second it claims to be embracing a trustless system.

Extra importantly, public firms ship indicators. Whether or not they prefer it or not, they grow to be de facto representatives of the Bitcoin technique they’ve adopted. Their habits turns into a part of the playbook for others contemplating related strikes.

That’s why the duty is increased. Transparency isn’t non-compulsory for firms who lead with Bitcoin. It’s an obligation. And firms that select opacity not solely tackle pointless danger—they weaken the credibility of the complete motion.e.

What Proof of Reserves Ought to Really Embody

For Proof of Reserves to have actual integrity, it should transcend obscure references to “custody companions” or inside assurance statements. The bottom line is verifiability—impartial,>

- Custody mannequin readability: Is the corporate utilizing self-custody, shared multisig, or third-party options? Who controls the keys, and below what governance?

- On-chain transparency: Whether or not by means of view-only pockets addresses or cryptographic attestations (like Merkle tree proofs), firms should make it potential to confirm balances towards public disclosures.

- Encumbrance disclosure: Reserves which might be pledged, lent out, or locked in yield methods needs to be disclosed clearly, with timelines and danger parameters connected.

- Routine updates: Proof needs to be refreshed recurrently—not as soon as per yr in an audit footnote, however as a part of ongoing monetary communication.

- Reconciliation framework: Firms ought to clarify how on-chain knowledge maps to reported BTC NAV in filings or investor supplies.

For boards and CFOs, this doesn’t must introduce operational danger. Instruments exist already—xpub view-only wallets, custody APIs, third-party validators—to supply assurance with out compromising safety. The impediment isn’t functionality. It’s willingness.

Setting the Trade Benchmark: The place Bitcoin Treasury Firms Should Lead

Bitcoin treasury firms are usually not simply monetary outliers—they’re structural pioneers. Their choice to carry BTC indicators not solely a perception in long-term worth, however a rejection of legacy capital inefficiency. That’s why they need to additionally lead on requirements of integrity.

By adopting PoR voluntarily and early, firms can place themselves as reliable, refined, and future-ready. It will matter extra as institutional capital rotates into Bitcoin, as index inclusion expands, and as regulators start asking sharper questions on crypto asset disclosures on stability sheets.

PoR isn’t only a technique to adjust to future requirements—it’s a technique to form them. The businesses that lead now won’t solely keep away from future scrutiny—they’ll appeal to capital from allocators who’re in search of transparency however don’t but know the place to seek out it.

At BFC, we consider the market rewards readability. Bitcoin treasury firms have an opportunity to bake transparency into their construction, not as an afterthought, however as a strategic differentiator.

Shareholders Should Demand It

Proof of Reserves isn’t only a firm initiative—it’s a shareholder obligation. When a public firm holds Bitcoin on its stability sheet, it’s performing as a fiduciary for shareholder capital denominated in one of many hardest, most clear property in historical past. To simply accept opacity in that context is to forfeit the very benefit Bitcoin affords.

When you’re an investor in a Bitcoin treasury firm and you may’t confirm the Bitcoin, you don’t personal a financial reserve—you personal a story. You’re trusting that another person is telling the reality, relatively than requiring the proof Bitcoin makes potential.

That’s not aligned with the rules of sound capital stewardship.

Institutional allocators, activist shareholders, and governance professionals have a rising function to play right here. Simply as proxy advisors and investor coalitions have pushed for local weather disclosures, board transparency, and ESG readability prior to now decade, it’s time to use that very same rigor to Bitcoin disclosures—particularly for firms who declare to function on a Bitcoin normal.

Demand direct solutions:

- Can we confirm the holdings on-chain?

- Are reserves totally collateralized and unencumbered?

- Has administration made public disclosures or carried out any verifiable PoR tooling?

- If not—why not, and what’s the plan to take action?

The purpose is to not undermine belief in management—however to bolster the rules of verifiability that Bitcoin makes potential.

Shareholder stress has moved capital markets earlier than. It will possibly achieve this once more—this time, in service of a system that was constructed for transparency from the beginning.

Don’t simply ask for alignment with Bitcoin. Require it. Not ultimately. Not optionally. However now, and constantly, till Proof of Reserves turns into the price of credibility.

Conclusion: Proof Is the New Customary

Bitcoin was born out of a monetary disaster fueled by opaque danger and trusted third events. Proof of Reserves isn’t a compliance guidelines—it’s a return to the rationale Bitcoin exists.

For public firms holding Bitcoin, proof is now a proxy for seriousness. It tells buyers: we didn’t simply undertake BTC—we perceive what it calls for. We’re not right here to invest. We’re right here to construct.

When you’re holding Bitcoin for its safety, show it’s safe.

When you’re holding Bitcoin to your shareholders, present them it’s actual.

When you’re holding Bitcoin to flee fiat danger, don’t recreate fiat opacity.

Proof of Reserves is not only about credibility. It’s about capital self-discipline, investor safety, and strategic management.

Let’s make it the usual.

Disclaimer: This content material was written on behalf of Bitcoin For Companies. This text is meant solely for informational functions and shouldn’t be interpreted as an invite or solicitation to accumulate, buy, or subscribe for securities.

This put up Proof of Reserves Ought to Be the Customary for Bitcoin Treasury Firms first appeared on Bitcoin Journal and is written by Nick Ward.